Debtors and Creditors

Control Accounts

Previous lesson: Posting Journal Entries to the Ledger

Next lesson: Trial Balance

What are control accounts? Why do we need them?

In this lesson we're going to answer these questions and more.

Check your understanding of this lesson by taking the quiz in the Test Yourself! section further below. And right at the bottom of the page, you can find plenty more questions on control accounts submitted by fellow students.

Introduction

As previously mentioned, we not only have the general ledger, but also two other subsidiary or supporting ledgers:

- The Debtors Ledger

- The Creditors Ledger

We also learned that all individual debtor T-accounts go in the debtors ledger and all individual creditor T-accounts go in the creditors ledger.

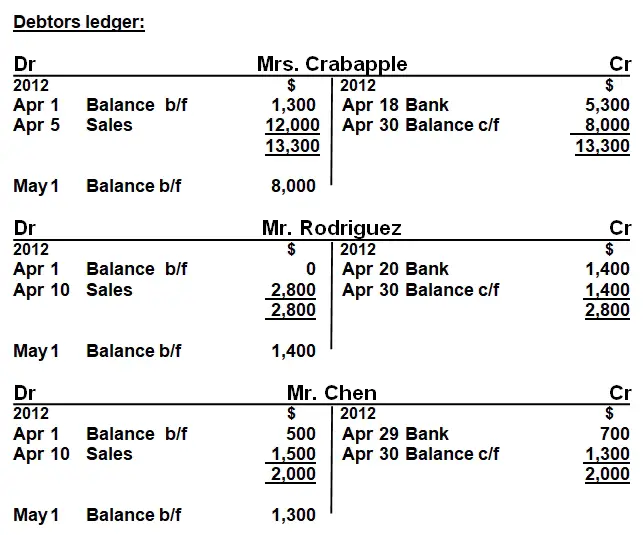

For example, here is a debtor's ledger with a number of individual debtor T-accounts:

Now, as far as we know, debtor and creditor T-accounts only go in the debtor and creditor ledgers, right?

None of the information about debtor or creditor T-accounts goes in the general ledger, right?

Well... no, not exactly.

The general ledger does contain information about debtors and creditors.

In fact, it contains two special accounts relating to the above, called control accounts.

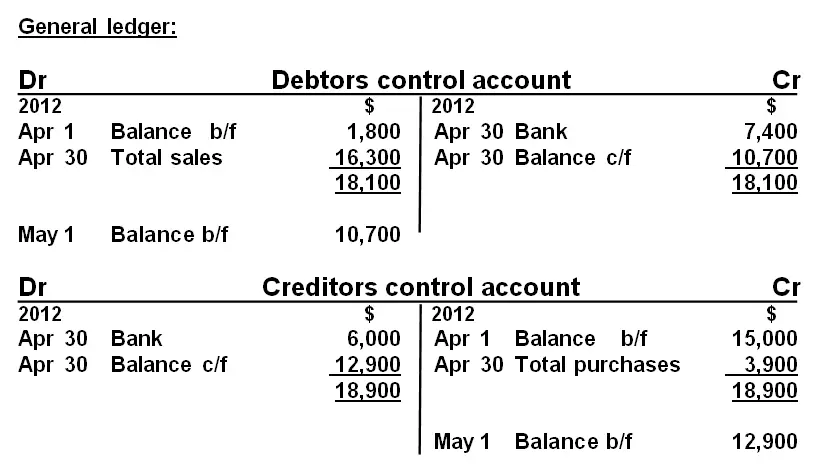

There is one control account for debtors and another for creditors:

Why Are These Called "Control Accounts?"

And What Are They Used For?

The reason these accounts are called control accounts is because one uses them to ensure there are no errors or mistakes in our records relating to debtors and creditors. Thus one gets more control. I will show you exactly how this is done shortly.

Control accounts are essentially summary accounts in the general ledger. They contain totals instead of amounts relating to individual debtors or creditors. They allow one to see the totals, without getting into too much details from individual accounts.

Where Do the Totals for the Control Accounts Come From?

Entries in the control accounts such as "total sales", "total purchases" as well as "bank" come from the relevant accounting journals.

For example, the "total sales" figure of $16,300 in the debtors control account above comes from the total in the sales journal below (which shows sales on credit).

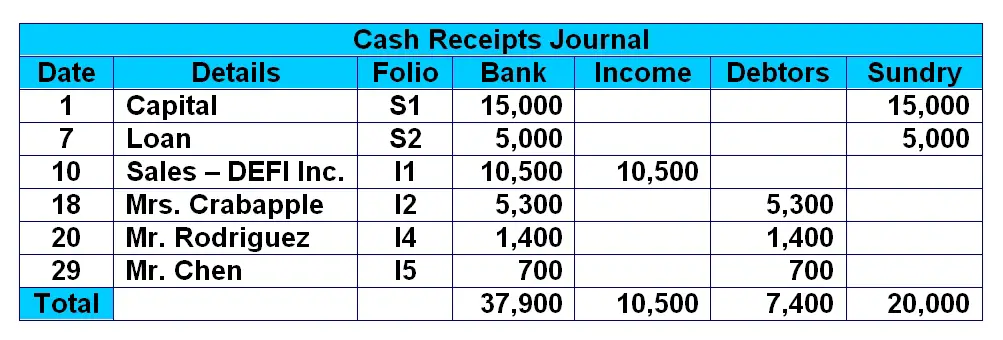

Also, the "bank" figure of $7,400 in the debtors control account would come from the total of the "debtors" column in the cash receipts journal:

Similarly, the "total purchases" figure of $3,900 in the creditors control account could be traced back to the purchases journal (which shows purchases on credit).

And the "bank" figure of $6,000 in this same account could be traced back to the cash payments journal (which shows all payments of cash).

Did you know?

The debtors control account is also known as the sales ledger control account. This name is sometimes used for this account because it reflects the total of the individual sales on credit (sales to debtors), as reflected in the sales ledger.

Likewise, the creditors control account is also known as the purchases ledger control account. Again, this name is used because it reflects the total of the individual purchases on credit (purchases from creditors), as reflected in the purchases ledger.

So How Exactly Do These Control Accounts Ensure There Are No Errors?

Good question.

Let’s take debtors.

For debtors, we compare the closing balance of the debtors control account in the general ledger to the total of all the closing balances of the individual debtor accounts in the debtors ledger.

As you can see above, the debtors control account has a closing balance of $10,700. The debtor T-accounts come to the same figure ($8,000 + $1,400 + $1,300 = $10,700).

If the debtor T-accounts came to a different figure – let's say $11,000 – we would know for sure that there was some error, either in one of the individual debtor accounts in the debtors ledger or in the debtors control account (general ledger).

And we would then go about trying to find that error and then correcting it.

Reconciling Control Accounts

Traditionally bookkeepers or other accounts personnel perform a reconciliation on a regular basis between the control accounts (general ledger) and the total of the debtors or creditors ledger.

The word reconciliation actually comes from reconcile, which means to make two amounts agree in value.

Accounts personnel may even produce a debtors or creditors reconciliation statement, which is a report showing the discrepancies between the control account (general ledger) and the total of the individual T-accounts (in the debtors or creditors ledger).

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty rating:

Beginner

Quiz length:

4 questions

Time limit:

5 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

So that's our lesson on control accounts. I hope it helped shed some light on this important topic.

Next up, we're going to tackle the penultimate step in the accounting cycle - the trial balance.

Click here to check out the next lesson on the trial balance.

Return to The Accounting Cycle

Return to the Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: Posting Journal Entries to the Ledger

Next lesson: Trial Balance

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

BAD DEBTS, BAD DEBTS RECOVERED & PROVISION FOR DOUBTFUL DEBTS

WEI'S FINANCIAL YEAR ENDS ON 31 DECEMBER. THE FOLLOWING INFORMATION IS AVAILABLE FOR THE LAST 3 YEARS OF TRADING (RM = Malaysian Ringgit = currency for …

CONTROL ACCOUNT ENTRIES QUESTION

THE LIST OF BALANCE FROM THE PURCHASES LEDGER SHOWS A TOTAL OF $14,530 AND THAT FROM THE SALES LEDGER A TOTAL OF $216,580. PLEASE SHOW ME HOW IT WILL BE …

Advantages of Selling on Credit

What are the advantages for a business selling goods on credit?

Debit Balance in Sales Account

What does it mean when there is a debit balance in a sales control account?

Debtors Control Account - Credit Balance?

Q: Is it possible for a debtor to have a credit balance?

Return to the full tutorial: Debtors and Creditors Control Accounts

Journal Entry for Recovery of Bad Debts?

Question: Q: What is the double entry for recording recovery of bad debts in control accounts?

Solution: First of all, let's make sure we understand …

Creditors Control and

Creditors List Question

Q: The information below was extracted from the records of Mermaid Traders for May 2011.

Creditors control balance on 30 April 2011 was 42,750.

…

Questions regarding Debtors and Collecting/Settling Accounts

Q: 1. How do I determine the effectiveness of the internal control system with regards to debtors?

2. What are the strategies that I can implement …

Prepare Total Debtors Account and See Whether the Balance Obtained Agrees with the Balance as per Schedule

Q: The following relate to a trader for the month ended 31 st January 2006 (rs = Rupees = Indian currency):

Sundry debtors on 1.1.06 (Dr) rs 9,000 …

General Ledger Exercise

The following balances are available from the books of Frema, a sole trader:

Balances as at 1st July, 2009:

- Dr. Balances in …

What is a Folio?

Q: What is a folio?

A: It's a cross-referencing code, usually a number or a few numbers and letters. It connects two separate records, such as …

Side and General Ledger Account (Discount)

Q: Which one of the following alternatives represents the side and general ledger account to which the total of the discount column in the cash payments …

Credit Balance in

Purchases Ledger?

Q: I was solving an exercise of control accounts in which one of the transactions given was this:

Credit balance in purchases ledger transferred from …

Bad Debts Recovered

Q: 1. Is recovery of bad debts included in the control accounts?

2. Once a debt is written off as a bad debt, when it is recovered, do we debit it …

Potential Refund of Turnover to Customer After Year-End?

I am working on a job where a client has been paid for an invoice raised at £7,000. However the company who paid him the money as a payment on account, …

Debtors and Creditors Ledger Question

Before you begin: It's important for testing and exams to make sure you not only answer questions correctly but also completed them at the right speed. …

Debit in Credit Control Account and Journalizing Cash

Q: Firstly, I found a debit balance in the creditor control account when I was closing the books of accounts. We opened the discussion with the finance …

Debtors and Creditors Control Accounts Exercise

Before you begin: It's important when preparing for tests and exams to make sure you not only answer questions correctly but also do so at the right …

Trade Discount

Q: Purchased merchandise on credit for R500 subject to trade discount of 20%... What journals must I use?

A: DR: Purchases R400 CR Creditors R400. …

3 Control Accounts Questions

Q: (1) Explain the ways in which control accounts can be of use to the management of a business.

(2) Outline the usefulness of these accounts.

…

Overcast in Returns Inward Journal

Q: The accountant of Golly Ltd ascertained that the returns inwards journal had been overcast by R100. Which ledger account will be affected by this …

Reasons to maintain "Memorandum Accounts" & "Control Accounts"

Q: What are the reasons to maintain individual memorandum accounts?

AND

What are the reasons to maintain control accounts?

Kindly answer in …

Carriage Inward included in Creditor's Control Account?

Q: Is carriage inward included in the control account? And if so, on what side?

A: No, carriage inward is an expense on its own and would be recorded …

Provision for Doubtful Debts

Q: Hi! I'm rashi doing CS and my question is:

State with reason/s whether this statement is true or false.

A provision for doubtful debts is created …

Debtors & Creditors Control Accounts:

Questions on Imbalances & Reconciliations

Q: What are the possible reasons for imbalances in these accounts?

A: Carl, I assume your question is regarding imbalances between debtor (or creditor) …

Various Debtors Questions: Journals & Receipts from Debtors, Debtors List, Debtors Control Account

Q: Where do receipts from debtors go?

A: I assume you mean which journal debtor receipts should be recorded in. If so, receipts from debtors are recorded …

Does the provision for doubtful debts go into the sales control account?

Q: Does the provision for doubtful debts go into the sales control account? Thank you very much!

A: The provision for doubtful debts does not go into …

Bad Debts, Provision for Bad Debts,

Debtors Control

Question: How does bad debts and the provision for bad debts affect the debtors control account?

Answer: Let's make sure we fully understand what …

Debtors Control Account &

Provision for Doubtful Debts

Q: Is the increase in the provision for doubtful debts included in the debtors control account?

A: Thanks for your question David.

I am sure …

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.