Accounting Journals:

The Books of First Entry

Previous lesson: Basic Accounting Journal Entries

Next lesson: T Accounts

Welcome to our lesson on the accounting journals - the seven different "books" and the types of transactions we enter in each one.

Be sure to check your understanding of this lesson by taking the quiz in the Test Yourself! section further below. And right at the bottom of the page, you can find more questions on the topic submitted by fellow students.

Introduction

As mentioned in our previous lesson, the word "journals" doesn't just mean journal entries (debits and credits) but is also the term used for the books of first entry.

An accounting journal used to be an actual physical book that the bookkeeper would use to make accounting entries, but of course, these days transactions are often entered in computerized accounting programs that do a lot of the accounting work for us.

Still, accounting journals are taught and tested in many accounting classes, they're used in manual accounting systems and also appear in accounting packages, so it's still worth knowing how they work.

If you arrived on this page about accounting journals (the books of first entry) but actually wanted to learn about the different journal entries we record, see our previous lesson on basic accounting journal entries.

The Seven Accounting Journals

Now, it's common for a bookkeeper to keep seven different accounting journals (i.e. seven books of first entry), with each journal covering a different aspect of the business.

Each of the journals follow the general debit and credit format, but with categories relating to that specific aspect of the business.

The format of each journal is shown below (along with a description).

1. Cash Receipts Journal (CRJ)

The cash receipts journal is the journal where you record all cash that has been received.

This is cash received from any source - from income, a loan received, a debtor, etc.

The format of the cash receipts journal is as follows:

Note that major categories of receipts, such as from income or debtors, receive their own column.

The category called sundry is used to represent various miscellaneous items that don't occur too often, such as capital or receiving cash from a loan (the word sundry actually means "various," "miscellaneous" or "general").

The "bank" column is added up to show the total cash received for the period concerned.

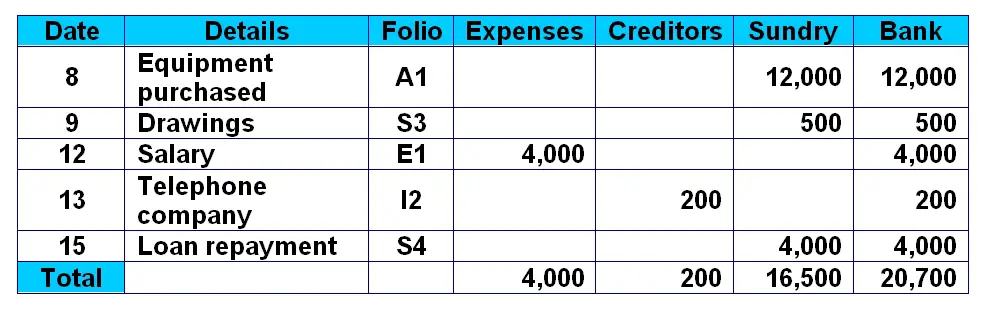

2. Cash Payments Journal (CPJ)

The cash payments journal is the opposite of the cash receipts journal.

It is the journal where you record all transactions where cash has been paid out.

Once again the "bank" column is added up to show the total payments.

The totals of the other three columns show how much was paid to what.

Expenses and creditors (accounts payable) would be the major categories to which payments would be made.

An Alternative - The Cash Book

Bear in mind that the cash receipts journal and cash payments journal can be replaced by a combined journal called the cash book.

The cash book is simply a combination journal (book) showing all receipts and all payments.

Returning to George’s Catering, the example business we've been using throughout our lessons, the total of the cash book (and of the cash on hand) after all the transactions would come to $14,800, which is the same as the total of the cash receipts journal above ($35,500) minus the total of the cash payments journal above ($20,700).

Petty Cash Journals

Have you heard of petty cash? Petty cash is simply a sum of cash on hand kept to pay small expenses.

In addition to the above, petty cash can also have its own separate journals - the petty cash receipts journal and petty cash payments journal. This is in addition to the regular cash receipts journal and cash payments journal.

And just like the cash book above, petty cash can also be accounted for in a separate journal combining receipts and payments, called the petty cash book.

But just remember, the cash book and the journals for petty cash are optional.

Let's move on to the five main journals which are remaining.

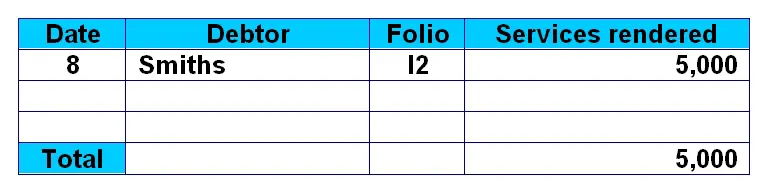

3. Sales Journal (SJ)

The sales journal is where all sales on credit are recorded (or in our example for George's Catering, where "services rendered" on credit are recorded).

The format of the journal is as follows:

Note that only income on credit is recorded here. We do not record any income received in cash here - income received in cash goes in the cash receipts journal above.

Also, when a debtor like the Smiths finally pays George’s Catering, this is also recorded in the cash receipts journal (not in the sales journal).

4. Sales Returns Journal (SRJ)

This journal is used specifically for transactions where goods that were originally sold have now been returned.

It would not really apply to a service business such as George’s Catering, but rather to a trading or manufacturing business that has products returned to them.

A trading business buys goods at a low price and sells them at a higher price. A manufacturing business makes products using materials and then sells the finished products.

The format of the sales returns journal is:

As you can see, it is similar to the sales journal in that it also includes debtors. But we're now dealing with sales returns instead of sales.

We originally made a sale on credit to the customer, who owed us money for it, but now he or she is returning the goods.

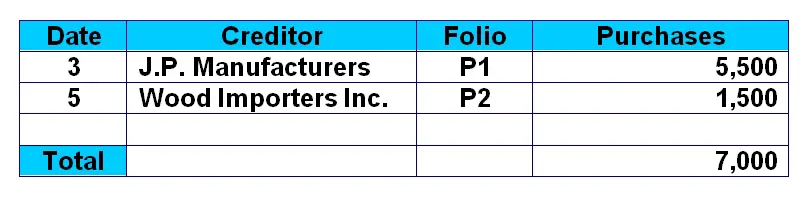

5. Purchases Journal (PJ)

The purchases journal is used to record all purchases of inventory on credit.

Again, the purchases journal does not apply to purchases of just any assets.

The purchases journal is only for purchases of inventory.

And only for inventory purchased on credit.

As such, we include a column here for creditors (suppliers we owe).

Inventory are stock or goods. See the lesson entitled What is Inventory? for more information on the subject.

And for the journal entries for purchasing inventory under the two different inventory systems, see the lesson Perpetual and Periodic Inventory.

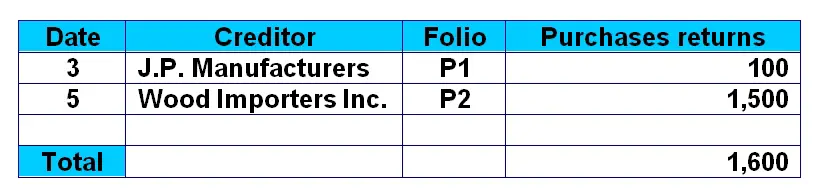

6. Purchases Returns Journal (PRJ)

The purchases returns journal shows all returns of inventory that were originally purchased on credit.

Just like the sales returns journal above, it is only applicable to businesses who have inventory - trading and manufacturing businesses.

7. General Journal (GJ)

The general journal shows all journal entries for anything not recorded in any of the journals above.

For example, if we wanted to record the purchase of equipment on credit, we would do so in the general journal.

Or if any adjustments of accounts needed to be made, this would also be done here.

This journal has the simple format that we saw in previous lessons:

Some Final Notes

Depending on the syllabus of the course you are doing, the formats of the above accounting journals may or may not be absolutely crucial.

In any case, as mentioned, they simply follow the debits and credits format that we have been getting used to up to now, so it isn't rocket science.

The accounting journals above have been shown in their simplest forms so they're easy to grasp. If the journals appear slightly different in your accounting textbook than here, then follow the format in your textbook. In any case, the format in your accounting textbook is what you'll be tested on, right?

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty rating:

Beginner

Quiz length:

7 questions

Time limit:

8 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

Okay, so those are our seven accounting journals (plus the optional extras or alternatives - cash book and petty cash journals).

Hope these are now a bit easier!

In the next lesson we're going to take a look at T-accounts, the step in the accounting cycle after the journals.

Return to The Accounting Cycle

Return to the Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: Basic Accounting Journal Entries

Next lesson: T Accounts

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

Which Accounting Journal Does This Transaction Go Into?

Q: Which accounting journal does this transaction go into?

Sammy stores issued us an invoice for stationery purchased from them, R759.

Return …

Purchase Returns & Discounts Question

Q: If I bought 3 units of merchandise on account and returned 1 due to defects, and was given a credit memo, what would the entry be?

Debit: Credit …

Capital Entry

Cash Receipts Journal

Q: Which accounts are affected and what is the entry for the following:

June 1: The owner invested an additional capital of $20,000 in the business …

Settlement Discount Granted

Q: How does a settlement discount granted affect the debtors column on the cash receipts journal?

A: Just to clarify for anyone reading, a settlement …

What is the Cash Book?

Q: What is the cash book?

A: Great question. The cash book is actually a combination of the cash receipts journal (CRJ) and the cash payments journal …

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.