Perpetual and Periodic Inventory

Previous lesson: Sales, Cost of Goods Sold, Gross Profit

Next lesson: Accounting for Manufacturing Businesses

Welcome to our lesson on perpetual and periodic inventory! In this tutorial we'll define these two inventory systems and cover the differences between them, including the different journal entries we make in either system when purchasing and selling goods and after doing a physical inventory count.

Be sure to check your understanding of this lesson by taking the quiz in the Test Yourself! section further below. And right at the bottom of the page, more questions on this topic (and related topics) submitted by fellow students.

What are the Perpetual and Periodic Systems?

Inventory records are kept using either one of the following systems:

a. Perpetual Inventory System

Perpetual means continuous. This is a system where a business keeps continuous, moment-to-moment records of the number, value and type of inventories that it has at the business.

A computerized accounting system – where each item of inventory is linked to the electronic accounting records – creates a perpetual system.

If a business is using barcode scanners, like at a supermarket or other retailer, they most likely have a perpetual inventory system in place. With a barcode system, products are automatically recorded as having been sold when they are scanned or swiped at checkout. An invoice is generated for the customer and records of inventory levels are automatically decreased.

b. Periodic Inventory System

Where one does periodic inventory counts (such as once a month, or at the beginning and end of each year), and does not have an accurate record of the inventories in between these points – well, this is a periodic system.

This system does not keep continuous, moment-to-moment records of inventories.

Accurate records are only kept periodically – meaning, at certain points in time – in this case, when the actual physical inventory counts are done.

Many small businesses still only have a periodic system of inventory.

Journal Entries During the Year: Periodic System

Now what do these two systems mean in terms of journal entries? Let’s look at the periodic inventory system first.

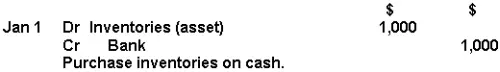

If we have a periodic inventory system and purchase more inventories during the year, we record the following:

This isn’t very complicated – we’ve been doing this already in previous lessons.

When we sell these inventories, we record:

Again, we’ve gone through this journal entry before, so nothing new.

Journal Entries During the Year: Perpetual System

Now, with the perpetual inventory system it’s a bit different.

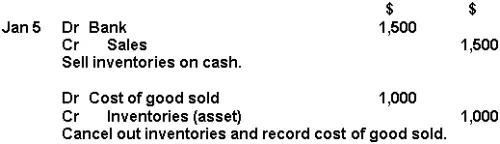

When we purchase more inventories during the year, we record the following:

Why do we use the “inventories” (asset) account here and not “purchases” (expense)?

The answer is that where we are keeping perpetual records of inventory, we can continuously adjust the "inventory" account when we purchase more goods.

Where we are not keeping perpetual records of our inventories, it is inappropriate to adjust the "inventory" account (since there are no continuous, accurate records of our inventory levels). So instead, we use the “purchases” account.

When we next do a physical inventory count, and thus have an accurate record of inventories once again, we can then adjust our “inventory” account to the newly-counted level. We’ll look at how this adjustment is done pretty soon.

FYI, in the examples in previous lessons, we used the periodic inventory system and so debited the “purchases” account when buying inventories (not the “inventory” account).

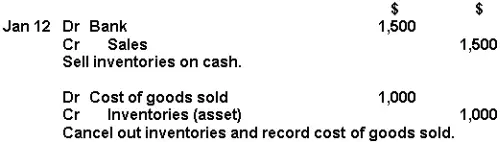

When we use a perpetual inventory system and sell inventories we record:

Thus we are left with a sales figure of $1,500 that can be matched against an expense – cost of goods sold – of $1,000, to give us $500 gross profit. We also have $500 in our bank account ($1,500 – $1,000). The balance of inventories is $0 ($1,000 – $1,000).

So with the perpetual system we have a cost of goods sold expense to match against revenue for each sale.

End of Year Adjustments:

Periodic Inventory

Let’s look at the periodic inventory system again. There was no entry regarding cost of goods sold using this system. So how does cost of goods sold fit in?

The answer is that we calculate and record cost of goods sold only at the end of the period, after we do a physical inventory count to calculate the inventory quantities and values on hand. This physical count gives us the information we need to work out the value of inventory that was sold during the period (cost of goods sold).

Let’s look at our example of the periodic system again to see how this works. We’ll use the same figures above, but now let’s also say that the business had $200 worth of inventories at the beginning of the year (opening inventories). At the beginning of the year our inventories T-account would have looked as follows:

At the end of the period we count $100 worth of inventory.

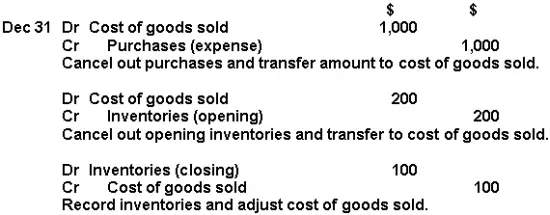

At this point in time we make the following adjustments:

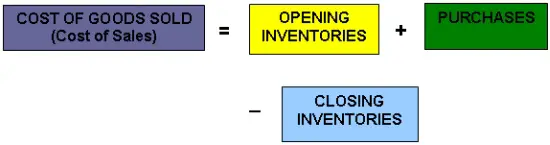

The above closing entries (entries at the end of the year) are in line with the formula for the calculation of cost of goods sold:

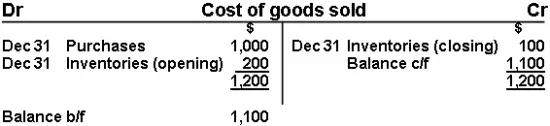

Our inventories account would look like this at the end of the year:

Inventories, existing in our records at $200, are adjusted to the counted figure of $100 at the end of the year (after the physical count is done).

This adjustment is done in two steps - 1) cancel out the old $200 figure, and then 2) add back in the new $100 figure. But this adjustment can also be done in one combined step.

The contra account for this is always “cost of goods sold.” One way of looking at why we use that as the contra account is that the difference between the $200 (opening inventories) and $100 (closing inventories) must have been sold, and the value of these goods that were sold ($100) is thus added to the “cost of goods sold” expense.

The “cost of goods sold” account would look like this at the end of the year:

End of Year Adjustments:

Perpetual Inventory

Let’s look at what we did with the perpetual system again:

When we purchased more inventories during the year, we said:

When we sold these inventories we recorded:

Cost of goods sold and inventories are thus adjusted continuously throughout the year – after each and every sale. And unlike the periodic system, at the end of the year cost of goods sold and inventories do not have to be adjusted at all. This is because the adjustments have already been done throughout the year.

And that represents the big difference between perpetual and periodic systems – continuous adjustment or adjustment only at certain periods.

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty Rating:

Intermediate

Quiz length:

6 questions

Time limit:

7 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

Return from Perpetual and Periodic Inventory to Inventory

Return from Perpetual and Periodic Inventory to Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: Sales, Cost of Goods Sold, Gross Profit

Next lesson: Accounting for Manufacturing Businesses

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

Journal Entry for Purchasing Goods

Q: What is the journal entry for the following?

Purchased goods from KJ Mehta for cash: 5,000 Rupees.

(Rupees = Indian currency)

A: Goods …

Journal Entry for Credit Card Sales Transaction

Q: Prepare the journal entries for the following credit card sales transactions (the company uses the perpetual inventory system):

Sold $3,000 of merchandise …

Sales Journal Entry Example:

Credit Card Transactions

(Perpetual Inventory System)

Q: Prepare journal entries for the following credit card sales transactions using the perpetual inventory system:

Sold $10,000 of merchandise, that …

Cash Sales Journal Entry Example

Q: What is the journal entry to record cash sales?

For example, cash sales of $3,000 to Mr. Hoover of goods that originally cost us $2,000.

…

Perpetual Inventory Write-offs

Q: Is perpetual inventory write-offs done on quarterly basis a healthy practice or not?

A: Depends on what the inventory is. If it is a product …

Stock Deficit and Stock Loss

Q: How do you account for stock deficit and stock loss on the general journal?

Credit Sale Journal Entry Example

Q: What is the journal entry for the following?

Sold goods to R. Botha on credit of R242,39. Issued invoice 001.

(R = Rands, South African currency) …

Purchase Returns Journal Entry

Q: What is the journal entry when purchases are returned?

A: The short answer is that the purchase returns journal entry is just the exact opposite …

Inventory Held For More Than One Year?

Q: Every company assumes that their inventory is a current asset as its term is less than one year. What do you do with inventory which you expect to …

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.