The Four Types of Financial Statements: Definition, Examples, Objectives

Lesson One: The Four Types of Financial Statements: Definition, Examples, Objectives (this page)

Lesson Two: Income Statement Example

Lesson Two-A: Income Statement Quiz

Lesson Three: Statement of Owners Equity

Lesson Four: Balance Sheet Example

Lesson Five: Cash Flow Statement Example

Lesson Six: Other Accounting Reports

In this tutorial we're going to find out what financial statements are, look at examples of the four component statements and learn about their objectives or purpose.

Be sure to check your understanding of this lesson by taking the quiz in the Test Yourself section further below. And right at the bottom of the page, more questions on financial statements submitted by fellow students, including a full company financial statements exercise with solutions.

What are Financial Statements?

The financial statements are simply the key accounting reports of a business.

The financial statements provide summarized figures that give an indication of the current financial health of the business as well as its recent financial performance.

The financial statements can be considered the business's scorecard (or scoreboard) - showing how well (or poorly) the business is doing.

The word statement simply means a report. So the financial statements are simply financial reports.

The Four Types of Financial Statements

Financial statements consist of the following four components (each of these reports are covered in their own full lesson where we'll look at their format and go over a more detailed example):

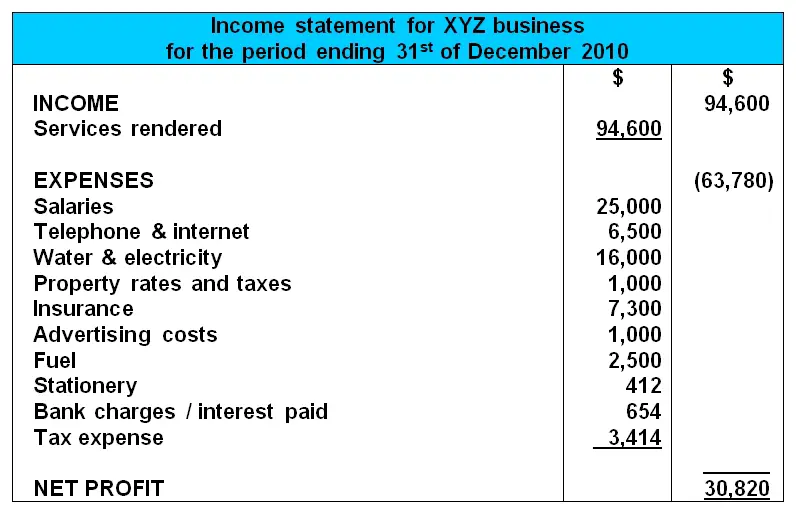

1. The Income Statement

The income statement is the first of our financial statements.

It is also commonly referred to as the profit and loss statement.

The income statement shows the reader the financial performance of the business over a specific period of time.

It does this by listing incomes and expenses as well as the resulting net profit or loss.

Check out our full lesson on the income statement here.

Note that the income statement shown above depicts the simplified format used for a service business. The format for a trading or manufacturing business is different.

Click here to see the income statement for a manufacturing business.

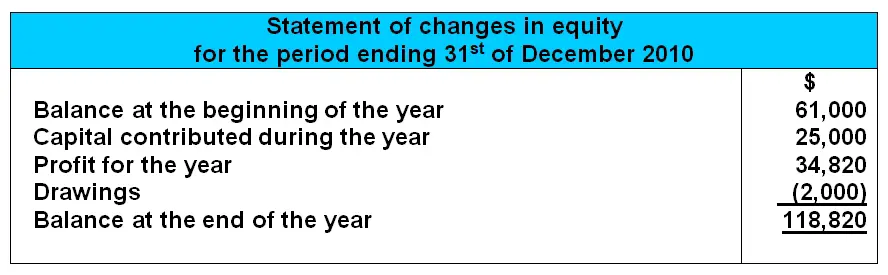

2. The Statement of Changes in Owner's Equity

The statement of changes in owner's equity is a short report that shows the opening and closing balances of owner's equity, as well as the changes that have affected it during the year.

These changes typically include additional capital (investment by the owner), drawings (owner withdrawals), as well as the net profit or loss for the year (which we calculate in the preceding income statement).

Click here for the full lesson on the statement of changes in equity.

3. The Balance Sheet

The balance sheet is also known as the statement of financial position.

As the name suggests, the balance sheet reflects the financial situation or financial position of a business at a specific point in time.

It does so by showing the quantities and categories of assets, liabilities and owners equity.

As such, it is actually very similar to our original accounting equation.

Click here for the full lesson on the balance sheet.

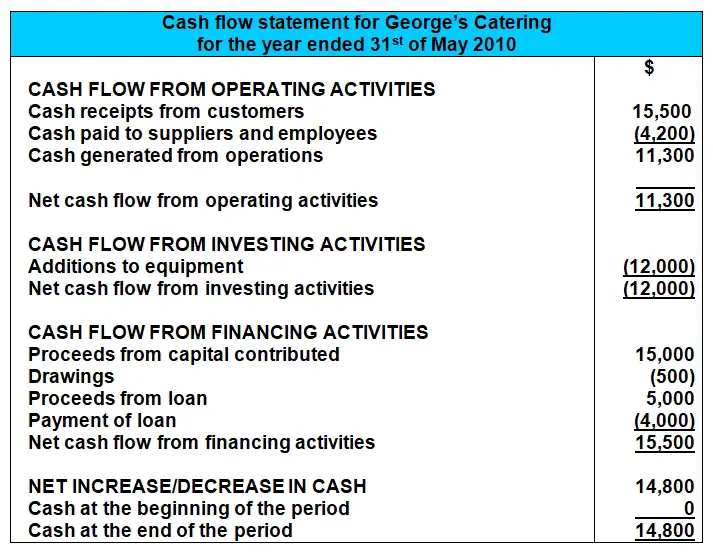

4. The Cash Flow Statement

The cash flow statement is a report showing the movement of cash within the business. It breaks down the major cash inflows and outflows during a certain period.

The report is divided into three main sections:

- Cash flows from operating activities (the core activities of the business),

- Cash flows from investing activities (what the business spent money on) and

- Cash flows from financing activities (from where the business got funding).

Of course there is a lot more to this statement, but that should give you the overall picture.

Click here for the full lesson on the cash flow statement.

Note that the cash flow statement format shown above uses the simpler direct method (not the more complicated indirect method, which begins with the net profit figure).

Objectives of Financial Statements

Financial statements come in various formats and all provide different information. However, they all have one thing in common: they give useful information about a business (or about an aspect of the business) to the reader.

The specific stated objective or purpose of the financial statements is:

To show the reader the financial position, financial performance and cash flows of a business.

As mentioned above:

- The financial position of the business is shown in the balance sheet.

- The financial performance of the business is shown in the income statement.

- The cash flows are shown in the cash flow statement.

It will become even clearer how each financial statement shows these aspects of the business as you go through each of the individual lessons in this section.

Note that the drawing up of financial statements is a compulsory (legal) obligation for public companies - companies that are listed on a public stock exchange - and must be published on an annual basis.

Also, after they are finalized, their financial statements have to be audited - meaning that they must be verified by an independent external auditor as being truthful and accurate.

The independent auditors publish an audit report on the accuracy of the financial statements, which is then often included as part of the company's published annual financial statements.

It is customary for all types of corporations to prepare their financial statements annually (not just public companies), but company executives often want them prepared more often for internal uses.

Users of Financial Statements

We said that the financial statements give useful information about a business to the reader.

But here's a question: who exactly are the readers or users of the financial statements? Who exactly are these reports prepared for?

Remember how I said that the financial statements are like the business's scorecard?

Well, the people who want to see the financial statements are the people that are interested in seeing this business scorecard - the guys who want to know how well the business is doing, including specific details such as its income, expenses, assets, liabilities, etc.

These people, in rough order of importance, include:

1) Business owners - They have the most direct interest in how well the business is doing. The better the business performs, the more money they make. They want to know how their business is doing.

2) Business executives - Business execs or managers are directly responsible for the performance of the business and as such are very interested in its scorecard. They will get fired if the business performs poorly, or get bonuses if it performs well.

3) Investors - Investors are only going to invest in businesses with good scorecards which show great potential for growth and profits.

4) The bank - They are interested in the financial statements (the business scorecard) of businesses they have a relationship with. For example, they may want to look at the financial statements to see how risky it would be to loan money to the business.

5) The government and tax authorities - They want to know that the business is fulfilling their legal duties, and in particular, that they are paying enough tax! The financial statements give a good idea of how much tax the business should be paying over.

6) Suppliers - Suppliers want to make sure that they will get paid by the business they are supplying goods to. So they may want to check the financial statements of the business before they start to do business with them.

7) Employees - Though this is not often the case, an employee may want to know how well the business is doing so he or she can plan for the future. For example, if the business looks like it might fall apart soon, the employee may want to start looking for another job. They may have even been given shares in the company they are working for, so will want to know that it's doing well.

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty Rating:

Beginner --> Intermediate

Quiz length:

7 questions

Time limit:

8 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

That's the end of our lesson on financial statements.

Now that you have a better idea of what these are, go ahead and check out the first of these accounting reports in our next lesson: the income statement.

Stay up to date with ABfS!

Follow us on Facebook:

Lesson One: The Four Types of Financial Statements: Definition, Examples, Objectives (this page)

Lesson Two: Income Statement Example

Lesson Two-A: Income Statement Quiz

Lesson Three: Statement of Owners Equity

Lesson Four: Balance Sheet Example

Lesson Five: Cash Flow Statement Example

Lesson Six: Other Accounting Reports

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

Order of Financial Statements

Q: The financial statements must be prepared in a particular order. Which statements are prepared first, second, and third? What is their chronological …

Company Trial Balance and Financial Statements Question

Before you begin: It's really important when you're preparing for tests and exams to make sure you not only answer questions correctly but also do so …

Balance Sheet, Owner's Equity Statement and Income Statement: Temporary vs Permanent Accounts

Q: The three primary financial statements that we have seen so far are the Balance Sheet, Statement of Owner’s Equity, and the Income Statement. Please …

Importance of Financial Statements for Investors

Q: How are the financial statements important for investors? How is the balance sheet, income statement, statement of owner's equity and cash flow statement …

Accounting Period and Audit of Company's Annual Report

Q: What is the longest period covered in financial accounting?

A: Accounting periods are generally one year. I've never heard of it ever being longer …

Financial Statement for Non-Profit

(Student Representative Council)

Q: Please how do I prepare a financial statement at the end of a session to show how we have spent as the financial secretary? Thanks in advance.

…

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.