Income Statement:

Example, Format and Explanations

Previous lesson: The Four Types of Financial Statements

Next lesson: Statement of Owners Equity

In this tutorial we'll learn the purpose of this key accounting report and go over a simple income statement example to learn its format and components.

At the bottom of this page you'll find a link to our income statement quiz (10 multiple-choice questions), which you can use to test yourself. Be sure to take this quiz after finishing the tutorial below.

Income Statement Definition and Purpose

The income statement is the first component of our financial statements.

The income statement is a report showing the profit or loss for a business during a period, as well as the incomes and expenses that resulted in this overall profit or loss.

Not surprisingly, the income statement is also known as the profit and loss statement.

The income statement's primary purpose is to show the financial performance of a business.

The amount of profit or loss that a business makes during a period is the key indicator of its financial performance.

Did you know?

The income statement is often abbreviated as I.S. or I/S.

The Income Statement Format

Here is the format of a basic income statement:

Some Notes on this Income Statement

Very important:

The income statement format above is a basic one - what is known as a "single-step" income statement (meaning, just one category of income and one category of expenses) and prepared specifically for a service business.

Examples of service businesses are medical, accounting or legal practices, or a business that provides services such as plumbing, cleaning, consulting, design, etc.

The income statement for a trading business (a business that buys and sells goods) and for a manufacturing business (a business that makes goods) is quite different to the one shown above.

If you would like to see the multiple-step income statement format for a trading business then check out the lesson on Sales, Cost of Goods Sold and Gross Profit.

To see the multiple-step income statement format for a manufacturing business check out the lesson on Accounting for Manufacturing Businesses.

Note that net profit is also sometimes called net income.

And finally, there's a common expense in the example above which we didn't cover in previous lessons: interest paid (or "bank charges"). Interest is usually payable on loans taken from the bank. For example, a loan of $10,000 may have an interest rate of 10%. This means that if you haven’t paid the loan back in a year, you would owe $1,000 more ($10,000 x 10%).

How to Prepare the Report:

Trial Balance to Income Statement

It's not that difficult to put together a basic income statement.

The number one thing to know when preparing an income statement is that it is drawn up from the figures in the trial balance.

Let's return to the example we've been using throughout our lessons, George's Catering. Our previous trial balance for this business is shown below:

When preparing the income statement, we look for all the income and expense items in the trial balance. Then we simply copy these over to create our report.

Note that when we are creating an income statement, we only take the incomes and expenses from the trial balance - we ignore everything else (assets, liabilities and owners equity).

Multiple-Step Income Statements and Tax

A major expense shown in our first income statement example above is tax.

Tax (or "taxation") is actually shown in a simplified way in that income statement as it is a single-step income statement.

In reality, companies often use more complicated "multiple-step" income statements, where key expenses are separated into groups or categories. In multiple-step income statements, tax is shown on its own line, completely separate from all other business expenses.

Why is this done? For a few reasons:

Firstly, companies are required to report tax as a separate line item on its income statement.

Secondly, from a common-sense perspective, tax is such a major expense for most businesses that it deserves special attention.

Finally, and perhaps most importantly, showing tax on its own line highlights the profit before tax in addition to the final profit after tax. Since tax is an expense that is not really under the control of management, profit before tax can be seen as a better indicator of how well the business was managed.

So, all other business expenses are totaled, and only after this do we show tax as a final expense on a line of its own. This means that the last three lines in a multiple-step income statement are shown as follows:

- PROFIT BEFORE TAX

- TAX EXPENSE

- NET PROFIT AFTER TAX (final figure)

Income Statement Accounting Period

An income statement usually covers a full year.

That is most certainly the case when the income statement is prepared as part of a company's published annual financial statements.

However, the income statement may be drawn up for shorter periods, such as one month or three months (quarterly income statement). These shorter periods are used where the business managers and employees want to analyze the performance of the business over a shorter time period to help make internal business decisions.

The period of time that is covered by the income statement (and other financial statements) is called the accounting period.

A regular 12-month accounting period does not necessarily have to begin on the first day of the year and end on the last. Accounting periods can run, for example, from March 1st to February 28th, or July 1st to June 31st, etc. The choice of the accounting period rests with the enterprise itself.

Income Statement Quiz

Think you understand what the income statement is all about? Ready to test yourself?

This quiz is a 15-minute timed test consisting of 10 multiple-choice questions and will test you on the theory above as well as the components of the income statement and various calculations including incomes, expenses, gross and net profit.

Click here to take the income statement quiz now.

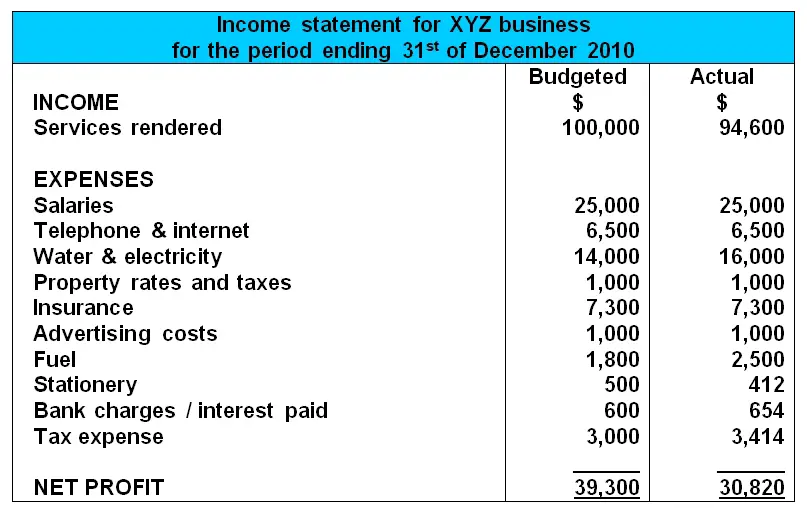

Budgeted Income Statements

Budgeted income statements can also be drawn up, showing targeted figures for sales, expenses and profits.

Later on, these budgeted figures can be compared to the actual figures and action can be taken to rectify any shortfalls.

In the budgeted income statement example above, we can see that the actual profit for the period is about $8,500 less than what was planned for. This was due to the income being $5,400 less ($100,000 – $94,600), and the expenses (such as water and electricity) being greater than expected.

These budgeted figures would normally be drawn up based on actual figures from past years, but taking into account any expected future changes. The budgeted figures (and the way these figures were obtained) could be explained or justified in additional notes to the income statement.

Hope you enjoyed our tutorial on the income statement.

In the next lesson we'll go over the next report in the financial statements - the statement of owner's equity.

Return from Income Statement Example to The Four Types of Financial Statements

Return to the Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: The Four Types of Financial Statements

Next lesson: Statement of Owners Equity

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

Sale of Scrap Raw Material

In an income statement where do you post a sale of scrap raw material?

Income, Expenses and Retained Earnings Question

Q: Andersen's Nursery has sales of $318,400, cost of $199,400, depreciation expense of $28,600, interest expense of $1,000, and a tax rate of 34%. The …

Relation of Profit to

Opening & Closing Inventory

Q: Why is the gross and net profit directly proportional to the closing inventory? So if the stock is over valued, the profit increases, and vice versa. …

Income Statement - Six Month Period (Multiple Choice Question)

If the income statement covered a six month period ending on November 30, 2010, the third line of the income statement would read:

A. Month ended November …

Goodwill and its Revaluation

What do I do with goodwill and the revaluation of goodwill?

Finance Table

Q: Is there different ways to create a finance table?

A: Kaleb, thanks for your question. There are definitely different ways to create a finance …

Manufacturing Business -

Trial Balance

Q1: What do you include in a manufacturing business' trial balance?

Q2: What do you do when the trial balance doesn't balance?

Q3: Are expenses …

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.