Sales, Cost of Goods Sold

and Gross Profit

Previous lesson: The FIFO Method & Weighted Average Cost

Next lesson: Perpetual and Periodic Inventory

What is the cost of goods sold? How do we account for incomes and expenses related to inventory? And how does the cost of goods sold formula work?

In this lesson we'll answer these questions and more.

Be sure to check your understanding of this lesson by taking the quiz in the Test Yourself! section further below. And right at the bottom of the page, plenty more questions on this topic (and related topics) submitted by fellow students.

Trading vs Service Business

We mentioned previously how a trading business differs from a service business:

Whereas a service business provides a service, such as accounting, medical or repair work, a trading business trades in inventory (this means that it buys goods at a low price and sells them at a higher price).

A trading business will also differ from a service business in terms of its income and expenses – i.e. the way a profit is made: whereas a service business renders services, a trading business makes sales.

The income statement for a trading business will thus look different to the income statement of a service business.

The Income Statement Format for a Trading Business (Multiple Step)

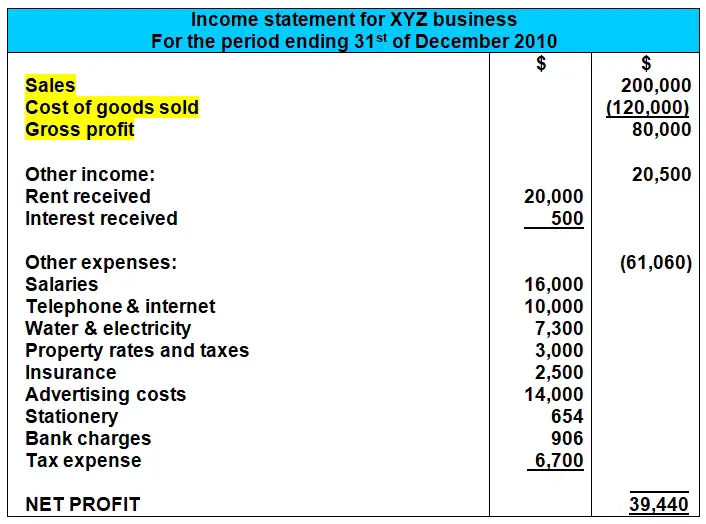

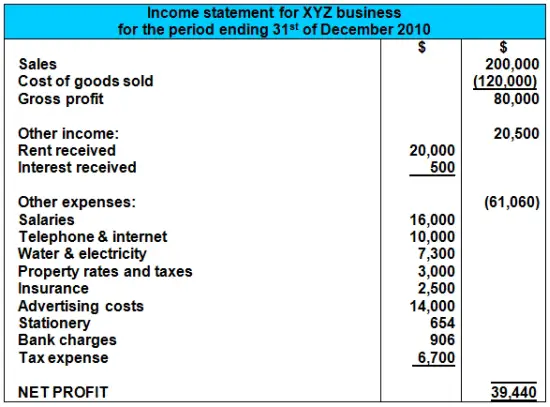

Here is the income statement for a trading business:

If you want to see what a basic income statement looks like for a service business and compare to the income statement above, or if you're just not familiar with this financial report, then check out the lesson on the income statement.

The income statement example above for a trading business is more complex than the simple one for a service business.

This income statement is known as a multiple-step income statement, meaning that it contains more than one section or category for income or expenses.

As you can see, the income statement for a trading business has a first section on its own. This first section describes its core activities, i.e. the buying and selling of goods.

Here are definitions and explanations of the terms used in that first section:

Sales

Sales are the full income for the year for selling goods.

It is also sometimes called revenue or sales revenue.

Cost of Goods Sold (or Cost of Sales)

Cost of goods sold refers to the cost of all the goods that we sold this year.

Cost of goods sold is commonly abbreviated as C.O.G.S. and is also known as cost of sales.

Cost of goods sold is an expense charged against sales to work out a gross profit (see definition below).

So, for example, we may have sold 100 units this year at $4 each, and these 100 units that we sold cost us $3 each originally. So our sales would be $400 and our cost of the goods we sold (cost of sales) would amount to $300. This would result in a gross profit of $100 (sales minus cost of sales).

Cost of Goods Sold does not include general expenses such as wages and salaries to office staff, advertising expenses, etc. It is simply the direct costs of the inventory that we have sold during the year.

Please note that Cost of Goods Sold is actually not the exact same thing as purchases, as you will see from our examples further below.

Gross Profit

Gross profit is an initial profit on the product we are selling, before deducting general business expenses.

Gross profit is calculated by taking the sales and deducting the cost of goods sold from this.

The gross profit figure is seen as an indicator of how well a trading business is managing its core business of buying and selling goods.

Example of a Trading Business Buying and Selling

Okay, let’s do an example where we can work out the sales, cost of sales and the gross profit for a business.

Here's our example of Ms. Sheppard's business again:

Cindy Sheppard runs a sweet shop. She enters into the following transactions during July:

July 1 Purchases 1,200 sweets at $1 each.

July 13 Purchases 500 sweets at $1.20 each.

July 14 Sells 700 sweets at $2 each.

How many sweets does she have at the end of the month?

Answer:

1,200 + 500 – 700 = 1,000 sweets

Okay, that's the quantity of her closing stock.

Now let's calculate the value of her closing stock - using each of the FIFO, LIFO and weighted average cost methods:

If you did not yet go through our tutorial on FIFO, LIFO and weighted average cost and are not familiar with these inventory valuation methods, check out that previous lesson first before moving ahead with the examples below.

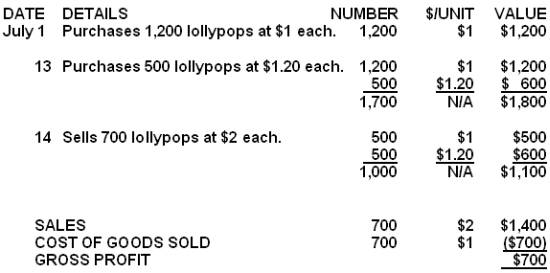

1. The First-In-First-Out Method (FIFO)

As you can see, even though the purchases amounted to $1,800, the cost of goods sold (or cost of sales) amounted to $700.

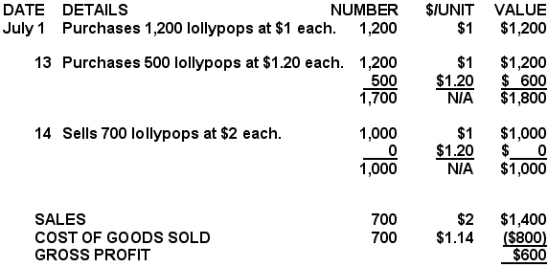

2. The Last-In-First-Out Method (LIFO)

In this case, even though our purchases amounted to $1,800, our cost of goods sold (or cost of sales) amounted to $800.

This is calculated as follows: (500 x $1.20) + (200 x $1.00) = $800.

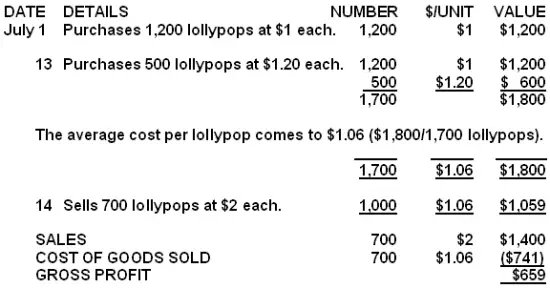

3. The Weighted Average Cost Method

Again our purchases are $1,800, but this time our cost of sales comes to $741.

Why am I showing you the different cost of goods sold figures?

To illustrate that purchases and cost of goods sold, although related, are not the same thing.

The Cost of Goods Sold Formula

& Closing Inventory

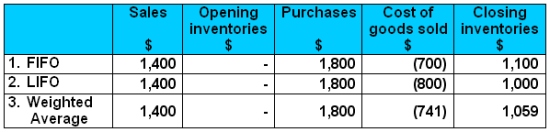

Now, let’s look at a summary of the figures we have calculated from these three methods:

We can work out some very useful formulas using these figures…

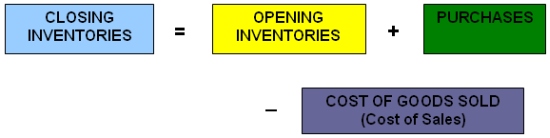

1. The Closing Inventories Formula

The closing inventories can always be calculated as follows:

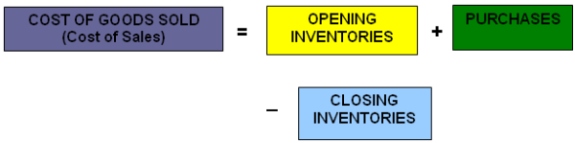

2. The Cost of Goods Sold Formula

If we switch around the first equation to make cost of goods sold the subject, we have a formula for working this out:

The formula just above is actually a very well-known formula in accounting.

It is called the cost of goods sold formula (or the cost of sales formula).

If you try the two formulas above using the figures from the table, you will see that they work every time.

For example, with the FIFO figures, we can see that we had 0 inventories to start with, plus we purchased $1,800 worth of goods. Of these $1,800, we sold $700, so we were left with $1,100 closing inventories.

Or, using the same figures, we can see that we purchased $1,800 worth of goods and were left with $1,100, so we must have sold $700 worth of goods (the cost of goods that we sold).

Almost every accounting student I have encountered has had to memorize the cost of goods sold formula because they simply didn't understand what it means and how it works in practice. I hope the explanations above will make it easier for you to understand and work with this key formula.

The Income Statement after Gross Profit

Once we've calculated our gross profit from the sales and cost of goods sold, we:

- Add other income to this,

- Deduct general business expenses, and

- Then arrive at our net profit.

Pretty simple, right?

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty Rating:

Beginner --> Intermediate

Quiz length:

5 questions

Time limit:

6 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

There you go! I hope the Cost of Goods Sold Formula is now a lot easier, and that you have a better understanding of how sales, cost of sales, opening inventory, closing inventory and gross profit all fit together.

You can find questions on these topics submitted by students around the world further below.

If you're feeling good about this lesson, feel free to move on to the next one on Perpetual and Periodic Inventory.

Return to What is Inventory?

Return to the Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: The FIFO Method & Weighted Average Cost

Next lesson: Perpetual and Periodic Inventory

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

General Journal Closing for Sales

When doing a general journal closing I am supposed to start with sales. Do I subtract sales returns and allowances and discounts in order to close revenue …

Calculate Gross Sales Question

(Rs = Rupees = Indian currency)

Opening stock Rs.30000,

Closing stock Rs.40000,

Purchases Rs.560000,

Returns outward Rs.15000,

Returns inward Rs.20000, …

Gross Profit Quick Question

Q: If net revenue equals $50,000, cost of sales $20,000 and operating expenses $10,000, then what does the gross profit come to?

A: This question …

What is the Cost of Goods Sold Formula?

What is the cost of goods sold formula?

A: The cost of goods sold formula (also known as the cost of sales formula or equation) is:

Or to …

Break Even Analysis

Please help me with the following break even analysis question:

Particulars Shoes Socks

Selling Price 645.00 36.00

Variable Cost 516.00 27.00

Fixed …

Gross Profit Question

Q: How do you calculate the gross profit when you are given gross profit percentage?

Gross Profit Percentage Question

Q: The following information relates to 20.6/20.7 financial year of ABC:

Sales 150,000

Purchases …

Income Balancing Amount Question

Q: You are given the following figures:

- Beginning capital of 200,000 - Ending capital of 190,000 - Additional investment 30,000 and - Personal withdrawal …

Cost Price, Sales Price, Mark-Up

Q: How do you find the cost price if the sales are $216,000 and the mark-up is 50%?

A: "Mark-up" literally means the amount you "mark up" the cost …

Gross Profit/Loss Question and Solution:

Q: The following information is provided to you (note that Rs = Rupees, official currency of Pakistan, India and Sri Lanka. O/B = Opening Balance):

…

Cost of Goods Sold and

Interest Expense

(Please note that in the following question R = Rands, which is the South African currency)

a) Sales totaled R15,000,000

b) Cash R370,000

c) Marketable …

Value of Closing Stock Question

Q: Opening stock 80,000, purchases 160,000, sales 200,000. Gross profit 33%. Goods destroyed by fire 30,000. Received claim of 20,000.

What is the …

Multi-Step Income Statement

Q: I have racked my brain on this and I cannot come up with an answer. If there were a business that did not have a cost of goods figure, would they still …

What is the Journal Entry for Carriage Inward?

Q: What is the journal entry for carriage inward?

A: Remember, carriage simply means transportation costs and carriage inward (or inwards) …

Carriage Inwards:

Meaning, Treatment and Example

Q: What is carriage inwards? Which category does carriage inwards fall under in accounting?

A: Well, first let's make sure we understand what "carriage" …

Cost Accounting - Fixed vs Variable?

Q: Fixed costs are really variable, the more you produce the less they become. Do you agree? Explain?

A: Thanks for your questions Ujala.

I agree …

Creditors, Purchases, Cost of Goods Sold Question and Answer

Before you begin: It's important for testing and exams to make sure you not only answer questions correctly but also completed them at the right speed. …

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.