Accounting for

Manufacturing Businesses

Previous lesson: Perpetual and Periodic Inventory

Next lesson: The Manufacturing Cost Statement

Welcome to our lesson on accounting for manufacturing businesses! In this tutorial we'll look at how manufacturing businesses differ from trading and other businesses in terms of their income statement and cost of goods sold.

Be sure to check your understanding of this lesson by taking the quiz in the Test Yourself! section further below. And right at the bottom of the page, more questions on this topic submitted by fellow students.

First Let's Define Manufacturing

Manufacturing means to make a product, whether by hand or by machine or both.

The word manufacture originates from Latin manu facere meaning "make by hand" (manus = "hand" and facere = "to make").

Unlike trading businesses, manufacturing businesses do not buy products at a low price and sell at a higher price.

Instead manufacturing businesses make products, which they then sell.

In this tutorial I'm going to show you one of the primary differences when accounting for manufacturing businesses (instead of service or trading businesses). This difference can be seen in the income statement.

A Quick Review of Trading Businesses

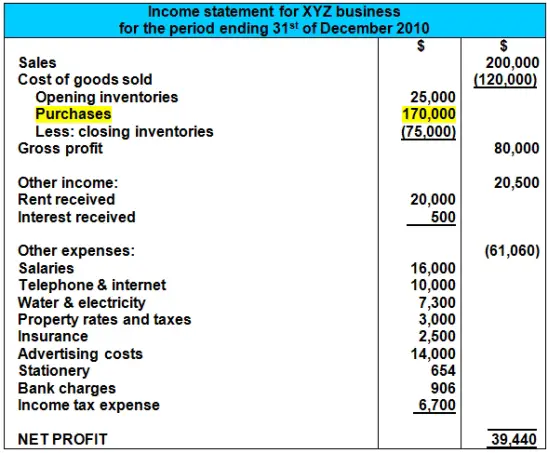

Okay, let's recap. Here is the income statement for a trading business (including the calculation of the cost of goods sold):

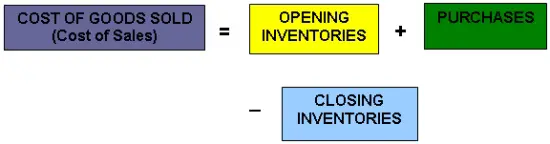

We can see that the cost of the goods sold was determined as follows:

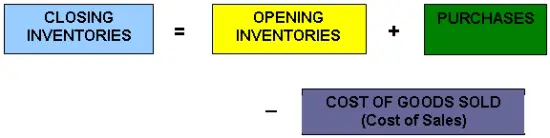

The formula above was based on the calculation of the value of closing inventories:

The Income Statement Format for a Manufacturing Business (Multiple Step)

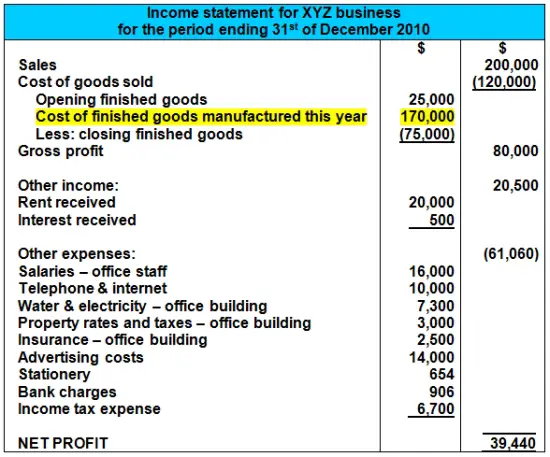

The income statement for a manufacturing business is a bit different to that of a trading business:

As you can see, the income statement for a manufacturing business is a multiple-step income statement, meaning that there are multiple sections or categories for income or expenses.

The initial section of Sales, Cost of Goods Sold and Gross Profit is one separate step in this multiple-step income statement.

To review a basic, single-step income statement for a service business, see the lesson on the income statement.

Finished Goods: Closing Stock and the Cost of Goods Sold Formula

Now, where do we get those new lines in the income statement above about finished goods, and what exactly does this mean?

First of all, here is the definition of this key term for manufacturing businesses:

Finished goods are inventories that have been fully manufactured and are ready for sale.

The Formula for Closing Stock

(for Finished Goods)

Now, the cost of goods sold calculation in the above income statement was derived from a formula...

In a manufacturing business the closing value of finished goods are calculated as follows:

Or, to write it out:

Closing Finished Goods = Opening Finished Goods + Cost of Finished Goods Manufactured - Cost of Finished Goods Sold

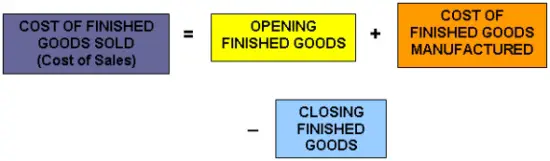

The Cost of Goods Sold Formula

(for Finished Goods)

By switching things around and making the cost of goods sold the subject, we can get another formula.

The cost of finished goods that were sold (cost of sales) is calculated as follows:

Or, to write it out:

Cost of Finished Goods Sold = Opening Finished Goods + Cost of Finished Goods Manufactured - Closing Finished Goods

As you can see, this Cost of Finished Goods Sold formula is represented exactly in the above income statement for manufacturing businesses.

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty Rating:

Beginner --> Intermediate

Quiz length:

4 questions

Time limit:

5 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

Alrighty. So accounting for manufacturing businesses is not too bad so far, right?

If you're happy with this lesson move on to the second lesson on the subject, which goes over the manufacturing cost statement.

Return from Accounting for Manufacturing Businesses to Inventory

Return from Accounting for Manufacturing Businesses to Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: Perpetual and Periodic Inventory

Next lesson: The Manufacturing Cost Statement

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

Adjusting Entry Preparation Manufacturing Business

#1) How to prepare a journal entry for the transactions related to inventories of raw material, goods in process, & finished goods?

#2) How to prepare …

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.