The Manufacturing Cost Statement

and its Components

Previous lesson: Accounting for Manufacturing

In this lesson we're going to review some of the common manufacturing costs that are you will hear about in this type of business, and go through the manufacturing cost statement and its format.

Be sure to check your understanding of this lesson by taking the quiz in the Test Yourself! section further below. And right at the bottom of the page, more manufacturing cost questions submitted by fellow students.

In a trading business we work out the value of our inventory by just looking at the supplier’s invoice and simply seeing how much it cost to buy the goods.

In a manufacturing business we work out the value of our inventory by calculating how much it cost us to make the goods.

So in order to calculate how much our inventory are worth and how much our cost of goods sold came to, we need to calculate how much it cost us to manufacture the finished goods.

Purpose of the Manufacturing Statement

The manufacturing cost statement is a report showing the various costs involved when manufacturing finished goods.

Note that although it is a formal (and important) report, it is not part of a business's annual financial statements.

In fact, it is generally not a report prepared for external users at all.

So, who is it prepared for?

The report is prepared primarily to help the management of a manufacturing business.

The purpose of the manufacturing statement is to help management analyze their costs of production and use this information to effectively plan their future manufacturing so as to minimize costs and maximize profits.

Manufacturing Costs

I'm going to show you the full format of the manufacturing cost statement further below, but before we look at the format, it's important to clarify the different types of manufacturing costs that we'll see there.

Manufacturing costs are divided into three broad categories:

1. Direct materials

Direct materials are materials that are directly used in making the product. Also known as raw materials. For example, wood used to make tables or furniture.

2. Direct labor

Direct labor is labor directly involved in manufacturing the product, such as a mechanic. This includes people working with their hands or operating machines used to manufacture the product.

3. Overheads

Overheads are other general business expenses attributable to manufacturing the product.

This includes rent (on the factory building), insurance (for the factory building or factory machines), and water and electricity (specifically for the factory building).

If a business had a factory building and also an office building (where administrative work was done), the overheads would not include any of the expenses to run the office building - only expenses for the factory.

The first two costs above taken together (direct materials plus direct labor) are known as the conversion costs of a product.

Let's go over a few more key terms we'll see in the manufacturing cost statement:

Indirect materials

Indirect materials are inventories that are used in the manufacturing process but whose cost is relatively insignificant.

For example, in manufacturing a car, the nuts, screws and bolts would be indirect materials. Cleaning materials that are consumed in producing a completed, clean car would also be indirect materials.

Indirect materials are recorded separately from direct materials, and actually fall under the category of overheads.

Indirect labor

Indirect labor is the cost of personnel not directly involved in manufacturing the product, but whose cost forms part of the factory expenses.

Included in this are wages and salaries to factory supervisors, cleaners and security guards.

Indirect labor is recorded separately from direct labor, and, just like indirect materials, falls under the category of overheads.

Work in progress

Work in progress are inventories that have started the manufacturing process but that are not yet finished goods. An example of this would be a car without an engine or fitted windows. Or tables that have been assembled but need sanding or finishing work.

Raw materials

Raw materials are inventories that have not yet been used in the manufacturing process at all. An example of this would be the raw (untouched) steel used to make parts of a car, or wood to make a table. Raw materials are also called direct materials.

The Manufacturing Cost Statement:

Format and Calculations

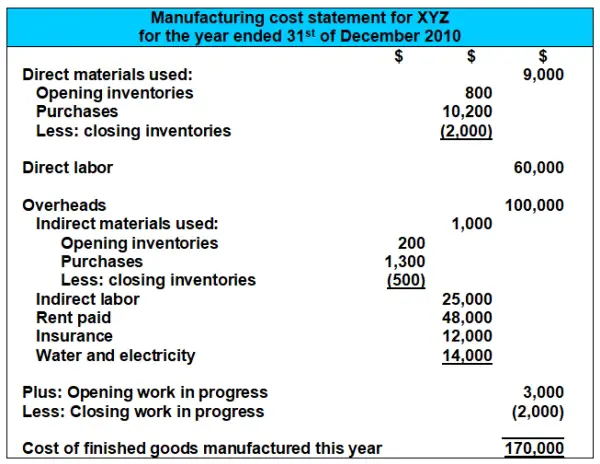

Now that we've covered all the necessary terms, here is the statement (shown here for a business using the periodic system of inventory accounting):

Now if you're a bit confused looking through the above statement I don't blame you. It's not easy.

You might be asking yourself how some of the above calculations in the manufacturing cost statement were obtained.

For example, why are we adding opening work in progress and minusing closing work in progress towards the end of the statement?

Don't worry, I'm going to explain these calculations in detail below.

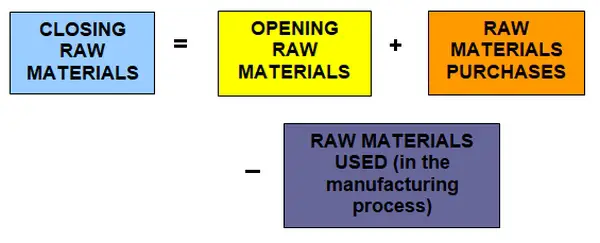

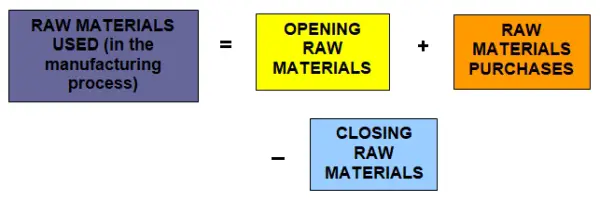

First of all, to calculate the value of direct or raw materials used in the manufacturing process (the first section of the manufacturing cost statement), we use a similar formula to that used to calculate the cost of the finished goods sold (cost of sales) in the income statement:

When we swap this formula around we get:

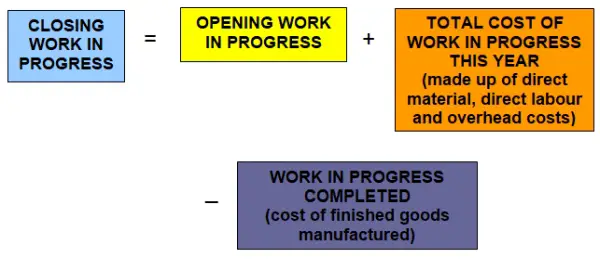

Now, we actually use a very similar equation for work in progress too:

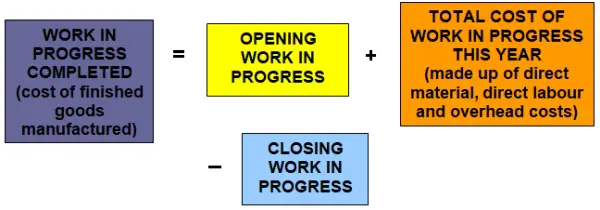

And once again, when we swap the formula around we get:

Our last formula above concerning work in progress completed (cost of finished goods manufactured) is a tricky one to locate in the manufacturing cost statement itself.

If you look at the statement, “opening work in progress” and “closing work in progress” are right there (towards the bottom), but where is the “total cost of work in progress” this year?

The answer is that this is equal to everything in the statement above the opening and closing work in progress.

In other words, it's the total cost of direct materials used, plus the cost of direct labour, plus the overheads. This is the “total cost of work in progress” this year.

The final line item in the manufacturing cost statement, the "cost of finished goods manufactured this year" is the exact same as the “work in progress completed” in the final inventory formula above.

After all, when work in progress inventory are actually completed, they become finished goods - it's the exact same thing.

So, that is why the manufacturing cost statement is structured the way it is - based on the above inventory formulas.

If you refer back and forth between the inventory formulas and the manufacturing statement you should be able to get a basic idea of how the formulas are actually embodied in the statement itself.

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty Rating:

Intermediate

Quiz length:

9 questions

Time limit:

10 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

That's it for our lesson on the manufacturing cost statement.

At this stage I have to say:

Well done!

Because not only did you just get through one of the more difficult accounting topics...

But you also just completed the final lesson on this site!

But... that doesn't mean that you're done with accounting yet.

I know, groan.

But listen...

Accounting is an action.

It's something you do, not just something where you learn theory.

So if you've not yet done so, you should start practicing accounting to make sure you not only know the theory, but can actually put this into practice.

What I'm specifically getting into is that you should practice as many accounting questions and exercises as you can.

There are two great free options on this site to help with this:

Feel free to go through as many of these questions and exercises as you want.

And of course, you can practice a lot more questions and exercises if you get one of our great accounting books or e-books!

Would you like more in-depth lessons on accounting, on topics such as:

- Depreciation,

- Bad debts,

- Provision for bad debts,

- Prepaid income and expenses,

- Closing and adjusting entries,

- And more?

Would you like questions and exercises on every topic covered on this site (and more)?

If so, check out our site's official basic accounting book - Accounting Basics: Complete Guide.

That's all folks!

It's now up to you to ensure you excel in accounting.

Thank you for checking out my site and going through the lessons here.

I hope they've helped make things a bit clearer.

You're welcome to return here at any point.

Wishing you great success in your studies and career!

All the best,

Michael Celender

Return from The Manufacturing Cost Statement to Inventory

Return from The Manufacturing Cost Statement to Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: Accounting for Manufacturing

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

Manufacturing Statement Exercise

Select the relevant information and prepare a fully classified manufacturing statement OR cost of production of Samiu Manufacturers Ltd.

Given below …

Manufacturing Costs Question

(The cost of raw materials purchased during the year)

Please help me with the following manufacturing costs question:

Inventories

Beginning …

Factory Machinery in

Manufacturing Statement

Q: In the Manufacturing Statement do I need to include the factory machinery under my factory overheads?

A: Hi Ambrose,

No, you would not include …

What is the Manufaturing Cost for a Vehicle?

What would be the cost to make a new car in a factory?

Calculating Value of Closing WIP

(Manufacturing Costs Question)

Q: Given the direct materials as $714,000, direct labour as $400,000, variable overheads as $100,000 and fixed overheads as $350,000. 90,000 units were …

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.