What is the Trial Balance?

Definition, Format, Example

Previous lesson: Debtors and Creditors Control Accounts

Next lesson: The Four Types of Financial Statements: Definition, Examples, Objectives

What is the trial balance? What's its purpose and format? In this lesson we'll answer all of those questions and learn how to put it together.

Be sure to test yourself on how to compile a trial balance by trying the Trial Balance Practice Example below as well as the Trial Balance Mini Quiz at the end of the lesson. And right at the bottom of the page, you can find more questions on the topic submitted by fellow students.

Definition of Trial Balance

The trial balance is an accounting report or worksheet, mostly for internal use, listing each of the accounts from the general ledger together with their closing balances (debit or credit).

The trial balance sums up all the debit balances in one column and all the credit balances in another column. The totals of each column should agree in value.

Purpose of the Trial Balance

The trial balance is our penultimate step in the accounting cycle (the final step is the financial statements).

The financial statements are the most important reports of a business.

Due to their importance, we do a final check before preparing the financial statements.

This final check is done with the trial balance.

A trial is a test.

So this step is literally a test of balances.

But what balances are we talking about?

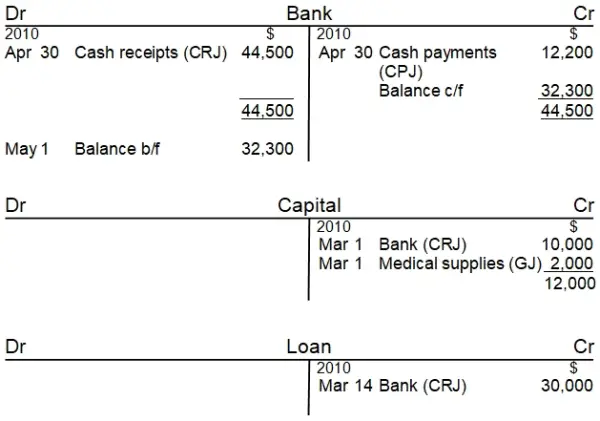

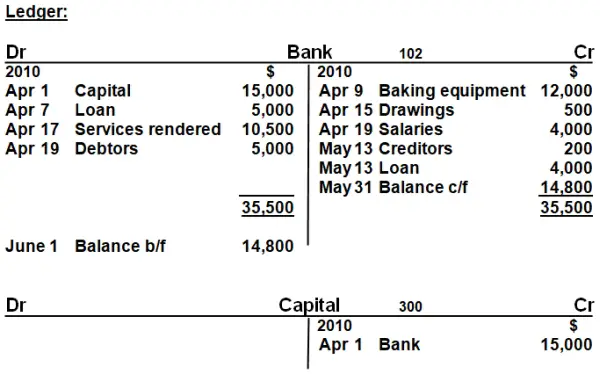

We’re talking about the closing balances that we worked out for each of the T-accounts:

We’re also talking about balancing the accounting equation (i.e. the left side must always equal the right side, as it is an equation):

The trial balance is drawn up to check for any mathematical errors that may have occurred during the earlier stages of the accounting cycle - during the recording of the journal entries and their posting to the various accounts.

The trial balance is usually prepared on an annual basis, in line with (and just before) the financial statements. However, it can be prepared on a more frequent basis, depending on the needs of the business.

Trial Balance Format

The trial balance has a simple format:

We list all the accounts from the general ledger on the left-hand side.

On the right-side of the report we show two columns, a column for debits and a column for credits.

At the bottom of each of the debit and credit columns are the totals.

An additional column showing the folio or code of each general ledger account can also be included.

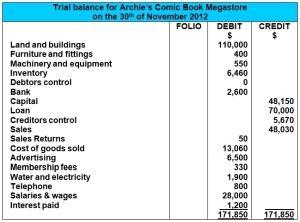

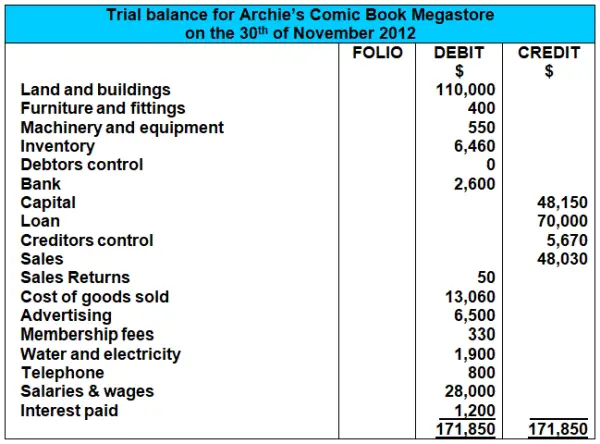

Trial Balance Practice Example

Let’s see how this works.

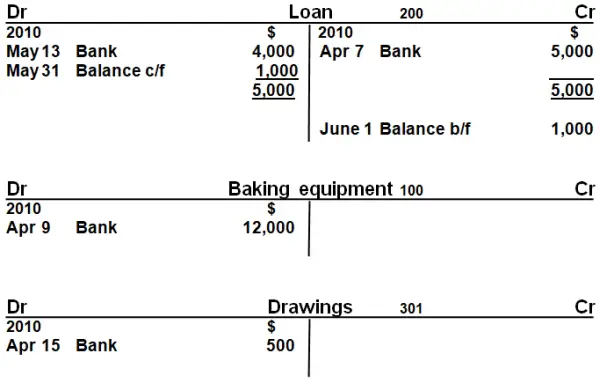

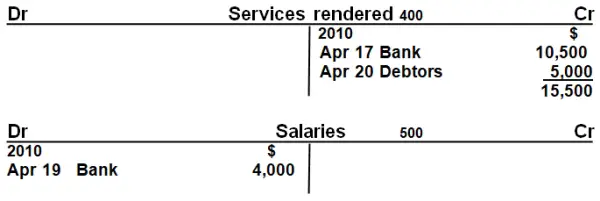

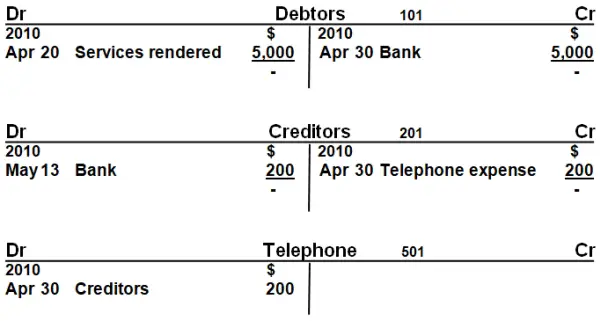

Here is the general ledger for the sample business we've been using throughout our lessons, George’s Catering, showing each of the T-accounts in our records:

When drawing up the trial balance, we're going to take each of the closing balances of the accounts above and list them out together with a column for debits and a column for credits.

Before going any further, try to draw up the trial balance for George's Catering on your own using the T-accounts shown above. When you're done, check your answer against the solution just below...

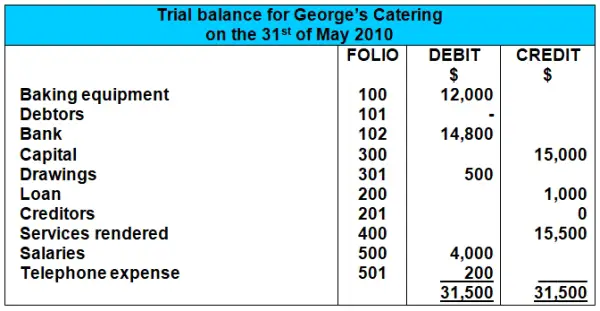

Solution:

In the trial balance example above, the total of the debits is equal to the total of the credits. This is how it should be.

And it makes sense, since we've been recording one debit and one credit for each and every transaction.

Trial Balance Errors

Should the debit and credit totals differ in value, then it is certain that there must have been one or more accounting errors.

The bookkeeper or accountant would then need to find and rectify the errors before preparing the financial statements.

But actually, even if the total of the debit balances agrees in value with the total of the credit balances, it still does not guarantee that there are zero errors in the accounting records.

For example, the bookkeeper could have incorrectly debited the $12,000 to debtors instead of to the baking equipment account. In this situation the total of the debit balances would still be $31,500.

Nonetheless the trial balance is a useful tool for locating and eradicating accounting errors.

Unadjusted and Adjusted Trial Balances

There are different terms used to describe the trial balance at different points in time.

The first trial balance (before any end-of-year corrections and adjustments are made) is called the unadjusted trial balance.

The next thing that happens is that any errors identified are corrected, and other adjustments are made to ensure the record-keeping is in line with accounting standards.

At this point the trial balance is known as the adjusted trial balance and the financial statements are prepared.

After the closing entries are done and the year is over, we call the trial balance the post-closing trial balance.

Note that closing entries are not covered on this site, only in our official books: Accounting Basics: Study Guide or Complete Guide.

Trial Balance - Manual vs Computerized Systems

As previously mentioned, errors are far less likely to occur with computerized accounting packages as these automatically take figures from the accounting journals to the ledger and right through to the financial statements with complete accuracy.

Thus it can be argued that trial balances are more relevant for manual (hand-drawn) accounting systems, where errors can be made when transferring information through the various steps of the accounting cycle.

The trial balance is less important if you use an accounting package.

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty rating:

Beginner --> Intermediate

Quiz length:

5 questions

Time limit:

6 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

That's it for our lesson on What is the Trial Balance?

Well done!

You just completed the last of the lessons in our section on the accounting cycle.

If you feel good at this point, move on to our next section on the four types of financial statements, the final step of the accounting cycle.

Or if you want more practice with the trial balance, check out some additional questions further below.

Good luck!

Return from What is the Trial Balance? to The Accounting Cycle

Return from What is the Trial Balance? to the Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: Debtors and Creditors Control Accounts

Next lesson: The Four Types of Financial Statements: Definition, Examples, Objectives

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

Trial Balance Should Always Balance?

Q: Should the debit and credit totals of a trial balance always agree?

If so, why?

Return to the main tutorial What is the Trial Balance? …

A Simple Trial Balance Exercise

(With Full Solution)

Before you begin: It's important for testing and exams to make sure you not only answer questions correctly but also complete them fast enough. Grab …

Journal Entries, T-Accounts and Trial Balance Exercise

You are required to enter the following transactions for May 19-5. The accounts are then to be balanced off and a trial balance extracted as at 31 May …

Bamba Trading

(Prepare Trial Balance, Income Statement, Balance Sheet Question)

Question 1

1) The following list of balances was extracted from Bamba’s ledger at 31 March 2011.

Bamba Trading:

1) Cash in hand 2,100

…

Trial Balance Major Errors

Q: What are the major errors located by the trial balance?

Trial Balance Errors

Q: What are some errors not affecting the trial balance?

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.