T-Accounts and Ledgers

Previous lesson: Accounting Journals: The Books of First Entry

Next lesson: Balancing T-accounts

If you've been studying accounting for even a short amount of time then you've probably heard of T-accounts and ledgers. In this lesson we're going to learn exactly what these are, we'll look at a detailed example of how to put a T account together, and we'll learn why they're so important.

Be sure to check your understanding of this lesson by taking the quiz in the Test Yourself! section further below. And right at the bottom of the page, you can find more questions on the topic submitted by fellow students.

What are T-Accounts?

In accounting we open an account for each item in our records.

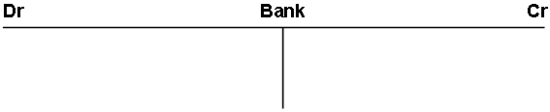

An account has the following format:

As you can see, the conventional account has the format of the letter T; hence they are often referred to as T accounts.

By account, we mean a summary record of all transactions relating to a particular item in a business.

Now Let's Define Ledger

According to the Collins English Dictionary, the ledger is "the principal book in which the commercial transactions of a company are recorded."

Before the days of accounting software, bookkeepers and accountants actually kept physical books, and each ledger was a separate physical book.

However, times have changed. And a simpler definition is probably more appropriate now too.

So these days, this might be a better description:

A ledger is simply a whole bunch of T-accounts grouped together.

Simple as that.

Now, there can be a number of different ledgers, each one dealing with a specific aspect of the business and listing T-accounts only in that category. We'll meet some of these further below.

General Ledger Definition

You may have heard of the general ledger.

The general ledger is simply our main ledger in accounting.

All the main T-accounts in a business fall under the general ledger.

For example, land and buildings, equipment, machinery, vehicles, financial investments, bank accounts, inventory, owner's equity (capital), liabilities - the T-accounts for all of these can be found in the general ledger.

Subsidiary Ledgers (or Sub Ledgers):

Debtors Ledger and Creditors Ledger

Subsidiary ledgers, or sub ledgers, are supporting ledgers - ledgers that support the main ledger - the general ledger.

We have two subsidiary (supporting) ledgers:

1. Debtors (or Receivables) Ledger

The Debtors (or Receivables) Ledger contains T accounts for each individual debtor - meaning for each person/business that owes our business.

2. Creditors (or Payables) Ledger

The Creditors (or Payables) Ledger contains T-accounts for each individual creditor - meaning for each person or business that our business owes.

We will discuss these subsidiary ledgers and their relation to the general ledger in more detail in a later lesson.

For more information on the debtors and creditors ledgers and their relationship to the general ledger, see the lesson on control accounts.

T-Account Examples

(How to Prepare a T-Account)

We're going to draw up a T-account for George's Catering, the example we've been using throughout our tutorials.

Let's take our previous transactions relating to the bank account and see how this would be used to draw up the bank T-account.

Transaction #1

The first transaction that involves the bank account occurs on the 1st of April, where Mr. Burnham invested $15,000 in the business.

Now, what happens to the bank account here?

It is debited, as it increases.

When drawing up the T-account for bank, we do the exact same thing...

We debit the bank account.

Remember, to debit means to make an entry on the left-hand side.

To credit means to make an entry on the right-hand side.

If you want to review debits and credits, see the lesson on debits and credits. And for a review of the most common journal entries, see the lesson on basic accounting journal entries.

As you can see, when recording a transaction in a T-account, we record the date of the transaction too.

The Contra Account

As a general rule, we use the opposite or contra account to describe the transaction.

In this transaction the contra account is capital. The source of this increase to the bank account is capital - the owner investing in the business.

If we were to describe each transaction occurring within the T-account above as "bank," it would not adequately describe why our bank account increased or decreased. All transactions would just be listed as "bank." Using the opposite or contra account gives us a much better description of the transaction.

Remember that with every transaction and journal entry there will be two accounts that are affected.

The above transaction would not only affect the Bank T account but also affect the contra account or second account, Capital.

Here's what the Capital T-account would look like:

As you can see, it's basically a mirror image of what we recorded in the Bank T account.

This time, the contra account for Capital is Bank, and that is what we write as the description here.

Transaction #2

Now, let's continue drawing up the bank T account. We're going to look at the remaining transactions for it and post each one (to post means to transfer over the details - in this case from the journal to the ledger T-account).

The next transaction relating to the bank account was on the 7th of April.

Let’s post this journal entry into our bank T account:

Once again, our journal entry relating to bank was a debit. So we debit our bank account.

The credit was to loan, so this is used to describe what has happened to our bank account above.

Transaction #3

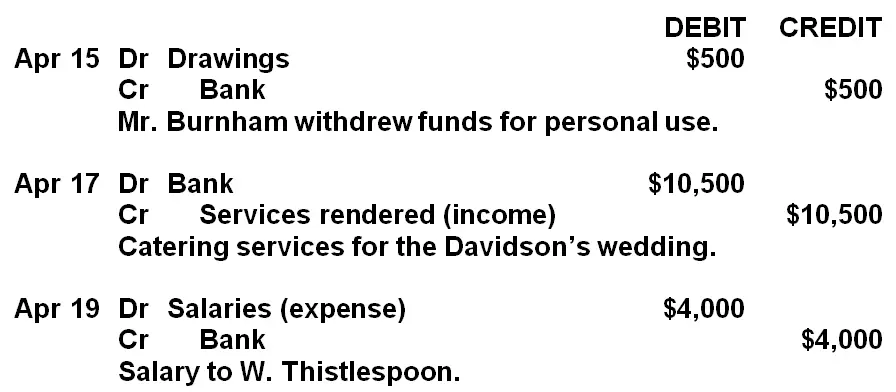

The third transaction involving the bank account for George's Catering was as follows:

This time bank was credited, meaning it decreased (we made a payment). So we do the same when posting this to our T-account:

This is the same as the previous transaction, just on the opposite side - we enter the transaction on the credit (right) side of the bank T-account.

The contra account here used to describe what occurred is baking equipment.

Remaining Entries: Try this T-Account Exercise

Below are the remainder of the journal entries relating to bank that we will enter in our bank T-account.

Before scrolling beyond the journal entries below, take out a piece of paper, draw up the Bank T account with the first three transactions above (just copy these in), then try post the remaining journal entries below into the bank T account too. Once done, check your answers against the solution further below.

Did you try posting these journals into your own Bank T-account?

Try it quickly now, then check the solution just below...

Solution:

Now let’s see what our bank account looks like after all the transactions above:

Take a look at each of the journal entries above and compare them to each of the entries in the T account. See if you got them right. I hope you did.

The Importance of T-Accounts

As previously mentioned, an account is the summary record of all transactions relating to a particular item in a business.

How does it help a manager or business owner?

A business owner can quickly look over T-accounts (such as the one in our example) in order to extract information.

For example, if you examine the T-account above, you can see that all increases to the bank account (receipts) occur on the left side. All the decreases to the bank account (payments) occur on the right side.

The nature of each transaction can also be quickly determined. For example, if one looked at the transaction on the 17th of April, one could quickly ascertain that on this day $10,500 was received due to services rendered (income was received immediately in the form of cash).

If one examined the creditors entry on the 13th of May one could quickly determine that $200 was paid to creditors (in this case one could actually add the word "telephone" in brackets next to "creditors" to make the description even clearer – the business paid the telephone company for the bill owing).

So bottom line is that one could look at a T account for information about specific transactions regarding that particular account or item.

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty rating:

Beginner

Quiz length:

5 questions

Time limit:

6 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

That's it for our first lesson on T-accounts.

But that's definitely not all to know about them!

In our next lesson we're going to continue working with T-accounts and focus on a very important aspect of them - learning how to balance T-accounts.

Balancing a T-account is very important - we do this in order to get the closing balance of the account, which is needed on a regular basis for reporting and leads us forward to our next step in the accounting cycle.

So if you feel good about this lesson, go ahead and move on to the next lesson on Balancing T-Accounts.

As a final point, make sure you get lots of practice with preparing T-accounts. There are various questions and exercises about T accounts further below which you can use for practice.

Good luck!

Return from T Accounts to The Accounting Cycle

Return to the Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: Accounting Journals: The Books of First Entry

Next lesson: Balancing T-accounts

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

T-Accounts, Journal Entry and Trial Balance Question

Before you begin: For tests and exams it's really important to not only answer questions correctly but do so at the right speed. Grab a pen and piece …

T-account Entries

Q: Tracy paid $200 for a widget. Please show me how this would be inputted in the T-account.

Previous year's balances

Q: Hi,

I have details for accounts from 2010:

Cash at bank 1100 $6,560

Accounts receivable 1200 $7,760

Prepaid Insurance 1300 $380 …

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.