Bad Debts, Provision for Bad Debts,

Debtors Control

by Anonymous

(South Africa)

Question:

How does bad debts and the provision for bad debts affect the debtors control account?Answer:

Let's make sure we fully understand what these terms are before I answer your question.Bad Debts

Bad debts are debts owed to the business that have become bad, meaning it seems they are uncollectable. For example, Joe Shmo, who owed you $1,000, files bankruptcy and informs you of this. So it seems we won't get paid by Joe in future.

For example, Joe Shmo, who owed you $1,000, files bankruptcy and informs you of this. So it seems we won't get paid by Joe in future.The original journal entry to record the sale would have been:

Dr Debtors Control ..................... $1,000

Cr Sales .............................................. $1,000

When we become aware that someone won't pay us (that the debt has become 'bad'), we do an entry as follows:

Dr Bad debt (expense) ............... $1,000

Cr Debtors Control ........................... $1,000

Note that we could use "Accounts Receivable" instead of "Debtors Control" (same thing basically).

For US visitors, note that the journal entry for bad debts above is using what is known as the "Direct Write-Off Method" (as opposed to an alternate method called the "Allowance for Bad Debts" method).

Provision for Bad Debts

The provision for bad debts is not the same as bad debts.

The provision for bad debts is not the same as bad debts.The provision for bad debts is an estimate of the debts owed to us that will go bad in the future.

We record this future loss of debts as soon as we are aware that we will definitely lose money in the future.

For example, let's say that at the end of the year we have $200,000 in debtors control

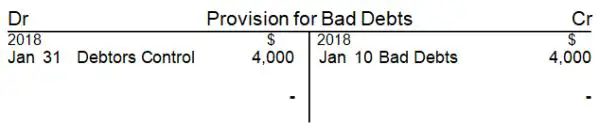

The entry to record this provision for bad debts is:

Dr Bad debts (expense) .............................................. $4,000

Cr Provision for Bad Debts (like a liability) ....................... $4,000

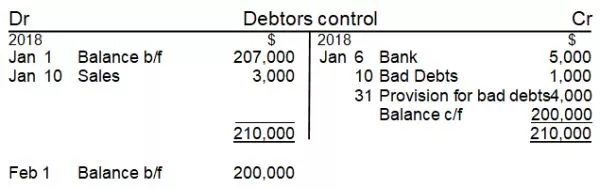

T-Accounts

Here are what the T-accounts for the debtors control and the provision for bad debts would look like:

These two accounts are, however, set off against one another in the balance sheet in order to present the true value of debtors. In our example above, the "Trade and other debtors" in our balance sheet would be shown as $196,000 ($200,000 - $4,000).

Note that the "provision for bad debts" is also known by a few other names, such as: the "allowance for doubtful debts," the "allowance for bad debts" or the "allowance for doubtful accounts."

Hope those explanations helped!

See below for more comments, questions and answers on bad debts and the provision for bad debts.

FYI I cover bad debts and provision for bad debts in a lot more detail in my accounting books, with full lessons, examples and exercises.

Best,

Michael Celender

Accounting Basics for Students

Related questions and tutorials:

- Debtors and Creditors Control Accounts

- What is the Journal Entry for Bad Debts?

- Journal Entry for Recovery of Bad Debts?

Return to our page of Full Accounting Questions and Answers

Comments for Bad Debts, Provision for Bad Debts,

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.