Balance Sheet:

Key Indicators of Business Success

Question:

What in the balance sheet shows the owner how well the business is doing?Answer:

There are a number of indicators of business success or failure in the balance sheet.Total Assets and Total Liabilities

How much assets does the business have in total?

How much assets does the business have in total? Assets are the basic value of a business. One business may have only $500 of assets, whereas another may have $500 million assets. Thus it is an immediate indicator of the size and success of a business.

How much are the liabilities (business debts)?

How much are the liabilities (business debts)? A business with fewer debts is obviously in a better position. Besides the fact that the owners have more control over the assets, there will also be smaller interest payments (as the debts themselves are smaller).

Financial Position

The primary purpose of the balance sheet is to show the financial position of a business.In other words, what portion of assets is owned by the owner as opposed to owed to liabilities?

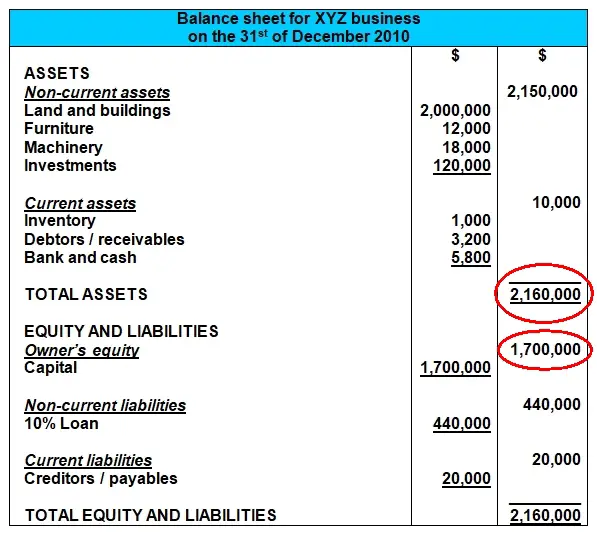

The equity ratio is used to measure the business's financial position. Take the total owner's equity and divide it by total assets. What is the percentage here?

= $1,700,000 / $2,160,000

= 78.7%

This means that 78.7% of the assets are owned by the owners and 21.3% of assets will be used to pay liabilities (external party debts) in the future.

Cash and Liquidity

How much cash does the business have and how much credit? This gives an indication of the liquidity of the business, which means

How much cash does the business have and how much credit? This gives an indication of the liquidity of the business, which means Remember, cash is the lifeblood of a business. A business that deals in more credit has more risk of non-payment by its debtors (accounts receivable).

In this example the business has $5,800 cash on hand and debtors of $3,200.

Another thing to look at is how much cash the business has in comparison to its short-term debts (current liabilities). This shows its ability to repay its ongoing debts. The cash ratio is used to measure this: Total Cash on Hand / Current Liabilities.

In this example the cash ratio would be:

= $5,800 / $20,000

= 29%

This 29% ratio is quite low and indicates a poor ability to repay its short-term debts.

The Balance Sheet Alone is Not Enough

Remember that when evaluating a business the balance sheet is just one piece of the puzzle, one part of the bigger picture.When evaluating a business one should always look at the remainder of the financial statements: income statement and statement of changes in owner's equity and cash flow statement too, as these will also contain indicators of the financial performance and liquidity for a business.

Which items, metrics and ratios in the balance sheet do you feel give the best indication of a business's success?

Have your say by adding a comment below.

Best,

Michael Celender

Founder of Accounting Basics for Students

Related Questions & Tutorials:

Click here for more Basic Accounting Questions and Answers

Return to the main tutorial on the Balance Sheet

Comments for Balance Sheet:

|

||

|

||

|

||

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.