The Statement of Owner's Equity

Previous lesson: Income Statement Example

Next lesson: Balance Sheet Example

Welcome to the lesson on the statement of owner's equity. In this tutorial we'll go over the purpose and format of the statement and use an example to see how we would put it together.

Be sure to check your understanding of this lesson by taking the quiz in the Test Yourself! section further below. And right at the bottom of the page, more questions on the topic submitted by fellow students.

What is the Statement of Owner's Equity?

The statement of owner's equity is the second report in the financial statements.

Its full name is the statement of changes in owner's equity.

This financial report shows all the changes to the owner's equity that have occurred during the period.

These changes include:

- Capital,

- Drawings, and

- Profit or loss

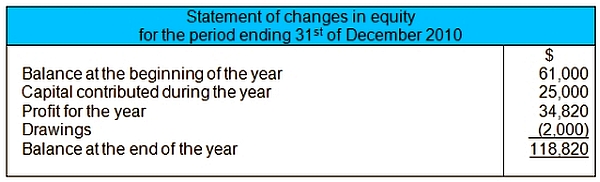

Statement of Owner's Equity Format

The format of the statement is shown below:

As you can see, it shows the opening and closing balances of the owner's equity as well as the changes that occurred during this period.

Just like the income statement (the previous report in the financial statements), the statement of owner's equity also normally covers a 12-month period.

Statement of Owner's Equity Example

How do we draw up the statement of owner's equity?

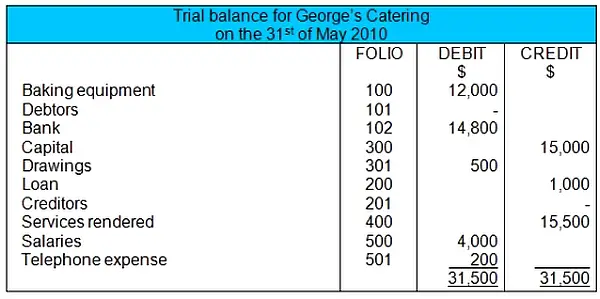

Let's return to the trial balance for George's Catering, the sample business we've been using throughout our tutorials:

In order to draw up the statement of changes in equity for George's Catering, we'll take all items in the trial balance that affect the owner's equity (the owner's share of the business) and simply insert these in this new statement.

So, capital and drawings will definitely be included here.

Our capital contributed by George during the period was $15,000, and the drawings came to $500.

Now, what about the income and expenses shown above? Don't these affect the owner's equity too?

The answer is that they do.

However, income and expenses have already been used in the income statement to calculate the profit or loss for the period.

This overall profit or loss figure is now going to be transferred to the statement of changes in equity to calculate the closing balance of equity (after all, profits and losses belong to the owner of the business, right?).

So, let's put it all together...

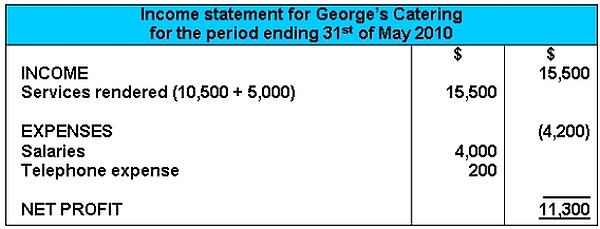

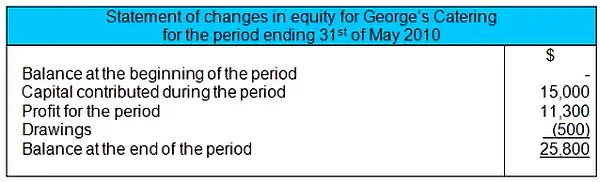

Here's the statement of changes in equity for George’s Catering:

Note that George's Catering is a brand new business that just started this year, so there was an opening balance of $0 in this example.

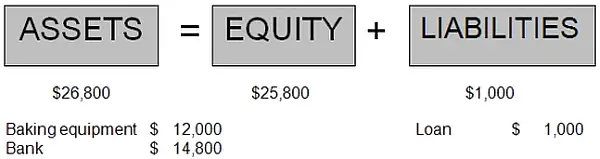

As you can see, the closing balance of the owner’s equity is the same as what we calculated in earlier lessons:

This closing balance of $25,800 would become the opening balance of owner's equity for the next year.

To conclude, the figures for the statement of owner's equity come from our first statement - the income statement (profit or loss figure) as well as from the trial balance (capital and drawings).

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty Rating:

Beginner

Quiz length:

4 questions

Time limit:

5 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

So that's the lesson on the statement of owners equity.

Hope this is a bit clearer now.

In our next lesson you'll learn how this equity statement actually links up with the next accounting report, the balance sheet.

Return from Statement of Owners Equity to The Four Types of Financial Statements

Return to the Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: Income Statement Example

Next lesson: Balance Sheet Example

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

Opening Balance of Equity in the Statement of Changes in Equity

Q: So how do you find the beginning capital or opening balance of equity to put in the statement of changes in owners equity?

A: Good question.

…

Income Statement and Statement of Changes in Equity Question

Preparation of the income statement and the statement of changes in equity.

The income and expense accounts of Nora Maniquiz Real Estate Agency, which …

Accounting Equation Exercise:

Fill in the Blank

Before you begin: For purposes of testing and exams it's important to make sure you not only get the questions right but are completing them at the …

Statement of Owners Equity Exercise

Use the trial balance below to prepare the statement of changes in equity.

Trial Balance

Date

Account Description Debits Credits

Cash 25,000 …

Owners Equity - Distributed and Undistributed Profits

Q: What is the share of undistributed profits? Do we have distributed profits?

A: Yes, there is something called undistributed profits and …

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.