Balance Sheet Example

Previous lesson: Statement of Owners Equity

Next lesson: Cash Flow Statement Example

In this tutorial we're going to go over the difference between the balance sheet and other financial statements, the general format of this statement and its components, as well as an example of how to put together this key report.

Don't forget to check out the Test Yourself! section further below for a free Balance Sheet Quiz! And at the bottom of the page, more questions on the balance sheet submitted by fellow students.

The Balance Sheet vs Income Statement and Statement of Changes in Equity

The balance sheet, together with the income statement and the statement of changes in equity, forms part of the financial statements of a business.

And just like these previous two statements (income statement and statement of changes in equity), the balance sheet is usually drawn up annually.

But there is one key difference between the balance sheet and those other two reports, a difference which is very important and which you really need to understand.

Whereas the income statement and statement of changes in equity show changes over a certain period of time (changes to income and expenses and changes to the owner's equity), the balance sheet shows the balances of assets, liabilities and owner's equity on a particular day.

The balance sheet thus provides a snapshot of a business at an exact point in time - it shows the balances of the various accounts on the last day of the reporting period.

The Vertical Balance Sheet Format

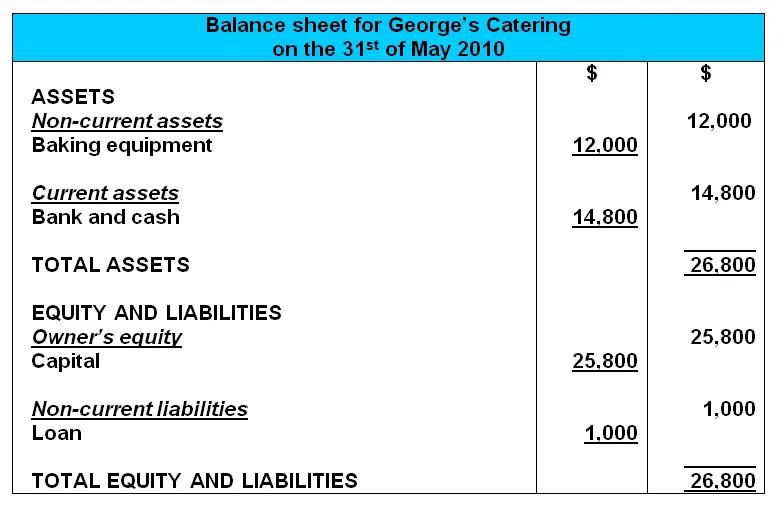

Here is a balance sheet shown in the vertical format:

As you can see from the balance sheet above, the total of the assets agrees in value (balances) with the total of the owner's equity and liabilities.

Let’s compare the balance sheet above to our original accounting equation:

One can clearly see that the balance sheet shows the accounting equation of a business, except that this accounting equation is turned on its head and shown in a vertical format, with the assets on top and the equity and liabilities on the bottom.

Now, remember in our earlier lesson on the accounting equation and financial position, how we said that the comparison of the assets, liabilities and owner's equity actually shows us the financial position of a business?

Well, the balance sheet is actually known by another name. Want to guess what that is?

The balance sheet is also known as the statement of financial position.

Makes sense, right?

But bottom line, just remember that the balance sheet is simply the accounting equation in the vertical format.

Did you know?

The balance sheet used to sometimes be shown in a horizontal format, instead of the vertical format shown above. This horizontal format basically looked like one giant T-account for the whole business, with Assets on one side and Liabilities and Owner's Equity on the other.

Also, the balance sheet is often abbreviated as BS or B/S.

And that's no B.S. my friends ;-)

Balance Sheet Categories:

Non-Current Versus Current

The balance sheet also divides the assets and liabilities into categories.

Assets and liabilities must be divided up into long-term and short-term categories.

Non-current means long-term.

Current means short-term.

The dividing line between current and non-current is one year from the date that the balance sheet is issued.

In other words, an asset will be classified as current if it is expected to be sold (or used) in less than a year from the date of the report.

An asset will be classified as non-current if it is expected to be used for more than one year from the date of the balance sheet.

A liability that is expected to be paid off within a year, such as a creditor, is classified as current.

A loan, which is expected to be paid off more than a year from the balance sheet date, is classified as a non-current liability.

The division of assets and liabilities into these subcategories is done to provide more meaningful information to the readers of the balance sheet.

Note that owner's equity, the third major component of the balance sheet, is presumed to always be a long-term item and so is not broken down into current and non-current.

Want to test yourself on categorizing balance sheet items

as current or non-current?

Click here for a quick quiz on asset and liability categories.

More Notes on the Balance Sheet Above

One type of asset that we haven't gone over in previous lessons is investments. Investments are also known as other financial assets.

This category of assets includes investments in other businesses as well as long-term investments with the bank.

Note that investments are usually non-current assets (unless you intend to sell off the investment within a year, in which case it is classified as a current asset).

As mentioned previously, inventory are stock or goods. See our later chapter on inventory for numerous lessons on this topic.

And finally, note that the "10% loan" in our balance sheet example above means that we have a loan that has a 10% interest charge on it per year.

Balance Sheet Example: Putting it all Together

So how do we actually put together a balance sheet? Where does the information in the balance sheet come from?

The answer is that we'll get the information from our various accounts, and in particular, from the previous step in the accounting cycle, the trial balance.

Here is our previous trial balance for George’s Catering, the sample business we have been using throughout our lessons.

Our balance sheet is going to require the balances of all assets and liabilities. So we stick these in there from our trial balance. That's fairly simple.

But what about the owner’s equity - how do we figure this out for our balance sheet? It's not shown anywhere in the trial balance!

The answer is that we take the closing balance of the owner’s equity from the statement of changes in equity and put this in our balance sheet.

Here's the statement of changes in equity for George's Catering (from the previous lesson):

And this is how the balance sheet for George's Catering would look:

Order of the Financial Statements

We actually have a clear sequence for the various financial statements, which is in line with working out the owner's equity figure to put in the balance sheet:

- First we draw up the income statement and get the profit.

- Then we put this profit into the statement of owner's equity and get the closing balance of the owner's equity.

- Finally, we take this closing balance of owner's equity and put it into our balance sheet.

The Balance Sheet Mirrors the Accounting Equation

FYI, if you check the balance sheet example for George's Catering above, you'll see that the balances of the assets, liabilities and the owner’s equity is the same as what we calculated in earlier lessons:

Budgeted Balance Sheets

As a final point, just like the income statement, the balance sheet can also be drawn up at the start of the period with budgeted figures, and these budgeted figures (assets, liabilities, equity) can later be compared to actual results on a specific day.

Test Yourself with this Quick Quiz!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty Rating:

Beginner --> Intermediate

Quiz length:

5 questions

Time limit:

6 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

That's it!

Hope this lesson and the balance sheet example shown above has helped you get a better understanding of this key report.

If you feel good about this lesson, then go right ahead and check out the next lesson on the Cash Flow Statement.

Good luck!

Return from Balance Sheet Example to our main page on Financial Statements

Return to the Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: Statement of Owners Equity

Next lesson: Cash Flow Statement Example

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

Define Capital Structure

Question: What is the meaning of "capital structure"?

Answer: The term "capital structure" refers to the structure or combination of capital (owner's …

Basic Accounting Quiz:

Asset and Liability Balance Sheet Categories

Before you begin: For purposes of testing and exams it's important to make sure you not only answer correctly but also do so at the right speed. So, …

Balance Sheet:

Key Indicators of Business Success

Question: What in the balance sheet shows the owner how well the business is doing?

Answer: There are a number of indicators of business success …

Credit Balance for Bank on

Balance Sheet

Q: Where is 'Bank' entered on a balance sheet if it is has a credit balance (overdrawn)? Is it still an 'asset' with a credit amount posted or is it listed …

Fixed Assets Question: Sale and Purchase

Before you begin: For purposes of testing and exams it's important to make sure you not only answer questions correctly but also complete them at the …

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.