Define Capital Structure

by SANTOSH

(VIZIANAGARAM)

Question:

What is the meaning of "capital structure"?Answer:

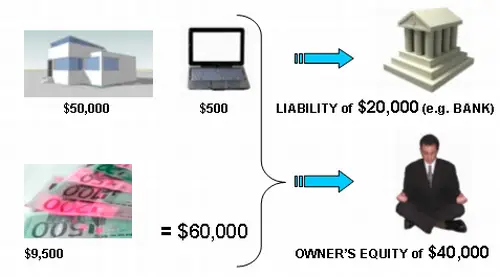

The term "capital structure" refers to the structure or combination of capital (owner's equity) and liabilities (debt) for a business.In other words, what and how much are the sources of financing for the business?

For example, let's say we have a company that has the following equity and long-term liabilities:

- Ordinary shares $6,000,000

- Preference shares $3,000,000

- Debentures $1,000,000

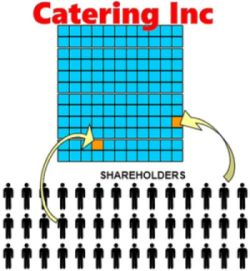

Shares are small bits of ownership of a company owned by many shareholders or investors and are classified as equity.

Shares are small bits of ownership of a company owned by many shareholders or investors and are classified as equity. Ordinary shares are the most common type of shares, they are like regular shares and are also known as common stock.

Preference shares are simply shares in a company that give more benefits than ordinary shares.

Debentures are the debt equivalent of shares - they are long-term liabilities - small amounts of debt that can be bought by an investor.

In the above example the ordinary and preference shares are equity. The capital structure (in terms of equity alone) would be $6 million ordinary shares and $3 million preference shares.

With the liabilities (debentures) included, we could say that the equity comes to $9 million (90%) and the long-term liabilities comes to $1 million (10%) of the capital structure. Or the capital structure is 90% equity and 10% debt (liabilities).

Do you have your own examples of capital structure or questions on this?

Let us know by adding a comment below.

Best,

Michael Celender

Founder of Accounting Basics for Students

Related Questions & Tutorials:

- Balance Sheet: Key Indicators of Business Success

- The Accounting Equation and Financial Position

- The Basic Accounting Equation: Another Viewpoint

- Journal Entry for Shares Issued

- Company Trial Balance and Financial Statements Question

Return to the main tutorial on The Balance Sheet

Return to Ask a Question About This Lesson!.

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.