What is Owners Equity?

Previous lesson: Liabilities: Definition and Examples

Next lesson: The Accounting Equation and Financial Position

Check out the quiz on this lesson in the Test Yourself! section further below when you're done. And right at the bottom of the page, more questions on the topic submitted by fellow students.

What is owners equity?

It's a question many an accounting student has pondered.

Or just plain guessed at.

The official owners equity definition is:

The residual interest in the assets of the enterprise after deducting all its liabilities.

But that's a pretty complicated definition.

Here's a simpler one:

The owners equity is simply the owner’s share of the assets of a business.

You see, assets can only ‘belong’ to two types of people:

- People outside the business who you owe money to (debts, known in accounting as "liabilities"),

- The owner himself (owners equity).

Owners equity, often just called equity, represents the value of the assets that the owner can lay claim to.

In other words:

It's the value of all the assets after deducting the value of assets needed to pay liabilities (debts).

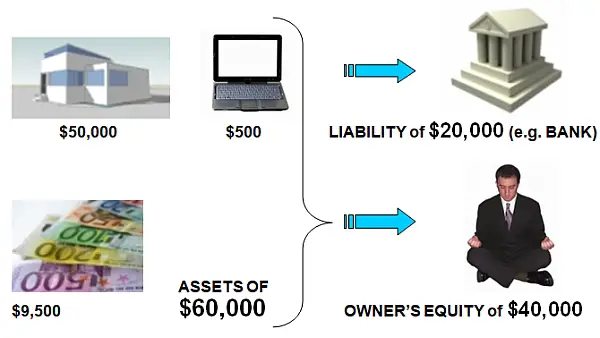

In the diagram above, the assets amount to $60,000, but the value of the assets the owner can lay claim to is only $40,000. This is because there are liabilities (debts) of $20,000, so $20,000 of the assets will be needed at some point to pay off these debts.

In the simplest terms, owners equity is:

The value of the assets that the owner really owns.

Owners Equity and the Accounting Equation

Let's take a look at the basic accounting equation again:

ASSETS = LIABILITIES + OWNERS EQUITY

Since we've now defined all three of the elements of the accounting equation, including owner's equity, we can look at this equation now with a bit more insight.

So, what does the basic accounting equation really represent?

The accounting equation indicates how much of the assets of a business belong to, or are owned, by whom.

Simple as that.

Hope this puts the record straight about owners equity and the accounting equation once and for all. :-)

Test Yourself

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty Rating:

Beginner

Quiz length:

3 questions

Time limit:

5 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

Well, that's all we're going to cover in our lesson on "What is Owners Equity?"

Hope things are starting to make more sense now!

In the final lesson of this section (basic accounting concepts) we're going to relook the accounting equation and introduce a brand new concept.

Click here for the next lesson - the accounting equation and financial position.

See an example of an Owners Equity Transaction (Capital Investment)

Or check out the Statement of Changes in Owners Equity (one of the four key accounting reports)

Return from What is Owners Equity? to Basic Accounting Concepts

Return to the Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: Liabilities: Definition and Examples

Next lesson: The Accounting Equation and Financial Position

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

Owners Equity Synonym

Q: Owner's equity is also known as _____________?

A: There are a few synonyms for owner's equity.

As you will see in the comments at the bottom …

Owner's Equity Question:

Fill in the Blank

Before you begin: For purposes of testing and exams it's important to not just get the questions right but also complete them at the right speed. Use …

Is Equity and Capital the Same?

Q: Is equity and capital the same ?

A: No, they are not.

Equity, also known as owner's equity, is the owner's share of the assets of a …

What Are Retained Earnings?

Q: What are retained earnings and how are they calculated?

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.