Expenses:

Definition and Examples

Previous lesson: Accrued Income (Part 2)

Next lesson: Accounts Payable: Definition and Examples

In this lesson we're going to define expenses, look at some common examples, and go through a full expenses example with our sample business, George's Catering, where we'll see the accounts that are affected and what happens to the accounting equation.

Be sure to check your understanding of this lesson by taking the quiz in the Test Yourself! section further below. And right at the bottom of the page, you can find more questions on the topic submitted by fellow students.

Income vs Expenses

In our previous lesson on income we defined income as:

An event that results in money (or other assets) flowing into the business.

Examples of income are sales or services rendered. These events result in the business getting paid straight away or at a later date.

So, how do you think we define expenses?

An expense could be defined as an event that results in money (or other assets) flowing out of the business.

If we pay our expenses immediately, then this will result in money flowing out immediately.

But if like many businesses, we don't pay our expenses the same day they occur, there will be a liability (debt), which we will pay later.

Perhaps an even better definition of an expense might be:

A short-term or repeating service or item that we use up and need to pay for.

Examples of Common Business Expenses

Here are some examples of common business expenses:

Salaries and wages

These are monthly or weekly payments to employees for work done for the business. Salaries are paid once a month at the end of the month, while wages are often paid to manual labor or casual workers on a more regular basis, such as once a week.

Telephone and Internet

Having office phones, cellphones and data connections are a must for any business. Paying the internet and telephone bill for telecommunications services is usually done on a monthly basis after receiving the bill from the phone and internet companies. Bills often include a fixed charged as well as a variable fee based on usage.

Water and Electricity

These are basic utilities that are needed to run your office and/or factory and are usually paid at the end of the month after receiving the bill from the utility company.

Insurance

Insurance payments are called premiums and are usually paid once a month.

Business insurance comes in various forms. One can purchase insurance against theft and damage for various business assets like an office building or equipment.

You can also purchase liability insurance, which protects your business in case there are any legal issues, such as a customer or other business that wants to sue your business for things like breaking a contract or accidentally harming them (many professionals like doctors need this kind of insurance in case they cause injury to a patient).

Advertising

Advertising is another common business expense. This includes any paid promotions, whether through traditional media such as print, radio or TV, as well as the variety of online advertising options such as search engines and social media platforms. Any promotion of your business would fall under advertising expenses.

Repairs and Maintenance

Repairs and maintenance is a common expense for many businesses. However, this kind of expense is not a regular one - it only occurs when machinery and equipment need to be maintained or repaired (usually just every now and then).

Repairs and maintenance expenses would apply if your business has office equipment like a copying machine or a computer server, or machinery in a manufacturing business that needs to be serviced or repaired.

How Do Expenses Fit into the Accounting Equation?

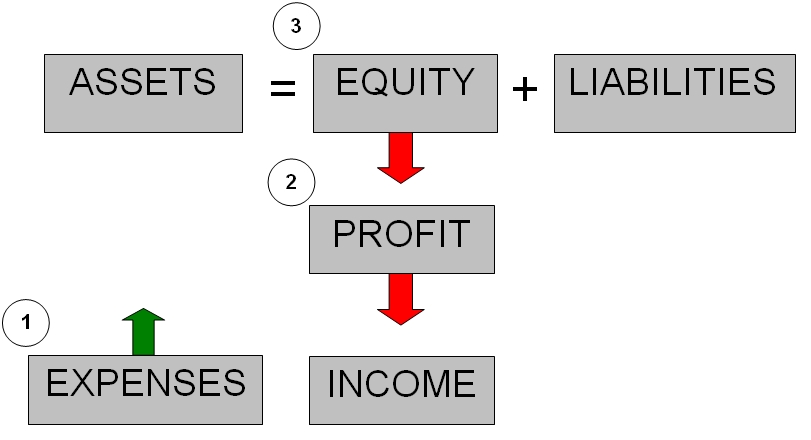

Let's see how business expenses affect the basic accounting equation:

Expenses are the opposite of income.

More expenses (1) means less profit (2), which means less for the owner (3).

The owner’s equity and expenses are therefore conversely (oppositely) related, and thus expenses come into being (and increase) on the left side.

Cash Expense Example

As usual, we're going to use our sample business, George's Catering, to provide an example and see which accounts are affected and what happens to the accounting equation when we have a cash expense.

Please note: The introductory example shown below excludes the journal entry. To see the debit and credit journal entry for this cash expense transaction (with detailed explanations), check out the tutorial Expense Journal Entry.

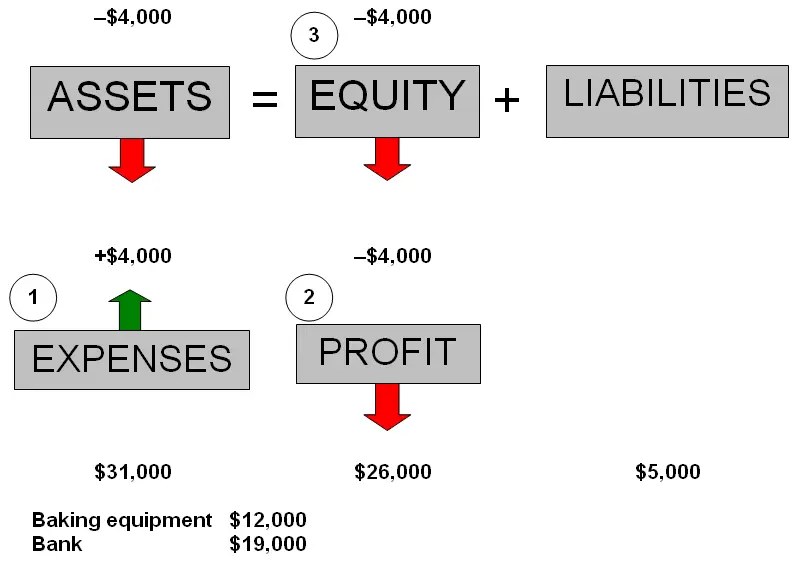

George's Catering business stood as follows:

Here's the next transaction:

h) In order to be able to successfully pull off the catering job for the wedding and for future jobs, George decides to hire an assistant. He paid the assistant a $4,000 salary. What happens with this?

The salary paid to the assistant is an expense, and this amounts to $4,000.

Expenses take place (or increase) on the left, because it is the opposite of income and means less for the owner (owner’s equity).

Consequently, this expense results in $4,000 less for the owner.

As we pay the $4,000 cash, our assets also go down (on the left).

The owner now has a stake of $26,000 of the total assets of $31,000. Once again, the external parties’ stake (liabilities) will be the same as it was before this transaction ($5,000).

So as you can see, expenses result in the owner having a smaller share of the assets.

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty Rating:

Beginner

Quiz length:

4 questions

Time limit:

6 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

Alright! So that's it for our lesson on expenses.

If you're a bit uncertain about the accounting equation and how owners equity works, return to our earlier lesson called What is Owners Equity? to get more certainty on this key concept.

Or if you're comfortable with the lesson above, feel free to move along to the next lesson on accounts payable, where we'll go over expenses that aren't paid immediately but instead are owing.

Return from Expenses: Definition and Examples to Basic Accounting Transactions

Return to the Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: Accrued Income (Part 2)

Next lesson: Accounts Payable: Definition and Examples

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

Supplies Expense Example: Accounting Equation & Journal Entry

Q: How do you account for "estimated expenses" in the accounting equation?

For example: Estimated supplies used for 6 months R700.

(R = Rands …

Interests on Loans - Income or Expense?

Q: Is interest on loan an income or expense?

A: Usually, when talking about a loan, we're talking about you or your business taking out a loan. In …

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.