Bank Loan Journal Entry

Previous lesson: Owner's Equity Journal Entry

Next lesson: Journal Entry for Asset Purchase

Welcome to the second example for our sample business, George's Catering, where we'll go over an example of taking out a loan and see what the bank loan journal entry should be.

Check your understanding of this journal entry and lesson by taking the quiz in the Test Yourself! section further below. And right at the bottom of the page, you can find more questions on the topic submitted by fellow students.

Before starting, a few quick reminders:

- A bank loan that our business receives is recognized as a liability, meaning a debt account.

- Since a loan from the bank is usually for the long term, it is specifically classified as a non-current liability in our records.

Journal Entry for a Loan from the Bank

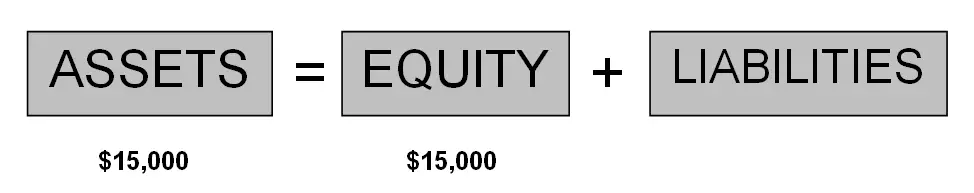

In our first journal entry lesson George Burnham invested $15,000 of his personal funds into his new business, George's Catering. As a result, the accounting equation and financial position of the business looked like this:

b) George now realizes that he needs more money to create a really high-quality catering business. Yet he does not have any more personal funds available to invest. He decides to take a loan from the bank to the value of $5,000.

The first thing you can ask yourself here is "Is there any change to our cash or bank account?"

The answer to this question is a definite "yes!" - our business is getting more cash.

This means that our cash or bank account (our assets) are increasing.

The next thing to work out is where the cash is coming from. The answer, of course, is the bank loan.

The loan is increasing in our records and, since this is a liability, we can say that our liabilities are increasing too.

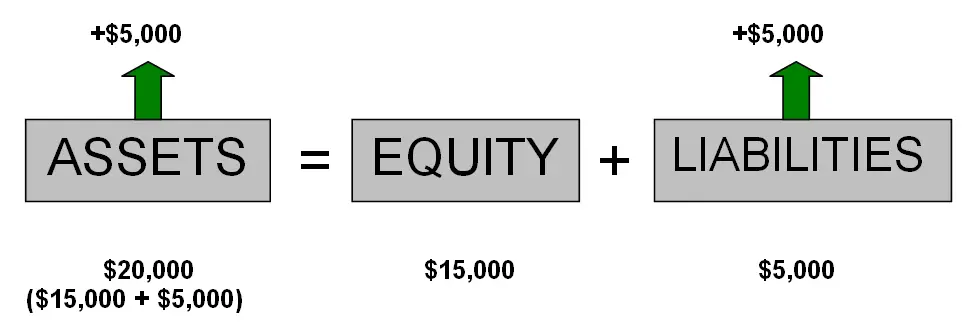

Here is how the transaction affects our accounting equation:

As you can see from this diagram, both assets (cash) and liabilities (loan) have increased.

George’s Catering now consists of total assets of $20,000 (in the form of cash), and external parties (the bank) now have a $5,000 claim to these business assets. George’s Catering will have to pay back the $5,000 at some point in the future.

Now let's figure out the journal entry for the above.

Our cash or bank is increasing, and this is an asset.

On what side do assets increase? The answer is the debit side (left). So, our cash or bank account is debited.

What is the other account? The loan, a liability.

This liability is increasing.

On what side do liabilities increase? The credit side (right).

So, the loan is credited.

Here is the full bank loan journal entry:

Note that there is no change to the owner’s equity here. This is because the owner has not contributed any capital (or withdrawn any funds for his personal use) as part of this particular transaction. This transaction is simply about receiving more funds through a bank loan.

Would you like to see the journal entry for paying back a loan?

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty Rating:

Beginner

Quiz length:

4 questions

Time limit:

5 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

That lesson wasn't too bad, eh?

I think that big scary monster called debits and credits is a little overrated.

We do still have a few more examples of journal entries though, so let's not get ahead of ourselves... There is still a monster to slay, and so far we've only just made a few scratches.

If you're finding debits and credits difficult at this point, please take a look at the powerful lesson Debits and Credits: What They Really Mean. This lesson explains exactly how debits and credits work and should make journal entries much easier for you.

Otherwise, if you're ready to move on, then click here for the next lesson where we'll learn the journal entry for purchasing an asset.

Return from Bank Loan Journal Entry to Double Entry Accounting

Return from Bank Loan Journal Entry to the Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: Owner's Equity Journal Entry

Next lesson: Journal Entry for Asset Purchase

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

Examples of Owners Equity

Q:Give examples of owners equity...

A: Okay, the two most common forms of owner's equity are:

Capital: The most common form of equity. Capital …

How do the Journal Entries Translate into the Profit and Loss and/or Balance Sheet?

And Why As a Business Owner Should I Know Debits and Credits?

Q: In your example you show how the entry is made on a GL I believe. How does that translate into the business's documents? Would it be recorded on the …

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.