Questions: Accounting for Donations

Q: An organization recently got a donation of a Motor Vehicle purchased for $40,000. How does the receiving organization account for it?

Q: An organization recently got a donation of a Motor Vehicle purchased for $40,000. How does the receiving organization account for it?

A: I would do the journal entry for this as follows:

Debit Motor vehicle (asset) $40,000

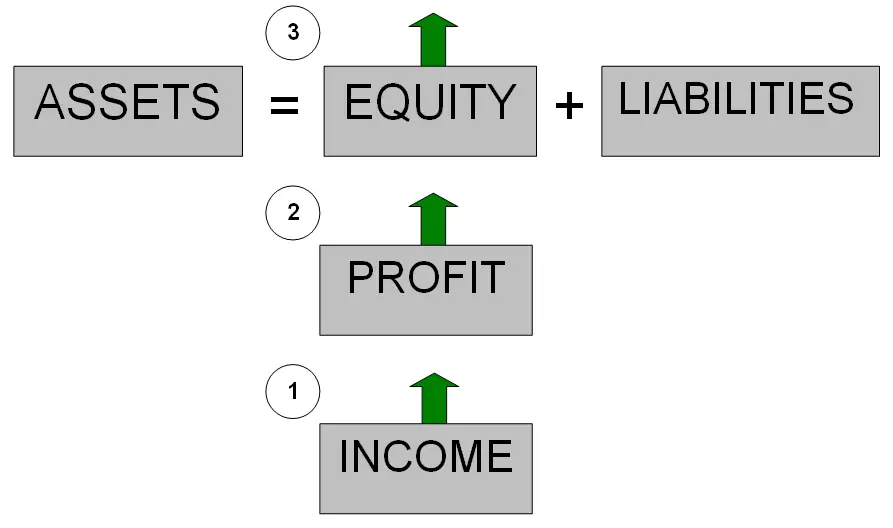

Credit Donation received (income) $40,000

The debit is the easy part here: the business is receiving an asset, assets occur and increase on the left side so we debit it.

The contra entry, the credit, described what occurred - we received a donation.

Since a donation is not usually the main or a regular source of income for a business, donations received would normally fall under "other income" in the income statement (profit and loss).

Hope that helps. See below for more questions and answers about donations, including for non-profits.

- Michael Celender

Accounting Basics for Students

Tutorials relating to this Topic:

Return from Questions about Donations to Full Accounting Questions and Answers

Comments for Questions: Accounting for Donations

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

Closing Entries for a Non-Profit

(Donating Remaining Items)

by Amy Hood

(Northbrook, Canada)

Q: I am trying to close accounts for a non-profit company. They have remaining t-shirts and food that they are donating to another charity (homeless shelters). How do I post closing entries?

A: I would record this as follows:

Dr Donation (expense)

Cr T-shirts/food (asset)

That way you are recording the assets you're giving away as a loss or expense.

Michael C.

Accounting Basics for Students

Comments for Closing Entries for a Non-Profit

|

||

|

||

|

||

Recording of Inventories Donated

Q: How do we record inventories when donated in the periodic inventory method?

Comments for Recording of Inventories Donated

|

||

|

||

|

||

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.