Income:

Definition and Examples

Previous lesson: What is Profit and Loss?

Next lesson: Accrued Income - Part 1

In our previous lesson we learned that profit is calculated by taking income and minusing expenses:

In this lesson we're going to see exactly what income is and go over some examples.

Be sure to check your understanding of this lesson by taking the quiz in the Test Yourself! section further below. And right at the bottom of the page, you can find more questions on the topic submitted by fellow students.

Let's Define Income

I'm not even going to mention the official definition of income. Look it up in an official-looking accounting book if you so choose.

Let's define income in simple terms:

Income is simply an event that results in money (or other assets) flowing into the business.

Income is actually not the money itself. The money is a separate thing (an asset).

One could think of income as the reason for the inflow of money or the actions that were done to cause the money to flow in. That is the income.

This should become clearer as we go through the examples below.

Examples of Income

Here are the most common forms of business income:

Sales

For many businesses, sales of goods are their main form of income.

A business can either buy products at a low price and resell them at a higher price to customers, or they can actually make the goods and then sell them.

A business that resells goods is known as a trading business, while a business that makes goods is known as a manufacturing business.

Products and sales (and how to account for them) is covered in our later chapter on Inventory (goods), trading and manufacturing businesses.

Services Rendered

Not all businesses deal with products. Many of them simply provide a service.

Examples of this range from labor-intensive work like construction, plumbing and repairs to technology-oriented services like graphic design, call centers, marketing and programming work. Legal services, medical practices and bookkeeping services also come under this category, of course. I'm sure you can think of other examples.

Since service businesses don't have to deal with products and product costs, accounting for them is generally a bit simpler.

George's Catering, the sample business used throughout our lessons, is a service business.

Interest and Investment Income

Another common form of income, though not usually the primary form of income for a business, is interest and/or income from investments.

A business can receive interest based on money they've invested in a savings account. The interest amount is calculated based on an annual interest rate and usually accumulates in the account on a monthly basis.

A business can also invest in another company or financial instrument and earn a return from this.

Rental Income

For businesses that own commercial or residential properties and rent them out to other businesses and individuals, they will receive rental income. This is normally invoiced and received on a monthly basis.

Each one of the income examples above represent some sort of event that occurs (like a sale being made), which results in money flowing into a business.

Income and the Accounting Equation

In our previous lesson on profits and losses, we said that profit belongs to the owner, meaning that more profit means more owner's equity. We also said that profit is calculated by taking income and minusing expenses.

So now, how exactly does income fit into our accounting equation?

Here's the answer:

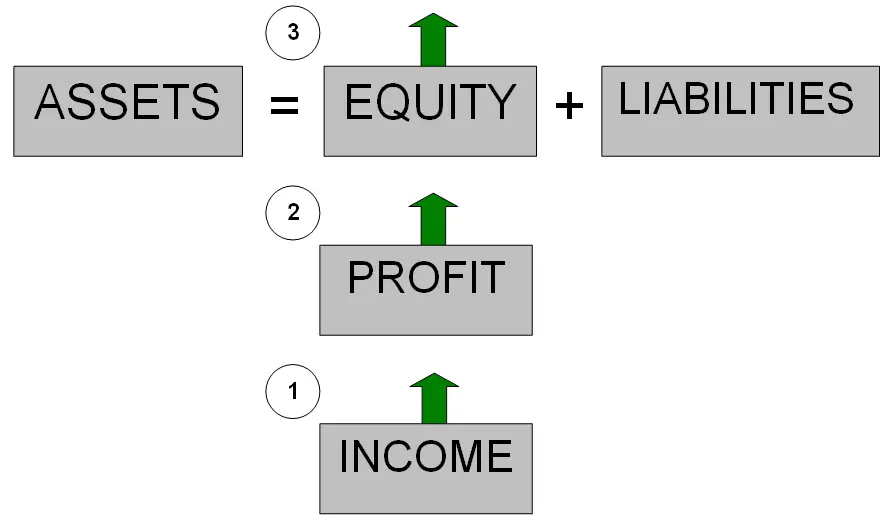

More income (1) means more profit (2), which means more for the owner (3).

Income thus comes into being (and increases) on the same side as owner's equity – on the right side.

A Detailed Income Example

Okay, let's return to George's Catering and see how George deals with income.

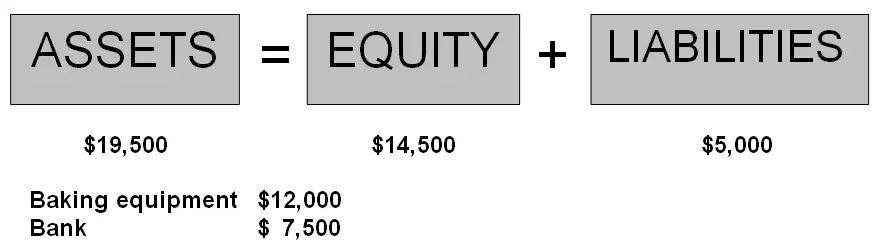

This is what the business looked like after our last transaction:

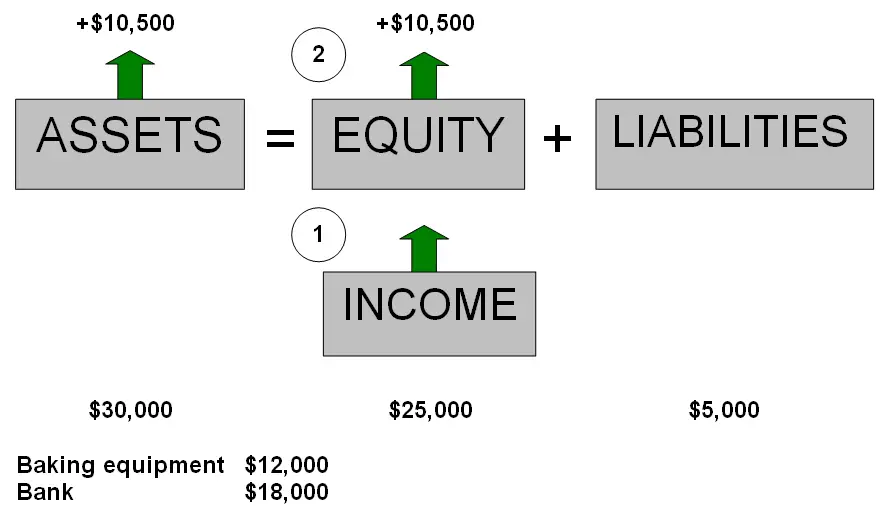

e) Now George’s Catering provides catering services for a wedding. George gets $10,500 from this job in cash. What happens to our accounting equation?

Well, the simple part is probably the cash, an asset.

Assets increase (on the left), because we have received $10,500 in cash.

The source of that cash is the catering services provided. These services are income, meaning the event that results in money flowing into the business.

The business has made income, and this is worth $10,500.

Income increases on the right (the same side as the owner’s equity) and causes the owner’s equity to increase by $10,500.

The owner now has a stake of $25,000 of the total assets of $30,000.

Once again, the external parties’ stake (liabilities) will be the same as it was before this transaction ($5,000).

So, as you can see, income results in more assets, and in the owner having a greater share in the assets.

Want to see the full journal entry for this transaction?

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty Rating:

Beginner

Quiz length:

4 questions

Time limit:

6 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

Well done on completing our lesson on Income Definition and Examples!

In the example we just covered George's Catering was paid immediately in cash for providing the catering services. But in real life, this is not always the case. A lot of the time we only receive the cash much later. In accounting, this is called accrued income, and we have a specific way to deal with this.

We'll go through this in detail in our next lesson: What is Accrued Income?

Return from Income: Definition and Examples to Basic Accounting Transactions

Return to the Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: What is Profit and Loss?

Next lesson: Accrued Income - part 1

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

Examples of Income?

Q: Can someone please give me some examples of income?

See answers further below...

Related Questions & Tutorials: Tutorial on Income and …

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.