Cash Flow Statement and Depreciation

Question:

Depreciation charged during the year will come under which activities?Answer:

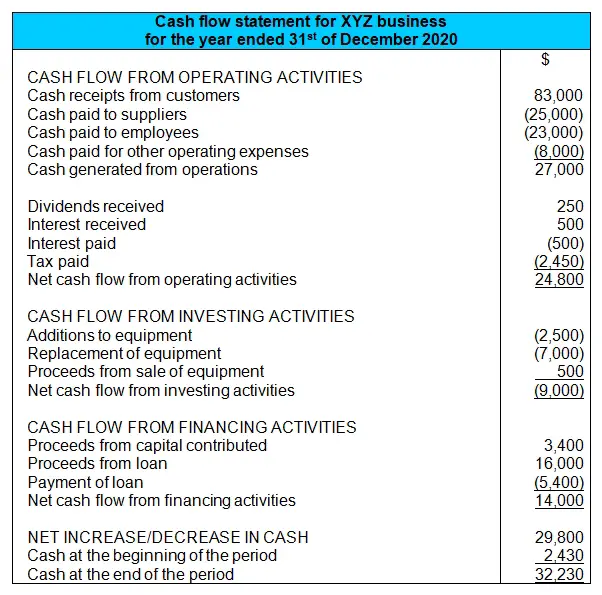

Depreciation actually does not come under any of the categories of the cash flow statement, at least when you're using the direct method:

Depreciation is simply the systematic reduction in the value of a non-current (long-term) asset each year. The amount of this reduction is recognized as an expense each year and shown in the income statement.

Depreciation is simply the systematic reduction in the value of a non-current (long-term) asset each year. The amount of this reduction is recognized as an expense each year and shown in the income statement. For example, you purchase a construction vehicle for your business for $200,000. You expect it to be used for 10 years in the business before replacing it. So you allocate $20,000 per year ($200,000 / 10 years) as an expense to the income statement. This expense is called depreciation.

From the asset point of view, after 2 years your business would have recorded $40,000 of accumulated depreciation ($20,000 each year for 2 years) against the asset's original value ($200,000), giving a carrying amount (the net value to your business) of $160,000 for the vehicle.

It should be noted that depreciation is included as part of the calculation of cash generated from operations when using the indirect cash flow statement, which is the preferred method of presenting the statement in the US:

Occasionally you will also see depreciation in a cash flow statement exercise or question using the direct method. In this situation they will provide you with the income statement (and other financial statements) and you will have to construct the cash flow statement from these. The income statement will include depreciation as one of the expenses there.

Similar to the indirect method, they may require you to start with the net profit in the income statement and go from this figure to a cash flow figure. In this case you have to remove the differences between the income statement and cash flow statement. One of those differences is depreciation, which occurs in the income statement but does not represent an actual movement of cash.

Hope that helps!

By the way I have full, detailed explanations of depreciation (multiple lessons) and exercises in my basic accounting book.

All the best for your studies,

Michael Celender

Founder of Accounting Basics for Students

Related Questions & Tutorials:

- Full Cash Flow Statement Exercise (direct method)

- The Indirect Cash Flow Statement Method

- Cash Flow Statement: Current Year Profit & Retained Earnings

- Bad debts in Cash Flow Statement?

- Cash Flow Statement: Dividends Paid under Financing or Operating Activities?

Return to the full Cash Flow Statement Tutorial

Comments for Cash Flow Statement and Depreciation

|

||

|

||

|

||

|

||

|

||

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.