Bad Debts in Cash Flow Statement?

by Katrien

(Havelock North, New Zealand)

Question:

Where is the writing off of bad debts entered on the cash flow statement?Thanks,

Katrien

Answer:

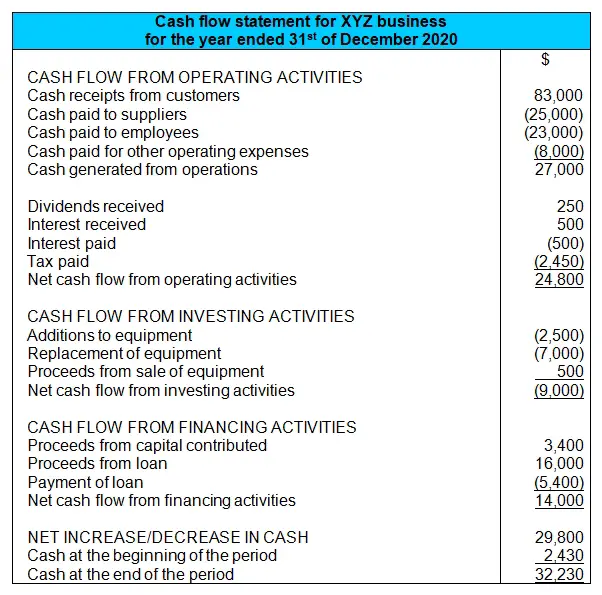

Hi Katrien,That's kind of a trick question. Because bad debts are generally not included in the cash flow statement - at least, not when using the direct method:

So it's just an accounting entry (a loss or expense) but there is no actual cash involved in the transaction.

Bad debts are thus included as an expense in the income statement but not included as a line item in the cash flow statement (direct method).

It should be noted that bad debts do, however, form part of the calculation of cash generated from operations when using the indirect cash flow statement, which is the preferred method in the US. For more info on exactly how and where it fits in there, see the tutorial on the indirect cash flow statement method.

Hope that answers your question! Good luck!

Best,

Michael Celender

Founder of Accounting Basics for Students

Related Questions & Tutorials:

- The Indirect Cash Flow Statement Method

- Cash Flow Statement and Depreciation

- Cash Flow Statement: Current Year Profit & Retained Earnings

- Cash Flow Statement: Dividends Paid under Financing or Operating Activities?

- Cash Flow Statement Exercise (full solution)

Return to the main Cash Flow Statement Tutorial

Comments for Bad Debts in Cash Flow Statement?

|

||

|

||

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.