Cash Sales Journal Entry Example

Q: What is the journal entry to record cash sales?

Q: What is the journal entry to record cash sales?

For example, cash sales of $3,000 to Mr. Hoover of goods that originally cost us $2,000.

A: The journal entry for a cash sale actually involves two possibilities. The exact double entries we do depends on which inventory system the business uses.

1) Periodic Inventory System

For a business using the periodic inventory system, we only have one journal entry for a cash sale:Dr Bank A/C.................$3,000

Cr Sales.......................................$3,000

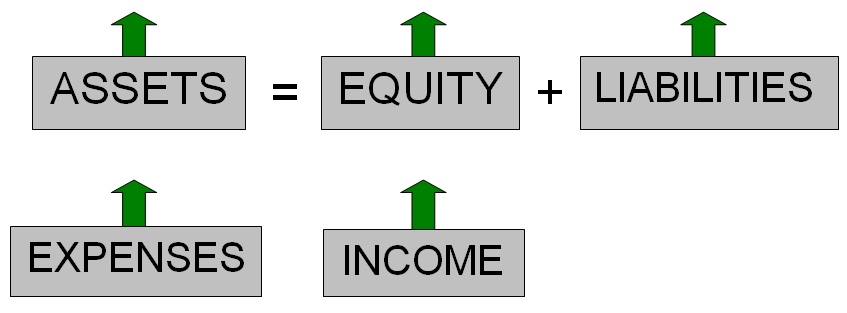

First of all, we're receiving cash in our bank account. This is an asset, and assets increase on the debit (left) side. So our bank account is debited.

Sales are income, and income occurs on the credit side (right) of our accounting equation, so we credit this.

Note that with a periodic inventory system, we don't keep continuous, up-to-date records of our inventory, we just do periodic (meaning "every now and then") physical inventory counts to check how much we have on hand. As a result, instead of adjusting an asset account (Inventory) when we make purchases (and sales), we use the Purchases account, an expense account. At the end of the accounting period we adjust our new value of inventory and record the Cost of Goods Sold.

2) Perpetual Inventory System

In contrast to the periodic system, with the perpetual inventory system we record two journal entries when we have a cash sale. This is because we keep perpetual (continuously up-to-date) records of our inventory and will also remove the inventory at its cost price whenever we make a sale. In this system we use the asset account called Inventory whenever we purchase goods or make sales.Here's the first cash sale journal entry under the perpetual inventory system:

Dr Bank A/C.................$3,000

Cr Sales.......................................$3,000

As you can see, it's exactly the same as above. We're recording the sale itself.

But since we're continuously adjusting our Inventory account when it increases or decreases, we have this additional journal entry at the time of the sale:

Dr Cost of Goods Sold.................$2,000

Cr Inventory.........................................$2,000

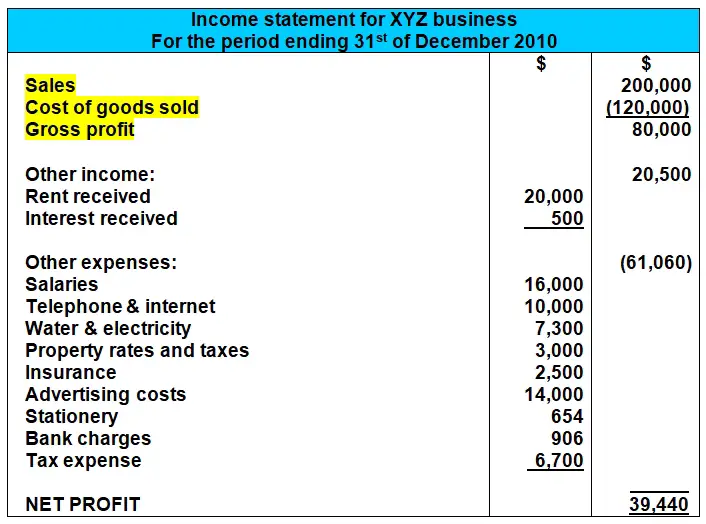

In this second journal entry, we're removing the inventory (asset account) from our records by crediting it at its cost price ($2,000). We also debit the Cost of Goods Sold account, an expense account that we keep to compare against Sales and calculate a Gross Profit (shown in the income statement below):

Note that we will do a similar entry for Cost of Goods Sold under the periodic inventory system, but this won't be done at the time of the sale, but rather only at the end of the accounting period. Check out the full tutorial on Periodic and Perpetual Inventory for these end-of-year journal entries to adjust inventory.

For any accounting question or exercise requiring one to record the sales journal entry, make sure you take note of which inventory system is being used. In most questions they'll tell you which system, but if they don't mention either one, you can normally just assume that they're using the periodic system.

So what did you think of this cash sales journal entry example? Did it make sense? Have your say by adding a comment further below.

And take a look at the related tutorials just below, especially our full tutorial on Perpetual and Periodic Inventory.

Best,

Michael Celender

Founder of Accounting Basics for Students

Related Questions & Tutorials:

- Full Tutorial: What is Inventory?

- Full Tutorial: Sales, Cost of Goods Sold and Gross Profit

- Credit Sale Journal Entry Example

Return to the full tutorial on Perpetual and Periodic Inventory

Click here for more Basic Accounting Questions and Answers

Comments for Cash Sales Journal Entry Example

|

||

|

||

|

||

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.