Rent Expense Journal Entry Example

Q: Prepare the journal entry for the following transaction:

Q: Prepare the journal entry for the following transaction:

Paid rent $200.

A: The rent expense journal entry is not too complicated:

DR: Rent..........................$200

CR: Bank / Cash.............................$200

Probably the easiest part of working out the journal entry is the cash (or bank).

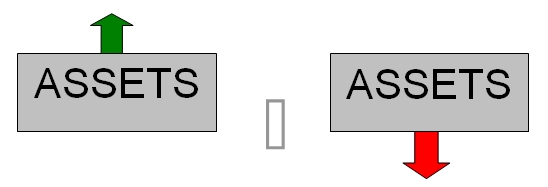

Our cash (or bank) is our asset and this asset is decreasing.

Assets increase on the left side (debit) and decrease on the right side (credit).

The next thing is to work out the debit entry.

You can do this by simply asking yourself, "What did we pay for?"

The answer, of course, is rent.

Rent is an expense account.

Expenses are always debited, meaning that we make an entry with them on the left side.

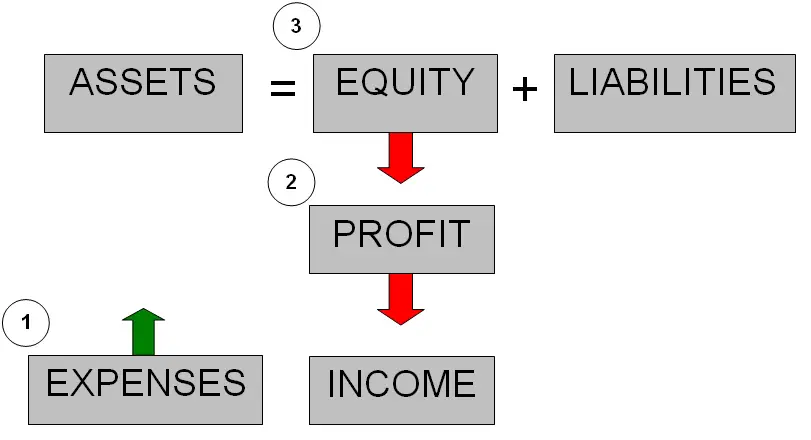

This is because expenses (1) reduce profit (2), which belongs to the owner (3).

The owner's equity occurs on the right side of our equation and expenses occur on the opposite side to this (left side).

So our expense, rent, is debited.

Does that rent expense journal entry make sense now? Let us know in a comment below. Or, add your own rent journal entry question for others to answer.

Best,

Michael Celender

Founder of Accounting Basics for Students

Related Questions & Tutorials:

Click here for more Basic Accounting Questions and Answers

Comments for Rent Expense Journal Entry Example

|

||

|

||

|

||

|

||

|

||

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.