Journal Entries and Ledger

Question and Answer

Before you begin: For purposes of testing and exams it's important to make sure you not only answer questions and exercises correctly but also complete them at the right speed. Use a watch or clock to time yourself while attempting this exercise.

Difficulty Rating:

Intermediate

Time limit:

20 minutes

Question:

Q: Mr Robert commenced business on 1st January, 2011 with a capital of $100,000 in cash. On the same date he opened the bank account in ADCB and deposited $20,000. During the month of January 2011 the following transactions took place:Jan 1 Bought goods for cash 70,000

2 Sold goods to Steve Co. (Credit) 38,000

15 Sold goods for cash 9,000

21 Steve Co. paid by cheque 35,000

22 Stationery bill paid by cheque 2,000

22 Telephone bill by cash 500

31 Paid rent by cash 2,000

Paid salaries by cash 3,000

Withdrew cash personal use 5,000

Required:

Record journal entries for the transactions and post them to ledgers.

Solution:

Journals:

Jan 1 Dr Cash on hand 80,000Dr Bank 20,000

Cr Capital 100,000

Note that in most accounting questions you won't have to account for "Cash on hand" and "Bank" in separate accounts. In most questions I just combine these into "Bank." But in this question they specifically talk about opening the bank account with $20,000 of the $100,000, which indicates they kept

1 Dr Purchases/Inventory 70,000

Cr Cash on hand 70,000

Note that it's "Purchases" for a periodic system of inventory and "Inventory" if it's the perpetual system. See the tutorial on perpetual and periodic inventory for more information.

2. Dr Debtors 38,000

Cr Sales 38,000

15. Dr Cash on hand 9,000

Cr Sales 9,000

21. Dr Bank 35,000

Cr Debtors 35,000

22. Dr Stationery expense 2,000

Cr Bank 2,000

22. Dr Telephone expense 500

Cr Cash on hand 500

31. Dr Rent expense 2,000

Cr Cash on hand 2,000

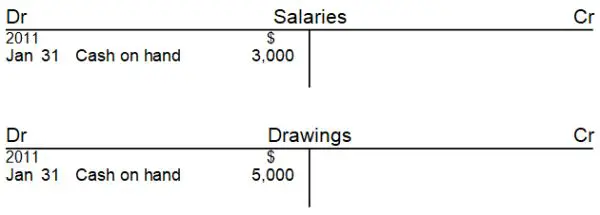

31. Dr Salaries 3,000

Cr Cash on hand 3,000

31. Dr Drawings 5,000

Cr Cash on hand 5,000

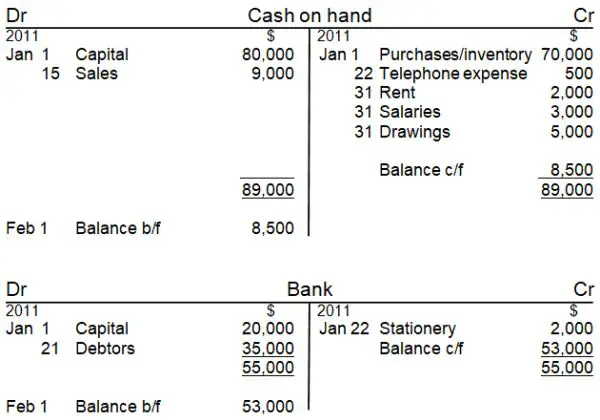

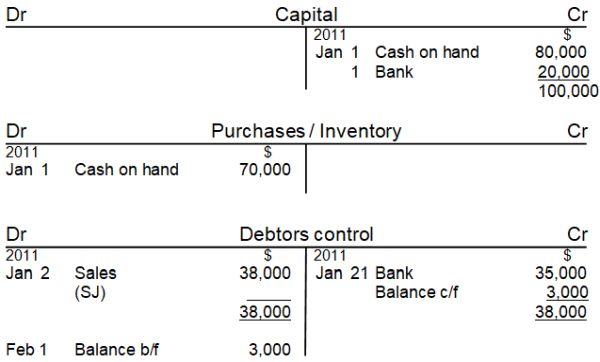

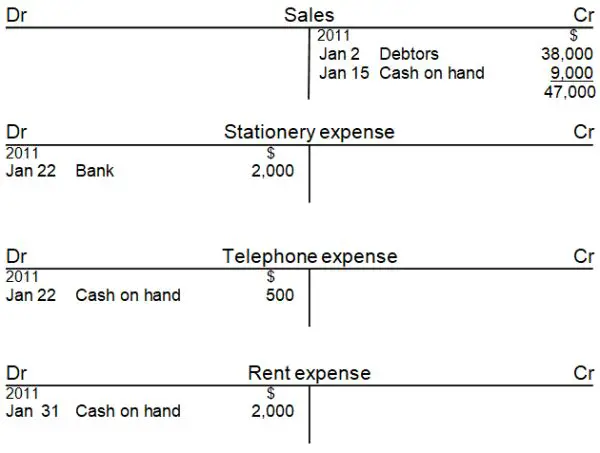

Ledger:

There you go. Hope you enjoyed this detailed journal entries and ledger question and answer.

Thanks to Kay Khine, Kong Chenda and others for contributions in the Comments section below that helped solve this question!

Good luck with your studies!

- Michael Celender

Founder of Accounting Basics for Students

Tutorials relating to this Journal Entries and Ledger Question and Answer:

- Journal Entry - Equity Example

- What is Inventory?

- Perpetual and Periodic Inventory

- Journal Entry - Cash Income Example

- Journal Entry - Income on Credit Example

- Journal Entry - Debtor Pays Example

- Journal Entry - Expenses Example

- Journal Entry - Drawings Example

- T-accounts

- How to Balance a T-account

Comments for Journal Entries and Ledger

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.