Double Entry Exercise:

Which Accounts Are Affected?

by Mogna

(Klang, Malaysia)

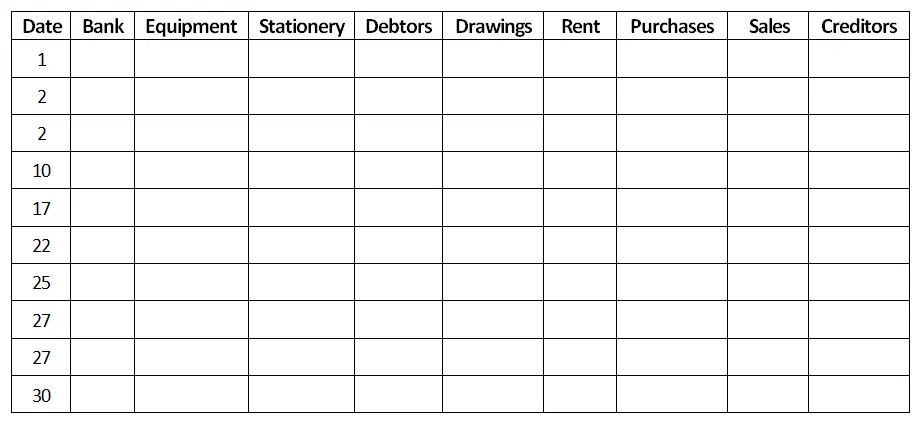

Before you begin: For purposes of testing and exams it's important to make sure you not only get the questions right but are completing them at the right speed. Use a watch or clock to time yourself for this exercise. Print out the blank table below (or copy it to a piece of paper) and then start the exercise.

To print the table below, right click the image and select "Save image as..." to save it to your computer for printing.

Note that the first solutions provided below are just the names of the accounts affected in the table, but you can find the full journal entries further below too. You can attempt the full journal entries if you want. If you choose to do so, the time limit for completing the table is 10 minutes, and the time limit for completing the journal entries is an additional 10 minutes (20 minutes for both).

Difficulty Rating:

Beginner --> Intermediate

Time limit:

10 minutes / 20 minutes

Q: Which accounts are affected by the following transactions?

(RM = Malaysian Ringgit = Malaysian currency)

(Bhd. stands for Sendirian Berhad and is the Malay equivalent of Incorporated)

July

1 Purchased goods from CBA Bhd. RM 800 on credit.

2 Withdrew RM 1,500 cash for personal use.

2 Paid cash RM 1,000 for July rent.

10 Sold goods to Mr. Lee on account, RM 850.

17 Sold goods on credit to Mr. Ahmad RM 3,500.

22 Bought computer for cash RM 2,100.

25 Bought stationery for cash RM 100.

27 Purchased goods from Alam Bhd RM 2,500.

27 Paid CBA Bhd. RM 450 cash.

30 Received RM 3,500 from Mr. Lee.

Required: For each transaction above, complete the table as in the example below:

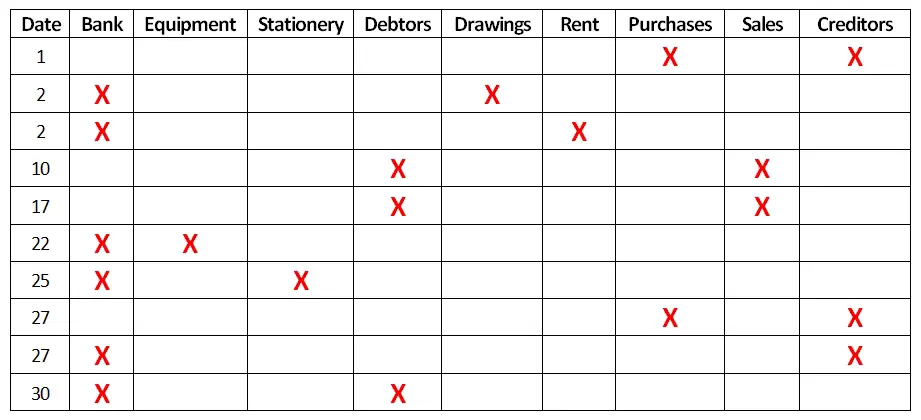

A: Here is the completed table, followed by an explanation of the accounts that are affected by each of these transactions:

1 Purchases and Creditors/Accounts Payable

Purchases is the expense account we use when we are purchasing goods in a periodic inventory system. For a perpetual system, we would actually use the asset account "Inventory." Since it's a credit transaction, the other account affected is Creditors or Accounts Payable, which is a liability account.

2 Bank and Drawings

Our bank account is affected as there is a change in money. The other account is Drawings, which is the account used for owner withdrawals from the business.

2 Bank and Rent

Our bank account is again affected here as there is a payment. The payment is for rent.

10 Sales and Debtors/Accounts Receivable

In this transaction we record income in the form of sales and we record the credit item of debtors or accounts receivable to show that money is owed to us.

Note that these are the only accounts affected if we were using the periodic inventory system. However, if we were using the perpetual inventory system we would also have to adjust our Inventories account and Cost of Goods Sold (see further below for the journal entries).

17 Sales and Debtors/Accounts Receivable

Same as just above.

22 Bank and Computers/Equipment

Since a payment occurred, our bank account is affected. The payment was for computers or equipment.

25 Bank and Stationery

A payment was again made, this

27 Purchases and Creditors/Accounts Payable

Same as 1) above. It does not explicitly say that the goods were purchased on credit but anytime this is the case, you can assume it was a credit purchase, not cash.

27 Bank and Creditors/Accounts Payable

CBA Bhd. is the creditor from the first transaction, which we are now paying. The payment means our bank account is affected, and it is for that Creditor or Accounts Payable.

30 Bank and Debtors/Accounts Receivable

Mr. Lee is a debtor of ours following the sale on 10 July. Since the sale on 10 July was only 850 but he is paying us 3,500 now, we can assume he already owed us money for previous transactions. Receiving the money means our bank account is affected, and this money is from the debtor or accounts receivable.

Here are the full debit and credit journal entries for each of these transactions:

1 Debit Purchases........................................800

Credit Creditors/Accounts Payable....................800

Purchases is an expense, which occurs on the debit side (left). Creditors or Accounts Payable is a liability, which increase on the right side (credit).

2 Debit Drawings....................1,500

Credit Bank........................................1,500

Our bank account is decreasing. Since it's an asset, an assets increase on the left and decrease on the right, we credit it. Drawings is the opposite of capital (owner's equity) and occurs on the right, so is debited.

2 Debit Rent....................1,000

Credit Bank...............................1,000

Again bank is credited as it is a payment (assets decreasing). Rent is debited as it is an expense.

10 Debit Debtors/Accounts Receivable....................850

Credit Sales..........................................................................850

Income occurs on the same side as owner's equity (right side), so it is credited. Debtors or Accounts Receivable is an asset and is increasing, which occurs on the left side (debit).

17 Debit Debtors/Accounts Receivable....................3,500

Credit Sales............................................................................3,500

Same as just above.

22 Debit Computers/Equipment....................2,100

Credit Bank.................................................................2,100

Since we're making a payment, bank (asset) is credited. Computers or equipment is an asset and is increasing, so is debited.

25 Debit Stationery......................100

Credit Bank..........................................100

Same as above as Stationary is also an asset which is increasing.

27 Debit Purchases...................................2,500

Credit Creditors/Accounts Payable....................2,500

Same as 1) above.

27 Debit Creditors/Accounts Payable....................450

Credit Bank.......................................................................450

CBA Bhd. is the creditor from the first transaction, which we are now paying. The payment means that our bank account (asset) is decreasing, which means a credit. The liability account, Creditors or Accounts Payable, is also decreasing (we owe less). Liabilities increase on the right side and decrease on the left, so this account is debited.

30 Debit Bank...............................................3,500

Credit Debtors/Accounts Receivable....................3,500

We are receiving money, so our bank account increases. Since it's an asset, we debit Bank. Mr. Lee is a debtor and his debt to us is decreasing. So we credit this asset account.

What did you think of this double entry exercise? Have your say by adding a comment at the bottom of this page.

Did you get them all correct? If not, check out the related tutorials below.

Best,

Michael Celender

Founder of Accounting Basics for Students

Related Questions & Tutorials:

- Name the Accounts Exercise (Plus Journals)

- Chapter on the Ten Common Basic Accounting Transactions

- Chapter on the Double Entry Accounting System (Journal Entries)

Click here for more Basic Accounting Questions and Answers

Comments for Double Entry Exercise:

|

||

|

||

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.