Cash Flow Statement:

Purpose and Importance

Q: What is the main purpose of preparing a cash flow statement in an organization? Why is it important?

A: The purpose of the cash flow statement is to present the flows of cash in a business.

But why is this important and do we really need it? We already have the balance sheet, which is supposed to show a snapshot of the business (assets, owner's equity and liabilities) and how the business is doing. We already have the income statement, which shows the incomes, expenses and profit for the business.

So why do we need the cash flow statement? Isn't income and cash the same thing anyway? Aren't expenses all cash payments?

ANSWER: Income and cash are not the same thing. And expenses can occur without paying them.

The income statement shows income, which can be actually received in cash but sometimes can be performed on a credit basis (i.e. the cash for the income is still owed to the business). And it shows expenses, which, like I said, can occur during the year and not yet be paid.

You can even have a situation where the business has made lots of income, but it's almost completely on credit and has hardly received any cash. For example, XYZ Incorporated (a construction company) records $2.5 million income for construction projects completed during the year but is only paid $800,000 cash from its clients for these projects.

But the business only received $800,000 cash so far. Let's say it paid out all $1.5 million expenses during the year. That means it has negative cash of $700,000 (i.e. bank overdraft, meaning money owing to the bank). Which is a terrible situation. But if you only were able to view the income statement it would show profit of $1 million ($2.5 million income - $1.5 million expenses).

So as you

Additionally, you can have major movements in cash for the year that do not involve income. For example, you can spend $150,000 on a construction vehicle. As this is a non-current (long-term) asset, it would not be recorded as an expense in the income statement, but just as an additional asset. This is $150,000 outflow of cash for the business, which could also be very useful information to know.

Additionally, you can have major movements in cash for the year that do not involve income. For example, you can spend $150,000 on a construction vehicle. As this is a non-current (long-term) asset, it would not be recorded as an expense in the income statement, but just as an additional asset. This is $150,000 outflow of cash for the business, which could also be very useful information to know.Or you can receive an investment of $500,000 in your business from a new business partner/investor. This would be included in the statement of changes in equity and in the balance sheet as new equity but it wouldn't even appear in the income statement as it's not income.

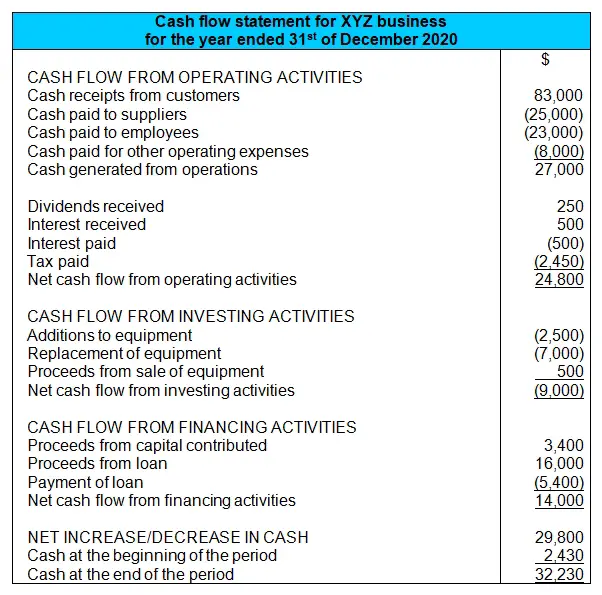

So in comparison to the income statement, the cash flow statement specifically shows all the flows of cash - all the cash that came into the business and all the cash that went out of the business.

So, in summary, what is the purpose of the cash flow statement?

It is to show additional information (besides the income statement, statement of changes in equity and balance sheet) to people who are interested in how a business is doing. And that additional information specifically concerns the flows of cash, both in and out of the business.

Hope that gives you a better understanding of the purpose and importance of the cash flow statement.

Are there any other reasons why the cash flow statement is important?

Have your say in a comment below.

All the best in your studies!

Michael Celender

Founder of Accounting Basics for Students

Related Questions & Tutorials:

- Full Cash Flow Statement Exercise

- The Indirect Cash Flow Statement Method

- Cash Flow Statement and Depreciation

- Cash Flow Statement Question: Dividends Paid under Financing or Operating Activities?

Click here to return to the main Cash Flow Statement Tutorial

Click here for more Basic Accounting Questions and Answers

Comments for Cash Flow Statement:

|

||

|

||

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.