Journal Entry: Cash Received From a Debtor / Accounts Receivable

(Accrued Income Part 2)

Previous lesson: Accrued Income Journal Entry (Part 1)

Next lesson: Expense Journal Entry

In our previous lesson we covered a journal entry for accrued income using our sample business, George's Catering.

The business provided catering for funeral services to the value of $5,000 to the Smiths.

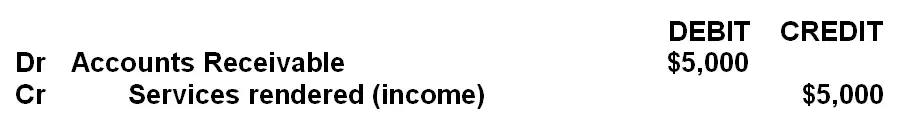

We recorded the journal entry for this as follows:

In this lesson we're going to see what the journal entry is when our debtor (accounts receivable) actually pays us.

Check your understanding of this journal entry and lesson by taking the quiz in the Test Yourself! section further below. And right at the bottom of the page, you can find more questions on the topic submitted by fellow students.

Debtor Payment Example

g) The Smiths pay the full amount owed to George’s Catering on the 30th of April. What do we do?

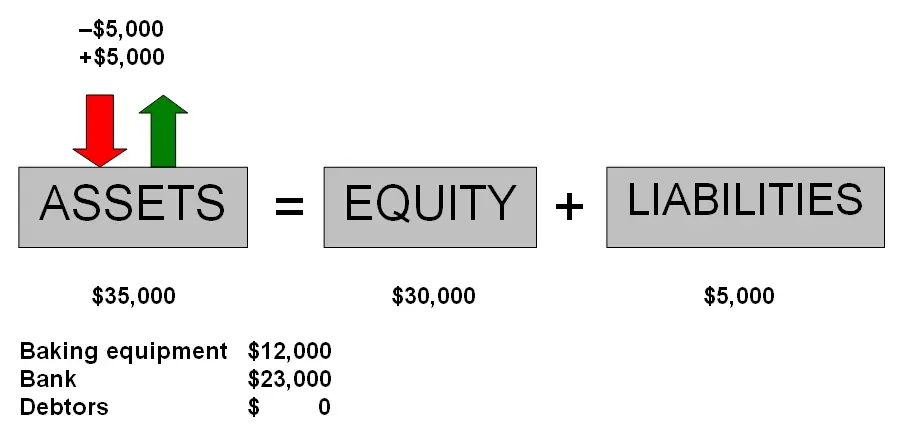

Well, the easiest part of this transaction is that we receive cash of $5,000. So cash or bank goes up.

But what happens with our debtor (the Smiths)?

Our debtor is also an asset. It exists currently in our records at $5,000. If the Smiths are now paying us, it means that they owe us less. Debtors should be decreasing (from $5,000 to $0).

Journal Entry

Here is the journal entry to record the above payment from the debtor:

Cash or bank is an asset. And when assets increase we debit them. So we debit the business bank account (or cash).

Debtors (or accounts receivable) are also an asset. If we want to decrease this account, we must credit it.

Note that accounts receivable or debtors now amounts to zero dollars in our records – in other words, we are showing that the Smiths' debt towards George’s Catering no longer exists.

Quick Reminder: Income vs Cash

Remember, income and cash are two separate things.

We defined income as: The event that results in money flowing into the business.

In our examples, the income consisted of catering services provided on the 8th of April.

This income did eventually result in more cash for the business – as it should.

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty Rating:

Beginner

Quiz length:

3 questions

Time limit:

4 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

Well done for completing our lessons on the journal entries for accrued income and the subsequent payment by the debtor.

Feel free to move on to our next lesson where we'll learn the journal entry for an expense.

Return to Double Entry Accounting

Return to the Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: Accrued Income Journal Entry (Part 1)

Next lesson: Expense Journal Entry

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

Journal Entry Question:

Settlement of Debtors Account, Bad Debts or Discount Allowed

Q: Prepare the journal entry or entries for the following transaction:

Issued a receipt for R105 to B. Baloyi in settlement of his account of R126. …

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.