Accrued Income Journal Entry

(Part 1)

Previous lesson: Journal Entry for Income (Cash Example)

Next lesson: Journal Entry: Cash Received From a Debtor / Accounts Receivable (Accrued Income Part 2)

In this lesson we're going to continue with our sample business, George's Catering, go through an accrued income example and see what the journal entry is.

Be sure to check your understanding of this journal entry and lesson by taking the quiz in the Test Yourself! section further below. And right at the bottom of the page, you can find more questions on the topic submitted by fellow students.

The Accrual Basis of Accounting:

A Quick Reminder

Remember: income and expenses are recorded using the accrual basis of accounting.

Accrual describes amounts that are owed.

Accrued income is income that is owed to us.

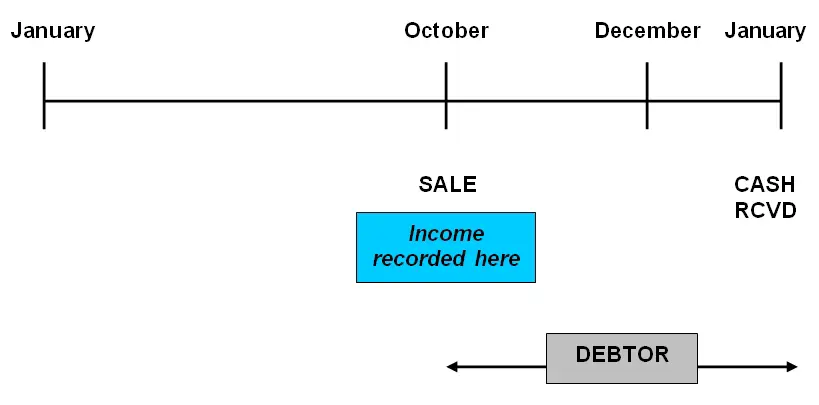

The accrual basis of accounting means that if a sale is made in October, but cash is received in January, the income is recorded in October (not when the cash is received in January).

Between October and January we record that cash is owed (a debtor is recognized).

Accrued Income Example

f) George’s Catering provides catering services for a funeral for the Smiths. The services are provided on the 8th of April and the agreed fee is $5,000. As part of the agreement, the Smiths will only make payment at the end of April.

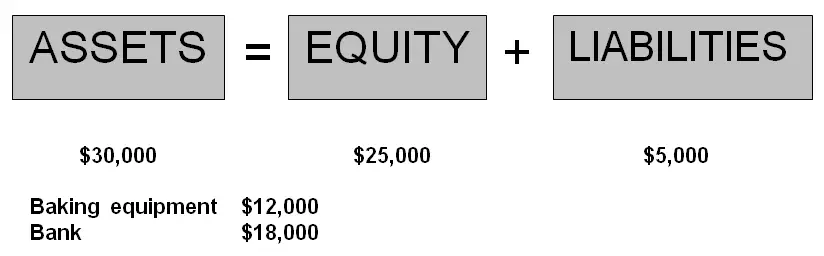

Here's where George’s Catering stood up to now:

What is the journal entry we record on the 8th of April? What do we do?

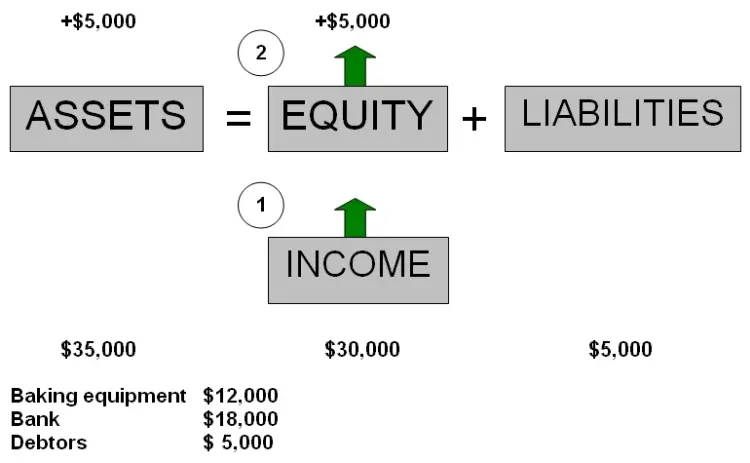

First of all, the income is recorded straight away on the 8th of April, as the income, meaning the event that will lead to money, has taken place. What is that event? Providing catering services for the funeral. So the business has earned income, and this is worth $5,000.

Income belongs to the owner, it increases on the right - the same side as the owner’s equity. Thus, we credit the income (services rendered).

As the $5,000 is not received in cash on this date, we record a debtor (the Smiths). The account we will normally used to record this debtor is called accounts receivable.

Remember that accounts receivable (a debtor) is an asset, as it will bring us future benefits in the form of getting paid.

Assets increase on the debit side, so we debit accounts receivable.

Journal Entry

So, here is the journal entry for recording the accrued income:

There you go, that's the accrued income journal entry for our example: debit accounts receivable (an asset, also known as debtors or receivables) and credit services rendered (income).

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty Rating:

Beginner

Quiz length:

5 questions

Time limit:

6 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

Okay, so that example was a little tricky. If you still feel a bit confused about the debit and credit entries, check out this excellent lesson entitled Debits and Credits: what they really mean.

Otherwise, feel free to move on to the next lesson (part 2 on accrued income), where we'll learn the journal entry for when the debtor actually pays off his debt.

Return to Double Entry Accounting

Return to the Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: Journal Entry for Income (Cash Example)

Next lesson: Journal Entry: Cash Received From a Debtor / Accounts Receivable (Accrued Income Part 2)

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

What is the Journal Entry for an Insurance Claim?

Q: What is the journal entry for the claim recovered from fire insurance?

A: This depends on the exact asset/s that were destroyed in the fire and …

General Journal Entry for Accrued Rent

Q: What is the general journal entry for accrued rent?

A: To do the journal entry for accrued rent you should first understand what this means.

…

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.