Accounts Payable:

Definition and Examples

Previous lesson: Expenses: Definition and Examples

Next lesson: Double Entry Accounting

In this lesson on accounts payable we're going to go over its definition and a full example with these kinds of transactions.

Be sure to check your understanding of this lesson by taking the quiz in the Test Yourself! section further below. And right at the bottom of the page, you can find more questions on the topic submitted by fellow students.

What Does Accounts Payable Mean?

Accounts payable, often simply abbreviated as AP, is a term describing the amounts that are owed by your business to its suppliers for various products and services they have received without paying for them immediately.

"Payable" means "to be paid" or "owing."

So accounts payable basically means owing other businesses for things bought on credit. Or in other words, goods or services are received by one's business but are only paid at a later point (usually a month or a few months later).

Of course, this means that a debt is created.

So as you might have guessed, "accounts payable" is a liability account (debt).

Since it is a short-term debt, it is specifically classified as a current liability in our records and in the financial statements.

Accounts payable is also known as creditors.

Accounts Payable and the Accrual Basis

Remember, when recording transactions we use the accrual basis of accounting.

The accrual basis of accounting means that income and expenses are recorded in the periods to which they relate, and not necessarily when the cash relating to these items are received or paid.

This means that expenses we're only planning to pay later are recorded when they actually occurred, not weeks or months later when the cash is finally paid. You'll see exactly what I mean in the accounts payable example below.

Accounts Payable Example

(Part 1 - The Liability)

Let's continue with the sample business we've been using throughout our tutorials, George's Catering.

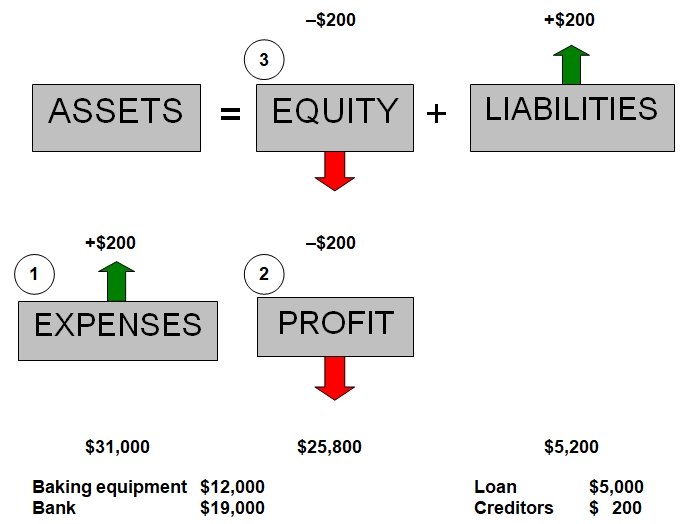

Up until now, George's Catering had assets of $31,000 ($12,000 baking equipment and $19,000 in the bank), owner's equity of $26,000 and liabilities (a loan) amounting to $5,000.

i) George Burnham receives a bill from the telephone company on the 30th of April. It says that George’s Catering owes $200 for the month of April. The telephone company offers payment terms of 15 days from the date that the bill is received. George intends to use these payment terms and pay after a week or two. How does this transaction affect our accounting equation on the 30th of April?

Please note: the explanation below does not include the journal entry, instead it just goes over the accounts that are affected and the impact of the transaction on the basic accounting equation.

Click here for the advanced lesson on accounts payable with the full journal entry.

The first question to ask is this: at this point in time (on the 30th of April), has any cash moved? In other words, have we actually paid the telephone bill yet?

The answer, of course, is no. In fact, our assets don't change at all at this point.

The telephone bill is an expense – meaning an event or something of value that we receive that results in money flowing out of the business (money flows out either immediately or at a later point).

The expense (event) has occurred – the telephone has been used in April. However, we'll only pay this at a later point.

So, this is not a cash expense, but rather an expense on account.

As the bill is owing, we add the value of this bill ($200) to our liabilities.

This liability is called accounts payable or creditors.

So, what is the effect on our accounting equation?

As you can see above, more expenses (1) results in less profit (2) and less owner's equity (3). Let me explain how this can be.

Remember, expenses are the opposite of income. More income means more profit, which goes to the owner and increases his share of the business. But more expenses mean less profit and a smaller share for the owner. The telephone expense means that the owner’s equity decreases.

So as a result of this expense, the owner’s equity decreases by $200 to $25,800.

The liabilities, meaning the external parties’ stake in the assets of the business, increases by $200 to $5,200.

In summary, we record the telephone expense, and we also record a liability called accounts payable.

Accounts Payable Example

(Part 2 - Paying our Creditor)

Okay, so George owes $200 to the telephone company for his April telephone bill.

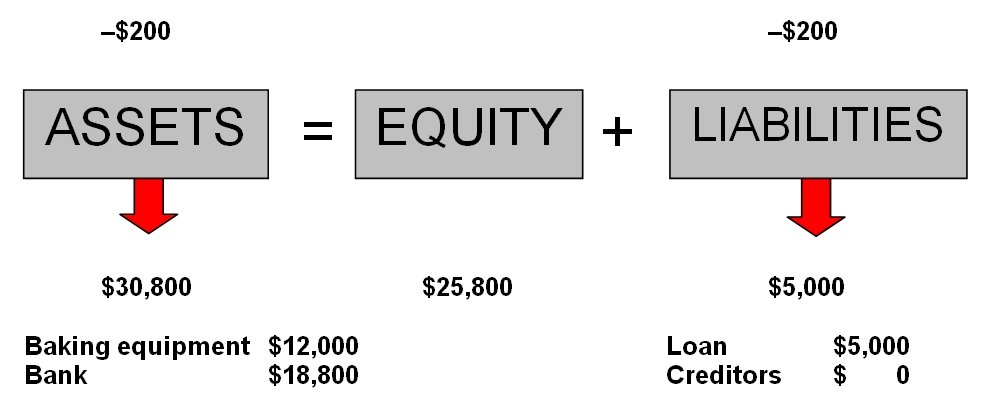

j) George Burnham pays the amount owing to the telephone company on the 13th of May. Now what do we record?

Again the easiest part of this transaction is the cash component. In this case, cash of $200 is definitely paid. So cash or bank decreases.

But what happens with the liability, our accounts payable or creditor?

Our creditor (the telephone company) exists currently in our records at $200. If we are now paying them, does this mean that we owe them less, or more, or that there is no change?

Answer: We owe them less. In fact, we don’t owe them anything now.

Here's how our accounting equation is impacted:

We decrease our bank by $200, and we also decrease our accounts payable (or creditors) by the same amount.

George’s Catering now consists of assets of $30,800, made up of baking equipment to the value of $12,000 and $18,800 cash.

Note that our accounts payable now amounts to zero – in other words, we are showing that the debt towards the telephone company, our creditor, no longer exists.

More Examples of Accounts Payable

Basically any expense that is not paid immediately will result in accounts payable.

Here are a few more examples:

- Utility accounts payable like electricity, rates and taxes, etc.

- Services like accounting or repair services payable,

- Supplies like office supplies or cleaning supplies that are payable,

- Stock or inventory purchased on credit (known as trade accounts payable),

- Salaries payable,

- Tax payable.

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty Rating:

Beginner

Quiz length:

6 questions

Time limit:

8 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

If you're feeling a bit confused after the above lesson, you may need to go back to one of the earlier lessons on this site. You can check out an easier cash expense example in the lesson entitled Define Expenses, or even review our more detailed explanation of the accrual basis of accounting in the lesson What is Accrued Income?

Well, that's not just the end of this lesson but also the end of our section on Basic Accounting Transactions. Well done! You should have now studied all the different types of basic transactions that can occur in accounting!

Yes, that's right, the ten or so transactions we've covered is all there is! (Well, all there is in terms of transactions. Sorry but there's a bit more to accounting as a whole than just that).

Remember how we said that accounting is a system of recording information about a business?

Well, our next section is going to teach you the double-entry system of accounting, a system used for hundreds of years and still used today to record transactions.

Yes, we're going to venture into the scary world of debits and credits, probably the number one source of stress in an accounting student's life.

You've probably heard of these terrible things before. Let me assure you, they are not some terrible monster. To be perfectly honest, they're actualpretty harmless. They may look kind of mean when you start, but once you give them a little bit of attention and try to understand them, very soon you'll find they're easy. They're just debits and credits, a simple system dreamed up to make recording things a little quicker and easier.

Okay, well let me not keep you any longer. Or scare you away.

Remember, if you're feeling a little confused, take your time and review earlier lessons. Really understanding these basics now will save you a lot of time and frustration later on.

Bottom line: if you feel comfortable at this point, move along to the next section, Double Entry Accounting.

Well done for getting this far... Let's go all the way!

Return to Basic Transactions

Return to Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: Expenses: Definition and Examples

Next lesson: Double Entry Accounting

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

What is the Difference between Accrued Income and Accrued Expenses?

Q: Why does the Accrued Income effect the assets but Accrued Expenses is not? Both indicate that cash was paid or received later but why is that difference …

Journal Entry for inventory used for Own Usage from the Stores

Q: Hi Sir / Madam,

I am working in a stores division of the one of the corporate firm. We are handling the purchase / procurement for the whole divisions …

Accrued Expenses and Revenue:

Closed or Not?

Q: Does accrued expenses and revenue need to be closed at the end of the accounting period?

A: First let's make sure we understand what accrued expenses …

What is Income?

Q: Is the income the money that is coming in from the profit that you made? (Today I have a quiz and the booksotores dont have the book until the thirteenth …

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.