Accounting Equation Liability Example: Capital vs Interest

by Loy

(Kuwait)

Q: In the liabilities example, when George pays the bank part of his loan for $4000, the amount is deducted from the bank account. Why is it not deducted from the owners equity? (since owners equity is based on the amount of assets) Please clarify.

A: Hi Loy,

In this example George is paying off what is known as the capital portion of his loan.

In this example George is paying off what is known as the capital portion of his loan. You might be confusing the capital portion of the loan with interest on a loan.

If George was paying interest, this would definitely be an expense.

More expenses mean less profit and less share for the owner (less owner's equity).

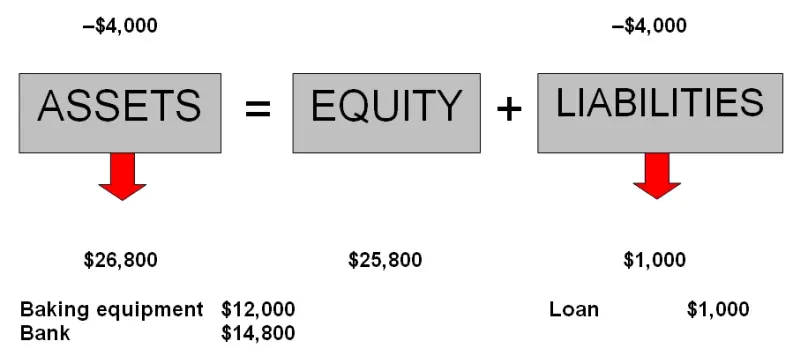

But this example is a $4,000 repayment of the capital portion (or principal) of the loan, not the interest expense.

So our cash or bank decreases, and our liabilities (the loan itself) also decreases in value (from $5,000 to $1,000).

Owner's equity is not affected either way (up or down) when we pay off a liability (debt to external parties). George's equity is the exact same as it was before this transaction took place: $25,800.

Hope that helps clarify things there!

Best,

Michael Celender

Founder of Accounting Basics for Students

Related Questions & Tutorials:

- The Basic Accounting Equation

- Definition of a Liability

- Accounting Equation: Liability Examples

- Liability Example Journal Entry

- Interest Charged By a Creditor on an Overdue Account

Click here for more Basic Accounting Questions and Answers

Return to Ask a Question About This Lesson!.

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.