Is my Building an Asset or Liability?

by Anonymous

(Unknown)

Q: Is my building considered an asset? Or a liability?

Q: Is my building considered an asset? Or a liability?

A: To answer this question, let's review the definition of both an asset and liability.

An asset is anything that adds future value to your business. Anything that provides your business with benefits.

This can be anything from cash in the bank account to equipment, inventory (stock), etc.

A liability is a debt or obligation of the business.

For example, accounts payable, where one owes one's suppliers for goods purchased on credit. Or a loan from the bank.

Asset Classification Criteria

As mentioned in the main tutorial on assets, there are three criteria you need to look at when working out if an item qualifies as an asset.1. DOES YOUR BUSINESS OWN/CONTROL IT?

2. WILL IT BRING YOUR BUSINESS BENEFITS IN THE FUTURE?

3. CAN YOU VALUE IT ACCURATELY?

So let's see how this works with a building:

1. In the case of a building, usually your business owns it.

2. A building will usually bring your business some benefits, namely that you can work there, store goods there, or even rent it out and get income from this.

3. Since buildings can be valued pretty accurately using a professional or simply by comparing to similar buildings in the area, this requirement

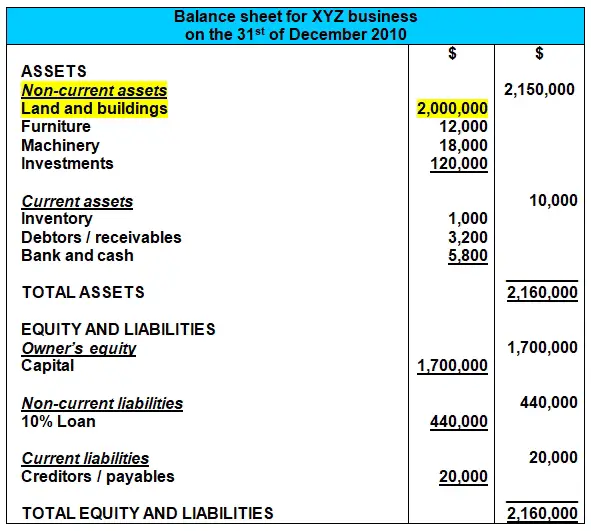

Building (Asset) vs Mortage Loan (Liability)

Remember that a business often will take out a mortgage loan from the bank to pay for a property (a mortgage is a loan with the property acting as security for the loan in case of non-payment).

Remember that a business often will take out a mortgage loan from the bank to pay for a property (a mortgage is a loan with the property acting as security for the loan in case of non-payment). The mortgage should not be confused with the building itself.

The building is an asset. The mortgage is a separate item in our records - a liability.

Non-Current vs Current

Well, I hope that answered the question for you on whether a building is typically classified as an asset or liability.

Have you ever come across a case where a building could not be classified as an asset? Do you have a related question? Have your say in the comments below.

Best,

Michael Celender

Founder of Accounting Basics for Students

Related Questions & Tutorials:

Click here for more Basic Accounting Questions and Answers

Return to Ask a Question About This Lesson!.

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.