Importance of Financial Statements for Investors

Q: How are the financial statements important for investors? How is the balance sheet, income statement, statement of owner's equity and cash flow statement useful for making investing decisions?

1. Balance Sheet

The balance sheet is important for investors in that they can see how "big" the organization is by looking at the total value of its assets, and can also see how the business is funded - how much is owner funding ("owner's equity" and specifically "capital") and how much is funded through loans and other liabilities. This balance of owner's equity vs liabilities gives an idea of how risky this business is.

2. Income Statement

The income statement shows an investor the profit/earnings, the sales, the cost of the goods sold, other income and a breakdown of major expenses for the business.

The income statement, also known as the profit and loss, shows how well the business performed during the year - how much profit was made. This is one of the most important indicators of how well a business is doing.

3. Statement of Owner's Equity

The statement of owner's equity breaks down changes to equity during the year - showing new capital investments, profit and drawings by the owners (known as "dividends" in a public company). This can be pretty important info for a potential investor to know.

4. The Cash Flow Statement

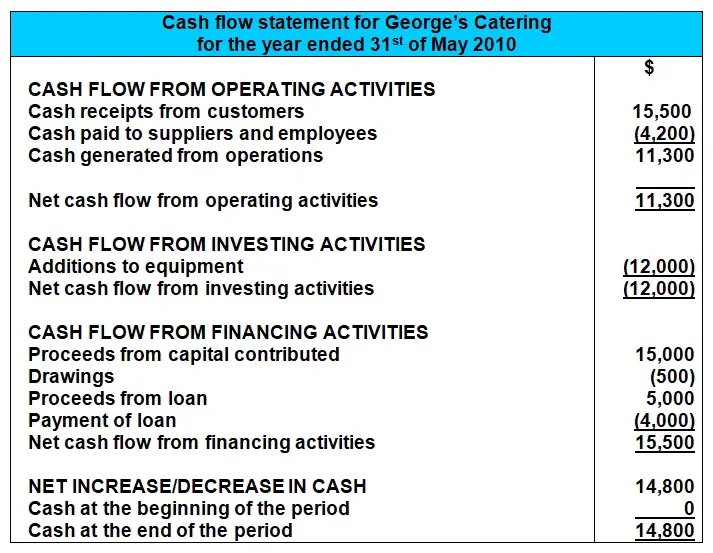

The cash flow statement shows the flows of cash - into and out of the business - during the year. This is important for investors because the income statement could show very different figures if the business made a lot of sales on credit, or had a lot of expenses that were still outstanding (not yet paid).

The cash flow statement also shows major inflows of cash like loans and major outflows of cash for capital investment (buying non-current assets).

Okay, that's the explanation of the importance of financial statements for investors.

How do you think financial statements are important for investors?

What do you think they should look out for in the income statement, balance sheet, etc.?

Give us your opinion in a comment below.

Best,

Michael Celender

Founder of Accounting Basics for Students

Related Questions & Tutorials:

Return to the full tutorial on Financial Statements

Comments for Importance of Financial Statements for Investors

|

||

|

||

|

||

|

||

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.