Debtors and Creditors Control Accounts Exercise

by Danie Kwexi

(Blantyre)

Before you begin: It's important when preparing for tests and exams to make sure you not only answer questions correctly but also do so at the right speed. So please make sure while attempting this exercise that you time yourself.

Difficulty Rating:

Intermediate --> Advanced

Time limit:

30 minutes

Question

The following is a list of balances relating to Phiri Properties Ltd during 2010. The company maintains a memorandum debtors and creditors ledger in which the individual account of customers and suppliers are maintained.

These were as follows:

Debit balance in debtors account 01/01/10 66,300

Credit balance in creditors account 01/01/10 50,600

Sunday credit balance on debtors ledger 724

Goods purchased on credit 257,919

Goods sold on credit 323,614

Cash received from debtors 299,149

Cash paid to suppliers 210,522

Discount received 2,663

Discount allowed 2,930

Cash purchases 3,627

Cash sales 5,922

Bad Debts written off 3,651

Interest on overdue account of customers 277

Returns outwards 2,926

Return inwards 2,805

Accounts settled by contra between debtors and creditors ledgers 1,106

Credit balances in debtors ledgers 31/12/10 815

Debit balances in creditors ledger 31/12/10 698

Required:

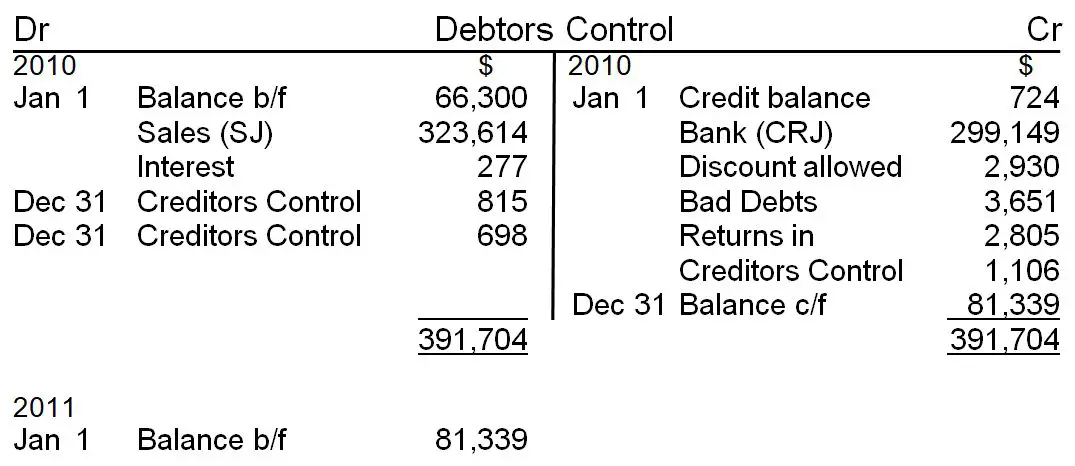

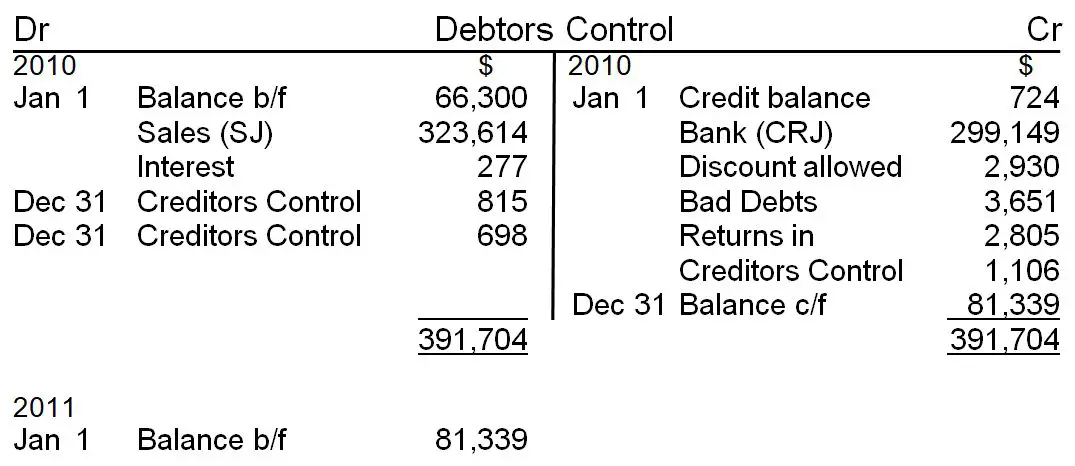

a) Prepare the debtors control account as at 31/12/10.

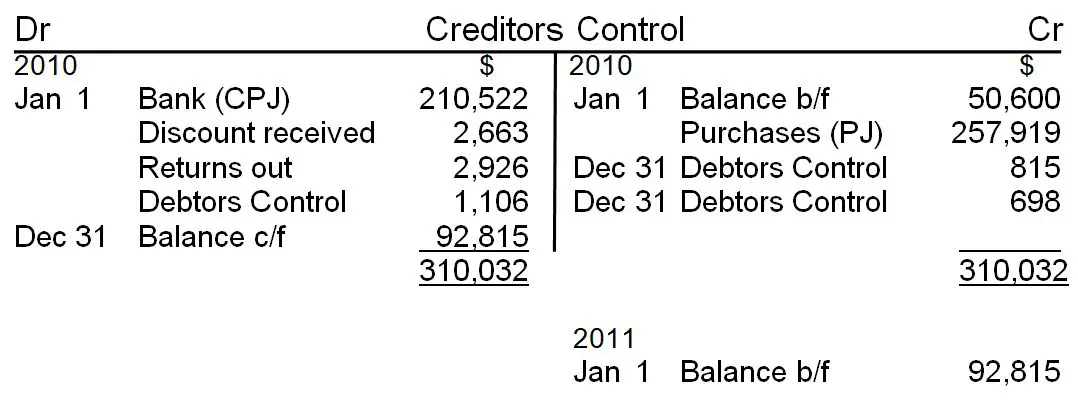

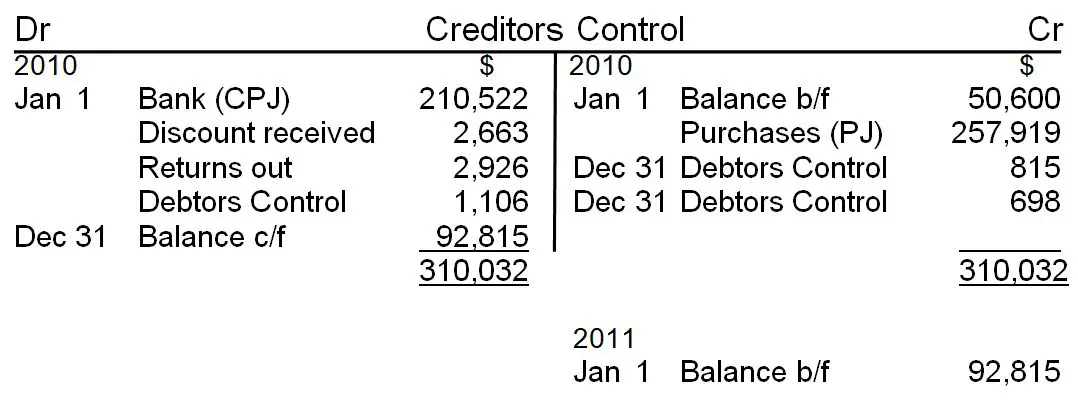

b) Prepare the creditors control account as at 31/12/10?Solution

a)

b)

Notes on the Above

A memorandum debtors and creditors ledger is simply a group of the debtor and creditor accounts. "Memorandum" here means that the ledger is maintained for internal record-keeping and these accounts are not shown on the trial balance (or financial statements). These individual accounts are maintained so as to track amounts owed by and to individual customers and suppliers. In contrast, the debtors and creditors control accounts are shown in the trial balance (and financial statements).Most of the entries in the debtors and creditors control accounts above should be self explanatory. Remember that debtors are our customers that owe us money, so we are talking about sales on credit here. And creditors are our suppliers that we owe money to, so we are talking about purchases on credit in that case.If you didn't understand what the Sunday credit balance on debtors ledger is, don't worry. You're probably not the only one. The "Sunday" in this case is weird. If anyone has any idea what this means please add your say in a comment below.The discount received and discount allowed amounts were assumed to be settlement or cash

discounts received and granted for early or prompt payment. In contrast to sales or trade discounts, settlement or cash discounts are recorded in the books (shown here under the debtors and creditors control accounts).Cash purchases and cash sales do not affect the debtors and creditors control accounts at all. They only affect the cash or bank T-account and the purchases and sales T-accounts.Bad debts are debts that the business has recognized will not be paid. In other words, these are debtor amounts that no longer seem likely to be received. So it reduces the value of our debtors.The overdue interest on our customer accounts simply must be added to the value of debtors - in other words, they owe us the interest now too.Returns outwards means returns going out from our business. In other words, to our suppliers. "Returns outwards" is also known as "purchases returns" or "returns out."In the same way, returns inwards means returns coming into our business. In other words, from our customer who purchased goods from us. "Returns inwards" is also known as "sales returns" or "returns in." For more information on returns in and returns out, see our tutorial on ______.Accounts settled by contra between debtors and creditors ledgers was another strange one. Since it indicated "between debtors and creditors," I assumed that this was an incorrect amount in the debtors ledger (credit balance) to be transferred to the creditors ledger.The unusual credit balances in debtors ledgers is like a liability balance and is more suited to the creditors ledger. So it has to be debited out of the debtors ledger and credited back into the creditors ledger.Likewise, the debit balances in creditors ledger is like a debtors (asset) balance and is more suited to the debtors ledger. So it has to be credited out of the creditors ledger and debited back into the debtors ledger.That's it!

How did you like our debtors, creditors control accounts exercise? What did you think of the solution?

Add a comment below to let us know what you think and if you have any questions.

Best,

Michael Celender

Founder of Accounting Basics for Students

Related Questions and Tutorials:Return to the full tutorial on Debtor and Creditor Control AccountsCheck out our page of Full Accounting Exercises

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.