The Accounting Equation

and Financial Position

Previous lesson: What is Owner's Equity?

Next lesson: Basic Accounting Test

Up until now we've covered the basic accounting equation and its three components: assets, liabilities and owner's equity.

In this lesson we're going to use the accounting equation to evaluate the financial position of a business in three scenarios.

Check out the quiz on this lesson in the Test Yourself! section further below when you're done. And right at the bottom of the page, more questions on the topic submitted by fellow students.

What is Financial Position?

Financial position refers to the financial situation a business finds itself in at a specific point in time.

One business might be in a good financial position at a certain point, another may be in a bad position. Or the same business might be in a good financial position one year, but a few years later its financial position is poor.

The main indicator of financial position is the business's ability to pay its liabilities (debts).

In other words, how much assets does the business have relative to its debts.

The Accounting Equation and Financial Position

The three elements of the accounting equation - assets, owners equity and liabilities - when compared to one another, show us a business's financial position.

The following three examples will illustrate this...

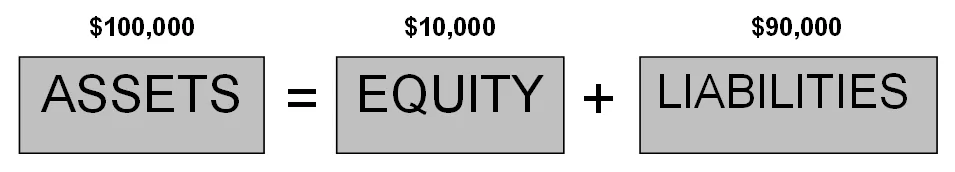

Example #1

Would you invest in the following business?

Probably not. 90% of the assets of this business will be used to pay debts in future.

The owner's equity, which reflects the net worth of the business (the real worth to the owner or owners) is only $10,000.

The financial position of this business is thus poor.

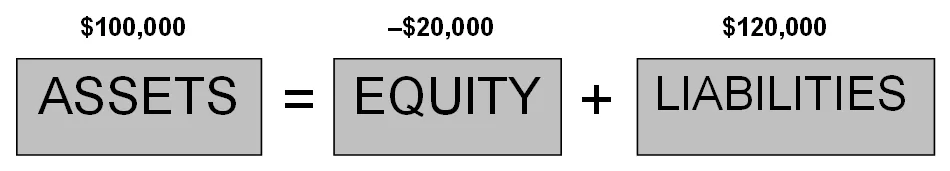

Example #2

What about this business – would you invest in it?

What on earth is going on here? Negative owner's equity - is that even possible?

Well, one thing is for sure: in this case you certainly would be quite apprehensive about investing.

The total liabilities (debts) of the business are greater than the assets it has to pay off these debts. As a result the owner or owners are stuck with a loss.

Or in other words, the owner or owners may have to fork out $20,000 out of their own pockets (from their private funds) to pay the liabilities.

Where the total debts of the business are greater than its assets, we say that the business is insolvent. This means that it cannot pay all its debts.

Obviously the financial position of this business is terrible.

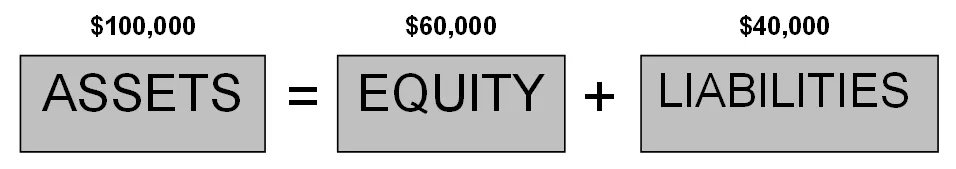

Example #3

Now how about this business?

This business looks a bit healthier.

The business can comfortably pay all of its debts. In fact, only 40% of the assets will be used to pay the debts – 60% of the assets are really owned by the owner (owner's equity).

The owner's equity or net worth of the business is $60,000.

The financial position of this business is quite good.

A Quick Note on Debts

Bear in mind that it's not always a bad thing to have debts.

For example, where you have a project that you estimate will bring you a $40,000 return, but you need to invest $5,000 to start with (and you don’t have the money yourself), it would be a wise move to borrow the $5,000 (thereby creating a liability of $5,000 towards the bank).

Maybe it takes you a year to pay the debts, which comes to $6,000 in total after all the bank charges and interest. Well, you’ve still made $34,000 from this ($40,000-$6,000). Not bad, eh?

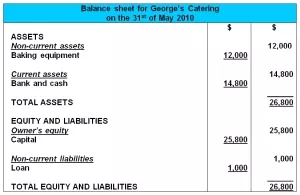

Balance Sheet

The financial position of a business is shown in a special accounting report called the balance sheet, also known as the statement of financial position.

The balance sheet lists out the assets, liabilities and owner's equity for a business at a specific point in time.

The balance sheet is one of the components of the financial statements, the key financial reports of a business, which we cover in a later chapter.

Click here for our full tutorial on the balance sheet.

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty Rating:

Beginner

Quiz length:

3 questions

Time limit:

5 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

Okay, so that's it for our lesson on the accounting equation and financial position.

If you're feeling good about the accounting equation, its components and financial position, then go ahead and take our basic accounting quiz, which will test you on all the concepts from our tutorials on Basic Accounting Concepts.

After that feel free to move ahead to the next chapter on this site, Basic Accounting Transactions.

Good luck!

Return from The Accounting Equation and Financial Position to Basic Accounting Concepts

Return to the Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: What is Owners Equity?

Next lesson: Basic Accounting Test

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

Negative Equity

Q: How can equity be negative? Shouldn't it be considered as a liability then?

A: When the equity is negative it means the liabilities are greater …

enter the unadjusted trial balance onto a work sheet

Enter the unadjusted trial balance onto a work sheet and close off the temporary accounts (income, expenses, drawings, etc.), leaving only the permanent …

Assets Minus Liabilities

Equals Equity?

Q: Why do they not say assets minus liabilities = equity?

A: They do. Well, some teachers, professors, lecturers do.

Actually that is the definition …

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.