Accounts Payable Journal Entries

Previous lesson: Expense Journal Entry (cash expense)

Next lesson: Loan Repayment Journal Entry

In this lesson we're going to cover the two most common accounts payable journal entries: 1) when we incur a debt to our suppliers and 2) when we pay this off later on.

In both examples we'll first work out how the transaction affects the accounting equation and which exact accounts are affected, and then we'll use this information to figure out the full debit and credit entry.

Be sure to check your understanding of this lesson and the accounts payable journal entries by taking the quiz in the Test Yourself! section further below. And right at the bottom of the page, you can find more questions on the topic submitted by fellow students.

A Quick Reminder About Accounts Payable

Remember that the term accounts payable refers to the value of debts to our suppliers for goods and services we have received but not yet paid for.

Accounts payable is a liability account, meaning a debt.

Another common term used instead of accounts payable is creditors.

Accounts Payable Journal Entry Example #1:

Incurring the Debt

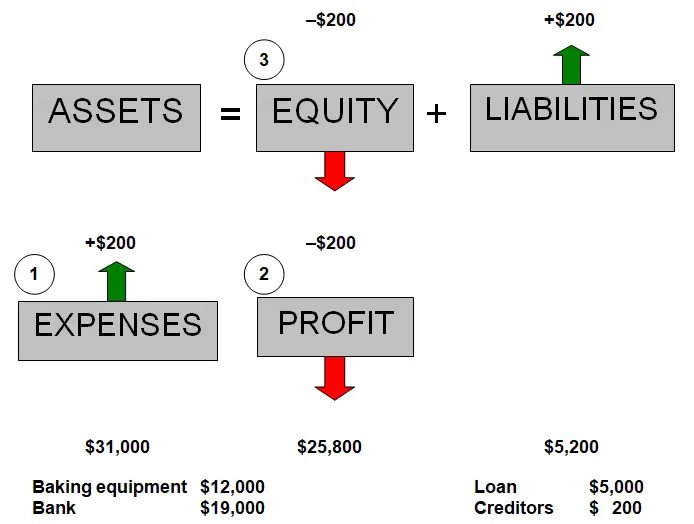

Let's continue with our sample business, George's Catering. As things stand for the business, they have:

- $31,000 assets consisting of $12,000 baking equipment and $19,000 in the bank,

- $26,000 equity and

- $5,000 liabilities.

i) George Burnham receives the telephone bill from the telephone company on the 30th of April. It says that George’s Catering owes $200 for the month of April. The telephone company offers payment terms of 15 days from the date that the bill is received. George intends to use these payment terms and pay after a week or two. How does this transaction affect the equation on the 30th of April?

The first question to ask is whether any cash has moved at this point in time? In other words, have we actually paid anything yet?

The answer, of course, is no. So we do nothing with cash now.

The telephone bill is an expense – it is an event or something of value delivered that results in money flowing out of the business, either immediately or at a later date. The expense (event) has occurred – the telephone has been used in April.

Remember that income and expenses are recorded using the accrual basis of accounting, and that according to the accrual system, we record the expense when it occurs, not later on when cash is paid.

So the one account that is affected is expenses.

Because this telephone bill is not paid straight away, it means that it is owed. So we need to record a liability (debt). This liability is known as accounts payable or creditors.

As you can see above, the owner’s stake in the assets of the business (i.e. owner's equity) decreases by $200 to $25,800. This is because 1) more expenses mean 2) less profit and 3) less for the owner. The external parties’ stake in the assets of the business (i.e. liabilities) has increased by $200 to $5,200 as a result of this telephone bill that is owing.

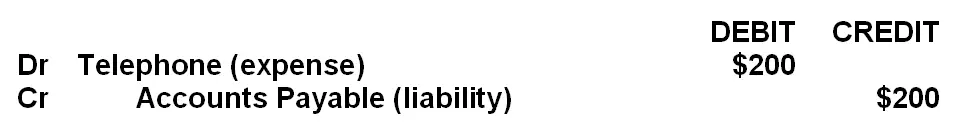

Okay, now that we've worked out which accounts are affected and the impact on the basic accounting equation, let's tackle the debit and credit journal entry.

First of all, expenses are the opposite of income and owner's equity, they occur on the left side of the accounting equation. As such, they are debited (debit = left).

Liabilities, on the other hand, increase on the right side of the equation, so they are credited.

So, here is the journal entry to record accounts payable:

Accounts Payable Journal Entry Example #2:

Paying the Debt

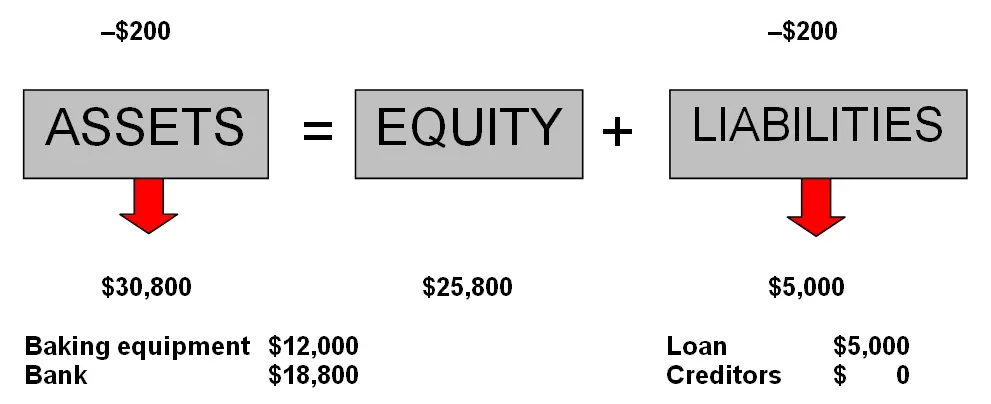

j) George Burnham pays the amount owing to the telephone company on the 13th of May.

This transaction is the exact opposite of the first one.

In this one, both our cash and our liability (accounts payable / creditors) are decreasing.

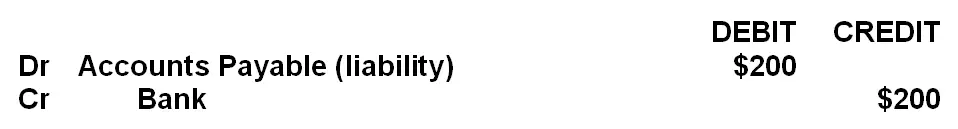

The easiest part of this transaction to work out is the cash component. Cash of $200 is paid this time. So bank decreases.

Bank is an asset. Assets increase on the debit side (left) and decrease on the credit side (right).

So if we want bank now to decrease, we have to credit it.

Our creditor (liability) exists currently in our records at $200 on the credit side (right). But since we're now paying the telephone company, this means that we owe them less. Accounts payable (liabilities) are decreasing.

Since liabilities increase on the credit side (right) and decrease on the debit side (left), we're going to debit this.

Here's the journal entry for paying off our accounts payable:

Note that the debit of $200 to the accounts payable account causes it to decrease down to zero – in other words, we are showing that the debt towards the telephone company no longer exists.

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty Rating:

Beginner --> Intermediate

Quiz length:

8 questions

Time limit:

10 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

Still a bit confused after this lesson? Consider checking out some of the earlier lessons, such as the simpler cash expenses journal entry lesson, or even our simpler accounts payable lesson (this lesson covers the same transactions as above and how they affect the accounting equation in more detail - but without journal entries).

If you find debits and credits generally difficult, check out our mind-blowing lesson Debits and Credits: What They Really Mean. This lesson should make journal entries much simpler and easier for you.

Otherwise, if you're happy with this lesson, then move on to the next lesson on the journal entry for repaying a loan.

Return to Double Entry Accounting

Return to the Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: Expense Journal Entry (cash expense)

Next lesson: Loan Repayment Journal Entry

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

Journal Entry: Payment on Account

Question: What would the journal entries be if the problem is like this: "Made payments on account, 17,000" ?

Solution: Here is the journal entry …

Is Carriage Inward a Direct or Indirect Expense?

Q: Is carriage inward a direct or indirect expense?

A: I assume you're talking about direct and indirect costs of a manufacturing business.

Direct …

Entry for a Free Sale

Q: What is the journal entry for selling goods for no value (i.e. giving it away for free)?

A: Good question.

If the goods had value, let's say …

Accrued Expenses Journal Entry:

Debit or Credit?

Question: Q: If the amount has been debited into accrued expenses, do we need to credit it after making the payment (so that the balance would be …

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.