Fixed Assets Question: Sale and Purchase

by Cheong

(Malaysia)

Before you begin: For purposes of testing and exams it's important to make sure you not only answer questions correctly but also complete them at the right speed. Use a watch or clock to time yourself while doing this fixed assets question.

Difficulty Rating:

Beginner --> Intermediate

Time limit:

5 minutes

Q: An item of plant originally purchased for $65,000 and with a book value of $12,000 was sold during the year for cash.

What is the amount I should put into purchases for plant and equipment? Thanks a lot.

A: First of all, in case you're unfamiliar with the term, fixed assets are long-term assets, meaning assets that are expected to be sold beyond a year’s time from the current date. Another name for fixed assets is non-current assets, and they are also often shown on the balance sheet as property, plant and equipment.

Now, before I go over the explanation of how to get to the solution and the full calculation, please take out a pen and piece of paper and try to solve this yourself. When you're ready, continue reading below...

Okay, here's how you solve this...

First of all, you may be surprised to hear that to answer this

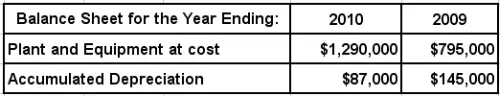

We only need to look at the plant and equipment account (i.e. cost prices of plant and equipment):

- We started with $795,000

- We sold an item that cost us $65,000

- We bought some plant and equipment for a certain amount (the answer we're looking for)

- We had $1,290,000 of plant equipment at the end of the year.

If we arrange this in a mathematical formula we would have:

$795,000 - $65,000 + X = $1,290,000

X = $1,290,000 - $795,000 + $65,000

X = $560,000

So the purchases of plant and equipment for the year must have been $560,000.

Make sense?

By the way, I have detailed explanations of accumulated depreciation and depreciation (multiple lessons) and exercises on these topics in my basic accounting books.

Did you like this question? Did I get it right? Let me know in the comments section below...

Best,

Michael Celender

Founder of Accounting Basics for Students

Related Questions & Tutorials:

- Full Journal Entry Exercise (including Depreciation)

- What is the Journal Entry for the Partial Payment and Trade-In of a Vehicle? (including Depreciation)

- Basic Accounting Test: Multiple-Choice Questions

- Balance Sheet Question: Categories of Assets and Liabilities

- Full Balance Sheet Tutorial

Click here for more Basic Accounting Questions and Answers

Return to Ask a Question About This Lesson!.

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.