Accounting Equation Exercise:

Fill in the Blank

by Sinthu

(Canada)

Before you begin: For purposes of testing and exams it's important to make sure you not only get the questions right but are completing them at the right speed. Use a watch or clock to time yourself for this exercise.

Difficulty Rating:

Beginner --> Intermediate

Time limit:

10 minutes

Question:

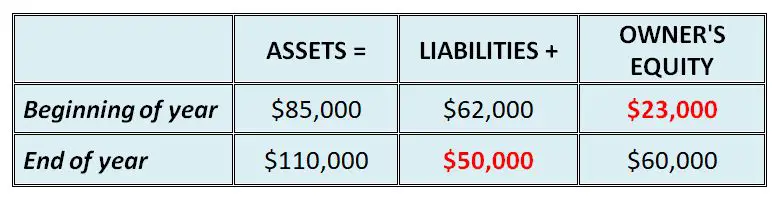

The summaries of balance sheet and income statement data follow.Beginning of year:

Total assets $85,000

Total liabilities $62,000

Total owner’s equity ?

End of year:

Total assets $110,000

Total liabilities ?

Total owner’s equity $60,000

Changes during year in owner’s equity:

Investments by owner ?

Drawings $18,000

Total revenues $175,000

Total expenses $140,000

Required: Calculate the missing items above.

Solution:

Beginning of year:If Assets = Liabilities + Owners Equity

then

Owners Equity = Assets - Liabilities

= $85,000 - $62,000

= $23,000 Owners Equity

End of year:

If Assets = Liabilities + Owners Equity

then

Liabilities = Assets - Owners Equity

= $110,000 - $60,000

= $50,000 Liabilities

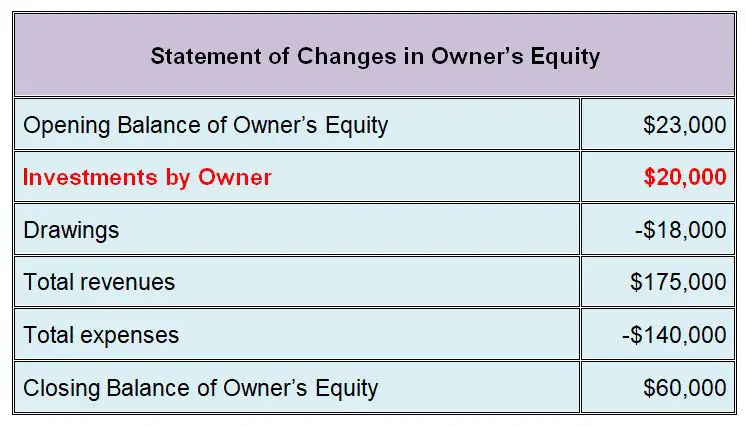

Changes during the year in owner’s equity:

For this final part of the question we need to use the calculation of owner’s equity at the end of the year starting with equity at the beginning of the year plus/minus changes during the year

Opening Balance $23,000

Investments by owner ?

Drawings - $18,000

Total revenues + $175,000

Total expenses - $140,000

Closing Balance $60,000

To solve this problem we're going to take the statement of owner's equity with all the figures above and put them in a formula:

Closing Balance = Opening Balance + Investments by Owner - Drawings + Revenues - Expenses

Switching around this equation to make "Investments by Owner" (capital) the subject, we then get:

Investments by Owner = Closing Balance - Opening Balance + Drawings - Revenues + Expenses

= $60,000 - $23,000 + $18,000 - $175,000 + $140,000

= $20,000 Investments by Owner

Here is how a complete statement of owner's equity would look:

So, what did you think of this accounting equation exercise? Did you try it, and if so, how did you do? Leave us a comment further below.

If you had some difficulty with this exercise, don't worry! Check out some of the related tutorials and questions further below.

Best,

Michael Celender

Related Questions & Tutorials:

- Owner's Equity Question: Fill in the Blank

- More Accounting Equation Questions and Answers

- Tutorial on the Basic Accounting Equation

- Tutorial on the Statement of Owners Equity

Return to our main page of Basic Accounting Questions

Comments for Accounting Equation Exercise:

|

||

|

||

|

||

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.